The potential of AI chatbots in driving financial inclusion: Assessing ChatGPT

by Judith Mwangoe and Sarah Corley

Jul 3, 2023

6 min

This blog, co-authored with The Alliance of Digital Finance Associations, assesses the potential benefits, concerns, and ethical considerations of financial service providers who use ChatGPT to further financial inclusion for underserved digital financial services (DFS) consumers.

Artificial intelligence (AI) is no longer in the future but is very much here and now. ChatGPT’s recent arrival has sparked discussions worldwide, including among The Alliance of Digital Finance Associations and MSC.

ChatGPT-4, launched on 14 March 2023, has 100 trillion parameters, compared to GPT-3’s 175 billion parameters, making it substantially more powerful, and we can even speculate on the brilliance of ChatGPT-5 and beyond.

AI chatbots already prevail in the financial services industry and have been used for many years. One of the first chatbots to launch was Ongair in Kenya in 2014, with Africa as a specific focus. Other examples include Zuri from Safaricom in Kenya, which helps customers access usage statements, top-up airtime, and check M-PESA and airtime balances; and Kudi in Nigeria, which allows users to transfer money, track account details, buy airtime, and pay recurrent bills, such as DSTV.

Another interesting deployment is Proto AICX, a multilingual chatbot deployed by the Bank of Ghana. This automated consumer protection solution collects and categorizes complaints across multiple channels and all financial institutions. Consumers can use the chatbot in English or Twi, which is the most spoken language in Ghana. Meanwhile, Standard Bank South Africa launched a WhatsApp-based chatbot that keeps its customers updated with its services and offers debt relief offerings. The chatbot also provided other important, relevant information during the COVID-19 pandemic.

Unlike other AI Chatbots, which are typically pre-programmed with limited responses, ChatGPT can generate natural language responses based on the conversation’s context and tone.

ChatGPT’s potential benefits for FSPs

Compared to other LLMs, ChatGPT stands out for its realistic approach to users, requiring them to type questions conversationally. This allows it to improve customer engagement significantly, streamline operations, and enhance overall customer experience. Customers are the lifeblood of any company. Hence, maintaining good relations with them is crucial to gaining loyalty and repeat business, ultimately leading to sustained growth and profitability.

Since ChatGPT was trained on publicly available information, it may not be helpful for inquiries on private matters related to an organization. Organizations can make ChatGPT more effective if they incorporate their data into the model using techniques such as fine-tuning and embedding.

In the digital finance industry, 24/7 customer services hinge on instant messaging and social media inquiries. By training ChatGPT to accurately and emphatically address questions and problems that may not necessarily need a live person, the chatbot can save banks and companies time, energy, and resources. Estimates show financial service providers will save around USD 7.3 billion by using chatbots in 2023-2024. Furthermore, businesses can gain helpful information about customer behavior and preferences through ChatGPT integration services. Businesses can uncover common pain points and areas for improvement by monitoring client interactions with ChatGPT. This would enable them to fine-tune their goods and services to suit customer needs better.

In addition, ChatGPT’s multilingual support could help businesses provide customers with answers and information in various languages. It would help the business grow clientele, provide customer service to a global customer base, and even enter new markets. The multilingual support can also potentially attract new customers who were excluded earlier due to language barriers.

For consumers, particularly the underserved

The benefits are not limited to businesses alone. Consumers can also benefit from being able to access advice and information in a timely and efficient manner.

ChatGPT-powered chatbots can be available on various platforms, such as websites, mobile apps, and messaging applications. This accessibility enables individuals with limited access to traditional banking channels, such as physical branches, to engage with financial institutions conveniently and access essential services with ease.

ChatGPT can serve as an educational resource that provides users with information on budgeting, saving, and other financial topics. By delivering accessible financial education, ChatGPT helps individuals acquire essential knowledge and skills and promotes their financial well-being and inclusion.

