The white spaces of the digital divide: 3G+ haves and have-nots

by Vivek Gupta, Anil Gupta, Mitul Thapliyal and Graham Wright

Jul 30, 2018

6 min

Examines the implications of the observation that in most rural villages, the infrastructure to support fintech remains inadequate.

In previous blogs, we discussed the seven key drivers of digital exclusion in emerging markets. This one examines the implications of the observation that in most rural villages, the infrastructure to support fintech, agtech, healthtech or any other form of “tech” remains inadequate. This is because these ‘techs’ depend on users being able to access app stores and the Internet – usually through smartphones, which we discuss in ‘Mobile Internet access – the next frontier for ‘Tech’’. Efforts are underway to expand access.

|

The World Economic Forum has developed the ‘Internet for All’ global initiative. It aims “to develop models for large-scale public-private collaboration that accelerate internet access and adoption”. Its initial work targets 75 million Africans in the Northern Corridor countries of Ethiopia, Kenya, Rwanda, South Sudan, and Uganda.

The initial work was to commission research from Boston Consulting Group, which concluded, among other things, “Infrastructure is a big hurdle for many countries, especially those that are poor or with large rural or remote populations. Many developing markets require massive investment to move up to more advanced mobile technologies.” Where is this investment going to come from?

To date, until (and perhaps even when) companies deploy new technology such as balloons and nano-satellites, infrastructure problems are likely to persist. As a result, a significant proportion of rural populations will remain without access to the Internet and thus most of fintech. This is because 3G technology is more expensive for providers – not least of all because of its higher frequency and thus reduced coverage (see box).

|

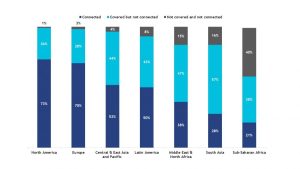

In a compelling illustration of the scale of the problem, this Intelsat graphic from their white paper on Overcoming Barriers to Providing Mobile Coverage Everywhere shows the situation in 2019.

In simple terms 40% of Sub Saharan Africa and 16% of South Asia have no coverage – and in both cases only about a quarter of the population is covered and connected. Beneath this high-level analysis, population-dense areas are served with 3G+ and the relatively rural areas are left with 2G or, more typically, no G. In the words of one Kenyan telecommunications expert, “3G is only available in major towns where providers are able to make more profit and so rural markets will take years before experiencing 3G or 4G technology”.

As a result, we will see an increasing divide between communities that have access to 3G+ technology and those left with 2G or no G. For those privileged to live within the 3G+ corridors, a wide range of emerging techs have the potential to significantly improve their lives – particularly if developers start to focus on serving the needs of the mass market.

In this context, MicroSave has been working on an approach in India to precision farming, which uses data on the following aspects:

- The landholding, tenancy status, and crops cultivated (from digital land records(see also Land record digitisation-Exploring new horizon in digital financial services for farmers. Part 1) or self-reported when procuring subsidies and inputs);

- The nutrient deficiency in soil and recommended fertiliser dosage (from the Government of India’s Soil Health Card scheme);

- The crops being cultivated (through Kisan Credit Card, seed purchases from agro-input stores including Primary Agriculture Cooperative Societies, and satellite or drone images);

- Fertilisers and agrochemicals purchased (through tracking purchases from agro-input stores and the platform managed by the state governments);

- PM Fasal Bima Yojanaor Prime Minister’s crop insurance scheme (tracking weather patterns likely to have an impact on crops through the Automatic Weather Station, satellites and databases);

- Market prices and inflow of commodities (from the e-NAM system);

- Optimising logistics for pick-up or delivery of the harvest and assessing the storage requirements.

This wide range of information will not only allow financial institutions to offer credit, insurance, and savings products based on high-quality insights into the farmers’ behaviour, but also allow tailored packaging of practices for each individual farmer. All farmers would receive carefully timed, personalised SMS reminders on when and what to cultivate and harvest based on weather conditions, availability of water, and recommended dosage and applications of fertiliser and agrochemicals. Specifically tailored AI and chat-bots would send these reminders according to the landholding, soil health, and cropping pattern of the farmers.

In addition, farmers will receive alerts when pests threaten their crops. So for instance, in case of maize borer attack in a district, all farmers that grow maize in the adjoining districts will receive warnings and recommendations based on Integrated Pest Management principles, telling the farmer how to respond. Monitoring compliance with these alerts, or at least purchase of the relevant pesticides and application techniques, will feed into the farmer’s digital locker and thus when the farmer chooses to open their digital locker provide financial institutions with additional information on how the farmer conducts business.

Similar systems will, no doubt, emerge to support education, health, and a range of other livelihoods … only for those that have access to 3G+ and the Internet. But not for those stranded in the world of 2G or no G.

There are, of course, important implications for financial institutions that serve these communities. We have already seen relatively simple algorithm-based systems used to offer credit to those with smartphones. But these will increase in sophistication and their ability to use customer data to make informed lending decisions … and thus reduce both interest rates and waiting time to receive loans. Microfinance institutions and others that lend into rural areas may well see their high-value clients who are often located in 3G+ coverage areas move in part, or in full, to these digital credit providers. They would then be left struggling to serve their remaining lower value clients with traditional analogue, or at best 2G, mobile money-enabled systems.

A solution, in part at least, may lie in seeking to combine the 3G+ and 2G worlds. This would ensure that in the precision agriculture example above, the data is uploaded and managed at the agro-input store, which is likely to be in a 3G+ coverage area and have access to either a smartphone or tablet or both. The farmer would then receive their tailored SMS alerts through 2G coverage in their village. This reflects an approach that MicroSave suggested in The Clear Blue Water on the Other Side of the Digital Divide. Similarly, in the context of financial inclusion, we will need to see a separation of sales and service agents as has been outlined in The Agent Profitability Conundrum in India – Time for Differentiated Agents? This would allow sales agents, who offer a range of products and services – perhaps as diverse as outlined in A Strategic Approach for Next-Generation DFS Agent Networks, to operate in 3G+ areas, and serve agents who conduct basic cash-in and cash-out transactions to operate in more remote coverage 2G areas.

For this, and a variety of reasons highlighted in Can Fintech Really Deliver On Its Promise For Financial Inclusion?, in the words of Jake Kendall, of the DFSLab “… it is safe to say that feature phones are here to stay, and a sizeable proportion of low-income individuals will continue to use feature phones for the foreseeable future.” Amid the excitement of app-based techs, we need to plan for the 2G and no G world if we are to address Sustainable Development Goals for rural populations through technology.

Written by

Vivek Gupta

Specialist

Anil Gupta

Managing Partner

Mitul Thapliyal

Managing Partner

by

by  Jul 30, 2018

Jul 30, 2018 6 min

6 min

Leave comments