What impact does social distancing have on global remittances?

by Shailey Tucker and Seka Parfait

Nov 20, 2020

5 min

Measures such as social distancing to curb the spread of Coronavirus have handicapped people used to cash-to-cash transactions. Migrants and their families have not been spared. This blog focuses on the extent to which digital channels provide attractive alternatives and opportunities for partnerships between money transfer services, governments and FinTechs to ease this challenge.

When the coronavirus epidemic first appeared in China in December 2019, no one thought that by March 2020, the world and many of its economic activities would be at a standstill. The measures brought in to fight the epidemic, turned pandemic, brought certain activities to a halt, forcing many businesses to close. Money transfer outlets feature among the long list of closures, handicapping people used to cash-to-cash transactions. Such measures have disrupted people’s habits and left many migrants and their families without bearings. Remittance flows have shown significant growth in recent years, reaching $554 billion worldwide in 2019 and accounting for more than foreign direct investment or development aid in low-income countries. With the COVID-19 pandemic, global remittances are projected to decline by about 20 percent in 2020.

To what extent do digital channels provide attractive alternatives and opportunities for partnerships between money transfer services, governments and FinTechs?

“As part of my activities, I often received money from Africa via the usual money transfer companies (MoneyGram and Western Union). During the health crisis period brought about by COVID-19, it was no longer possible for me to make cash-out transactions. The lockdown implemented in France limited outings to essential activities. Thanks to a friend, I discovered the company Small World, which allowed me to receive money from Africa directly into my bank account with relatively low fees in less than three days,” says Mylène, a business owner who lives in Paris, France, with businesses in Abidjan, Côte d’Ivoire.

Some alternatives to cash-to-cash transactions already exist:

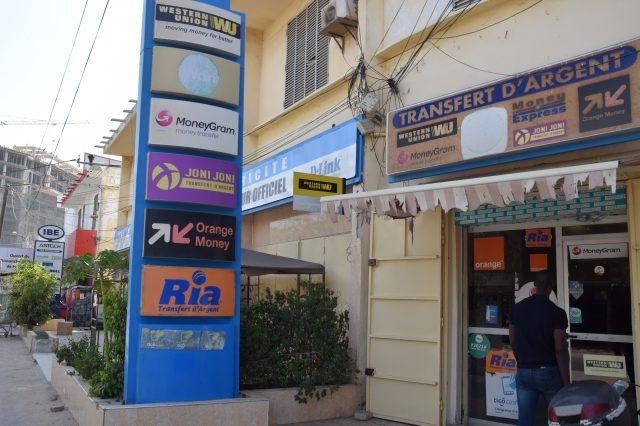

- Cash-to-account transfers: a minimum of 48 working hours is required. Western Union (WU), Small World (SW), RIA, MoneyGram all offer this service.

- Card-to-card transfers: only possible between cards of the same nature, but the transaction limits are low. The WAEMU GIM’s Baraka prepaid platform allows transfers of up to 100,000 FCFA a day.

- Transfers to mobile money accounts: partnerships with mobile money operators have made this option possible. This is the case of RIA and Orange Money in Senegal with the Kalpé offer for example.

- Money transfer applications and products developed by banks: Rapidtransfer, BOA Express, Oryx, and SC Mobile, for example.

- Money transfer service websites and applications: WU, SW, worldremit, Taptap Send, RIA and MoneyGram offer transaction options, especially for western residents

Challenges faced by customers and money transfer services

Cash point closures imposed by lockdown measures have forced money transfer customers to look for alternatives – including digital alternatives – which they are not familiar with. Moreover, concerns relating to cybercrime, appeal challenges and the complexity of certain customer processes, do not argue in favor of using new channels.

Ali, a money transfer user in Dakar, explains that he faced difficulties installing and using one of the money transfer operators’ applications, which led him to disable the application and settle for cash transactions.

Money transfer service providers do not communicate enough with their customers regarding these new channels, except for WU. Some services, such as cash-to-account transfers, are not available in every outlet and recipients do not always have an account.

Remittances via online platforms continue from the West to countries where cash withdrawals and mobile money cash-outs are still possible. However, current limitations (market closures, curfews, etc.) affecting informal activities, which account for about 55% of GDP in Sub-Saharan African, due to the evolution of COVID-19 cases in Africa, are likely to continue weakening economic activities. This may result in liquidity issues at mobile money agent outlets, for example. Customers, keen to limit any travel, are also increasingly looking for local solutions, recommended by friends and family.

Not all remitters have stable and formal jobs; the measures imposed by the COVID-19 epidemic have had a severe impact on migrant workers, forcing many to suspend their activities, sometimes without any compensation. Without income, these workers are unable to continue to support their families, with significant consequences given the impact and the role such support provides (health, education, investments, etc.). “My sister, a babysitter in France, used to send me 100 euros per month for the rent. Since the beginning of the lockdown and the suspension of her contract, she is no longer receiving enough income and is not able to send me the 100 euros in time. As a result, I have had to turn to friends or family members in Congo, which is not without consequences,” explains Ester, a Congolese student in Dakar. Maintaining money transfer operations is key; digital platforms provide an opportunity to ensure service continuity with limited disruptions, through strategic partnerships.

Some measures taken to support money transfers, in relation to COVID-19

Little has been done to adapt money transfer offers to COVID-19 realities. RIA, for example, recommends that their clients use its location platform, which is regularly updated, to find transaction outlets, or else to go to outlets providing cash-to-account services. Western Union makes the same recommendations with the addition of their wu.com application.

To limit cash circulation, some companies such as MTN in Guinea have waived some money transfer fees. The BCEAO has adopted seven measures to promote digital payments, including making certain transfers free of charge, eliminating and reducing merchant fees, and raising balance limits on electronic wallets.

What is the impact on the economies of Sub-Sahara Africa?

According to a World Bank report published at the end of April 2020, a 23.1 percent decline in remittances to Sub-Saharan Africa is expected in 2020. While it would be felt globally, the impact of such a decline would hit the weakest economies hardest. A study by MSC assessing the impact of COVID-19 on FinTechs, shows that regardless of their size, experience or sector, FinTech companies and mobile money operators have been affected by the crisis and have seen their activities slow down.

In this context, where remittances represent a significant share of GDP, it is important to ensure that money transfer outlets remain open and that the needs of the most vulnerable that depend on them are met. There is an opportunity to expand digital service offerings to ensure they can adapt to current constraints. What role do regulators, governments, but also the private sector, FinTechs, start-ups, banks and mobile money operators have to play in the promotion of digital innovation with regards to money transfers? How can financial literacy and digital adoption rates be increased to ensure the most vulnerable are not excluded in this period where contactless is the new norm? What measure have been taken at the sub-regional level? Can digital technology save the 20 million jobs at risk, as forecasted in a study by the African Union? These are some of the questions we will seek to answer in our next blog. Keep an eye on our website for more!

by

by  Nov 20, 2020

Nov 20, 2020 5 min

5 min

Leave comments