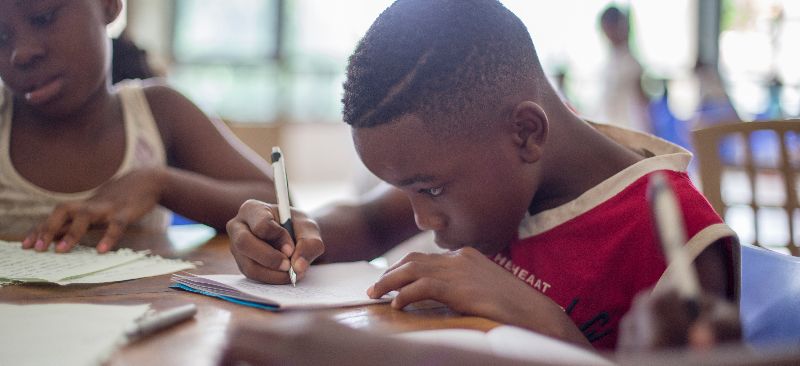

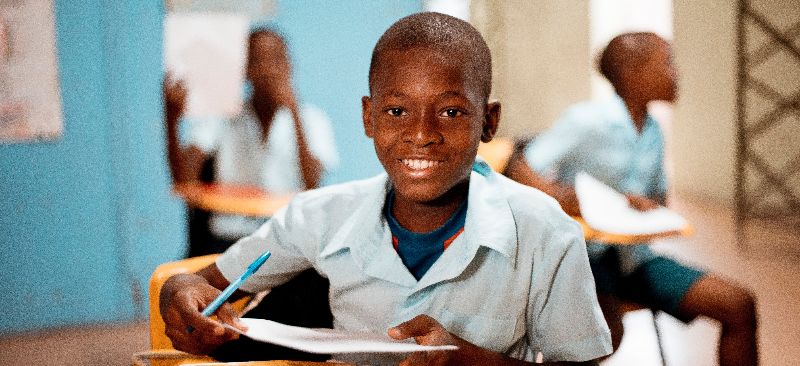

Education is an area of growth for MSC. Our experts collaborate with government and private schools, government ministries, non-government organizations, and financial services providers in education and skill building. We analyze and support affordable private school finance in emerging economies in Asia and Africa.

MSC works in edufinance, ed-tech, behavioral research, and subsidy in education. Detailed country assessments, impact investments, and market sizing exercises make up the bulk of our work in this area.