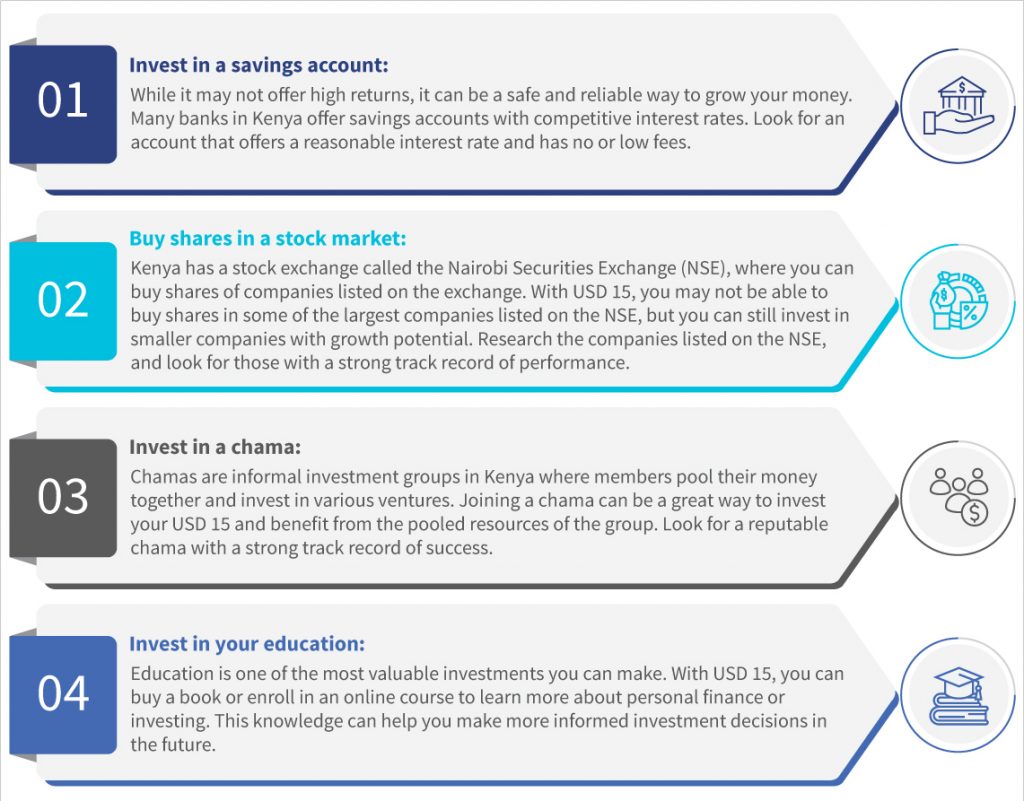

We gave ChatGPT a second test to understand what further benefits it could bring to an individual. We wrote to ChatGPT from the perspective of an MSC consultant based in Kenya and asked for financial advice on investing USD 15 in Kenya. This was ChatGPT’s response based on data available as of September 2021:

Investing in Kenya with just USD 15 might be challenging, but there are still some options available to you. Here are a few tips to help you invest your USD 15 wisely in Kenya:

Remarkably, ChatGPT provided localized, applicable, and understandable options that could help consumers make informed choices regarding their finances. One of the seven recommendations from the Centre for Financial Inclusion for financial capability building is to reach consumers when making financial decisions. ChatGPT could provide financial service providers and consumers with a way to enhance financial capability and decision-making.

Similarly, ChatGPT’s usage in advanced economies has stayed strong. As per a publication by Forbes, The Impact Of ChatGPT And Open Banking Cannot Be Underestimated. Mike Kelly, an entrepreneur, and a FinTech enthusiast, has built a plug-in to link ChatGPT to his bank account using the UK’s open banking APIs. The plug-in, called “BankGPT,” can show you your balance, find transactions, discuss your budgeting, and even make payments.

Concerns and ethical considerations

We have highlighted some of ChatGPT’s potential use cases, but what are some challenges and concerns in its use?

ChatGPT will also need training, and its output would need to be edited to ensure that the messages fit the company’s tone and voice, and, of course, be accurate. Without time and human intervention, it cannot be plugged in and output results immediately.

Regulations are minimal on the use of chatbots, and they certainly will not account for some of ChatGPT’s power and scope. Still, legislations, such as data protection and human rights laws, must be updated to cover obligations when developing and using AI to protect the customer and their data and avoid discrimination and bias. Some countries with no or outdated policies must incorporate or update them to protect consumers.

In the developing world, financial service providers and regulators have limited capacity to understand AI’s potential and its dangers fully. AI is often closed-source and for-profit, so its usage to support an agenda for inclusion will likely be limited. Many countries and financial service providers would find it prohibitive to purchase, train, and launch AI and then experiment with and use it.

AI could widen the digital divide if funding and capacity within the profession remain constrained. The open-source nature of ChatGPT, however, stands to deepen access further if it is adopted as a digital public good.

The rapid rise of AI and tools, such as ChatGPT, has raised profound ethical concerns about their safety and exacerbated existing challenges, including climate change, discrimination, and exclusion. Even Sam Altman, the CEO of OpenAI (the creators of ChatGPT), has expressed his concerns about the danger of AI and the significant harm it could bring. UNESCO published the first global standard-setting instrument on recommendations in the Ethics of Artificial Intelligence in 2022. However, the rapid pace of development poses a challenge in keeping the recommendations up-to-date and relevant, and the implementation of these recommendations by countries across the globe provides an ever more significant challenge.

The advancement of ChatGPT and other tools to accurately generate realistic conversations will transform how we work, how businesses operate, and how customers experience services. Before we can confidently say that ChatGPT will enhance financial inclusion, we need to see the challenges around funding, capacity, and, particularly, regulations being tackled to realize its potential to support improved customer experiences and offer services that could enhance greater inclusion and informed customer choice.

Written by

by

by  Jul 3, 2023

Jul 3, 2023 6 min

6 min

Leave comments