EasyPlan: Simple and digital savings for LMIs

by Abhinav Guptha, Anil Gupta and Anshul Saxena

Jul 8, 2019

4 min

This blog examines EasyPlan, a new-age digital savings app that allows low- and middle-income segments to overcome their chronic state of under-saving. Read on to see how EasyPlan makes use of various behavioral nudges (including gamification) to make customers save more and better.

This blog post is part of a series that covers promising fintechs making a difference to underserved communities and supported by the Financial Inclusion Lab accelerator program MSC is a partner to the FI Lab, which is a part of CIIE’s Bharat Inclusion Initiative.

|

|

Young Indians with limited incomes need a simple and hassle-free option to invest in MFs – clearing their doubts about risks involved. That’s what EasyPlan plans to do.

In one of her research projects, Manisha realized that current financial products in India do not complement the low-and-middle income (LMI) segment’s financial goals such as housing, wedding, etc. LMI customers often rely on informal options, such as ROSCAs, which offer flexibility to save and borrow. Offline chit funds, a kind of ROSCA are inherently risky with the possibility of theft of the principal amount. Moreover, the practice of visiting the ROSCA meet-ups to socialize often come with a significant opportunity cost. All this, when the return offered by many ROSCAs do not even match the investments of time, money, and effort put in by the ROSCA subscribers. “LMI customers need a financial tool which they can customize according to their circumstances. They seek a flexible way to save with the protection of the principal amount, and generate safe and smart returns.” – Manisha

EasyPlan can help young Indians in LMI segment save in a smart, simple and digital way – via an app.

The pitch: An easy and flexible savings option

EasyPlan encourages millennials like Rajat to set financial goals based on their needs and save regularly in a hassle-free manner. The app’s unique selling proposition (USP) is the flexibility of the product offering, such as the absence of lock-ins, penalties or minimums. Moreover, users can instantly pull their savings back into the bank accounts whenever needed. Starting at just Rs. 100 (USD 1.50), they can skip or change their contribution without incurring any penalty. Apart from all the flexibility of payments and withdrawals, EasyPlan whose product is short term duration debt mutual funds, offers potentially better returns than other formal products and better protection of the principal in comparison to other debt funds.

The evolution: Identifying challenges and overcoming them

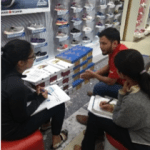

At the clinics, boot camps and diagnostic sessions conducted by Centre for Innovation Incubation and Entrepreneurship (CIIE) and MicroSave Consulting (MSC), the experts mentored the EasyPlan team in crafting their business strategies. As a result, the team gained an in-depth understanding of the Indian financial ecosystem and was able to troubleshoot its business challenges and define its business model.

Building trust in MFs

The participants associated MFs with either a risky, volatile proposition of stock market or something “which is spoken very fast in advertisements” in the form of the mandatory SEBI disclaimer. Moreover, they felt that digital savings lacked a personal touch—a cornerstone of the closely knit ROSCA communities.

Here, education was the key. The Easyplan-MSC team talked to the participants and dispelled their notions about the high risks associated with MFs. The team also imparted crucial information about MFs to people, including possible higher returns as compared to LIC endowment policy, FD, RD, savings account, etc. They also educated the participants about how the Easyplan app would customize their product offerings according to the aspirations and financial capabilities of the app users.

Selecting the right occupational segment:

The LMI workers have fluctuating incomes and are left with a scarce amount after covering basic costs such as installments for vehicle loans, fuel, and maintenance expenses. As a first step, EasyPlan had to identify the segment that has a relatively stable income so that they can allocate funds for MFs.

MSC conducted primary research in Delhi and Jaipur among LMI segments. Based on the understanding of MFs and product attributes proposed by EasyPlan, it arrived at three probable occupational categories i.e. retail workers, Uber or Ola cab driver-partners, and Zomato or Swiggy delivery boys.

This helped EasyPlan to concretize the product idea, prioritize its features, and understand competition.

The future is ‘easy’

EasyPlan aspires to focus on attracting more customers like Rajat and retaining their existing customers. “Collaborating with more employers and aggregators is one part of this effort. The other part is building a stronger online presence to garner the trust of customers.” – Manisha

Finally, EasyPlan will enhance the engagement on the financial product through more behavioral nudges and gamification elements. Stay tuned!

Follow #TechForAll and #BuildingForBharat to stay updated on fintech start-ups driven to bridge the social, financial and economic inclusion gap.

by

by  Jul 8, 2019

Jul 8, 2019 4 min

4 min

Leave comments