Expanding access to finance for small businesses in India: A critique of the Mor Committee’s approach part 1. Background and the supply gap

by Anup Singh, Abhay Pareek and Raunak Kapoor

by Anup Singh, Abhay Pareek and Raunak Kapoor Jun 6, 2014

Jun 6, 2014 4 min

4 min

This three-part blog dissects and examines the Mor Committee report and critically reviews it with respect to enhancing access to financial services for small businesses in India.

In 1966, the Hazari Committee on industrial licensing recommended nationalization of banks, which changed the Indian banking industry fundamentally. After a gap of nearly forty-five years, a similar path-breaking effort has been initiated by the Reserve Bank of India, in the form of the Committee on Comprehensive Financial Services for Small Businesses and Low-Income Households. The Committee and its report are part of an explicit and dedicated effort to expand the ambit of financial services from partial to full inclusion of small businesses and low-income households in India. The Committee’s terms of reference included the formulation of design principles to develop institutional frameworks and regulation and development of new strategies to achieve full inclusion and deeper financial support. Chaired by Nachiket Mor, the Committee tabled its report in a record time of four months. The report, with its visionary and reformative recommendations, aims at significantly and fundamentally overhauling the entire banking industry in India. The report’s bold and ambitious recommendations have so far received a range of responses from critics, ranging from wholehearted support to skepticism, from wonder to bewilderment. While the report has its fair share of ambition and optimism, in our view there are parts that are aptly conceived and its recommendations in the light of best practices and global learning make sense. In this blog, we critique the Committee’s approach with respect to enhancing access to financial services for small businesses in India.

Considering that small businesses were an integral part of the target segment, the report’s following observations and recommendations have the potential to impact the delivery of financial services to small businesses fundamentally:

- “Close to 90 percent of small businesses have no links with formal financial institutions. There exists robust and visible demand by small businesses for a wide range of financial services. Currently, this demand is being serviced by informal sources.”

- “The current approach of full-service, national level, scheduled commercial banks using their own branches and a network of mostly informal agents is a case of “too much for too little” as access is low compared to risks and costs.”

Apart from these observations, the Committee also recommends that by January 1, 2016, there should be:

“High-quality, affordable and suitable credit for all small businesses from conveniently accessible formally regulated lenders. It further establishes the need for full inclusion of small businesses with regard to basic payments and savings, and risk and investment products.”

For market making impact, the Committee suggests the following:

“DFIIs such as NABARD, CGTMSE, and SIDBI should re-orient their focus to be market makers and providers of risk-based credit enhancements rather than providers of direct finance, automatic refinance, or automatic credit guarantees for banks.”

In addition, the Committee recommends that by 2016, every sector and sub-sector of the economy with more than 1 percent contribution to GDP would have a credit to GDP ratio of at least 10 percent.

In three parts of this blog, we dissect each of these observations to assess why and how it can impact enhancing access to financial services by small businesses in India. We also showcase examples of similar initiatives that have yielded far-reaching impact in terms of bridging the demand-supply gap for financial services.

- Demand and Supply Gap for Small Businesses Financing in India

One of the key observations of the Committee is that 90 percent of the small businesses are self-financed. Regulators, donors and financial institutions have constantly raised this issue on several platforms and flagged it as a challenge that needs to be addressed on a priority if India is to attain its dream of full financial inclusion. The reason is obvious, as, in a developing nation like India where the country’s growth is being fuelled by vibrant small businesses, the lack of adequate finance mars the growth of the small business sector and in turn impacts on the growth of the nation.

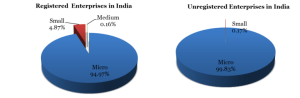

An analysis of financing to enterprises reveals that small businesses face a major gap in financial services. India has 1.8 million registered and 29 million unregistered enterprises. 95 percent of registered enterprises and 99 percent of unregistered enterprises are micro-enterprises.

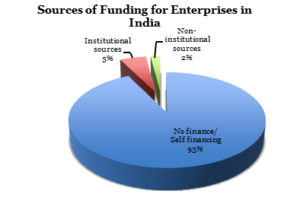

As per the annual report 2012 from the Ministry of MSME, Government of India, only about 7 percent of enterprises have access to finance from institutional and non-institutional sources.

As per the annual report 2012 from the Ministry of MSME, Government of India, only about 7 percent of enterprises have access to finance from institutional and non-institutional sources.

93 percent of such enterprises rely upon self-finance, which includes the entrepreneur’s savings and short-term loans from friends, family, and relatives.

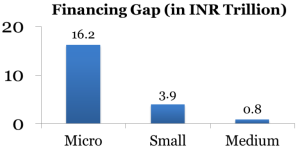

The International Finance Corporation, in its 2012 Research Report estimates that the finance gap for small businesses is a whopping 96 percent. The report estimates that of the INR 20.9 trillion MSME finance gap, INR 19 trillion is the debt gap and INR 1.9 trillion, is the gap in equity.

In the next blog in this series, we examine why financial institutions are unwilling or unable to sieze the market opportunity to fill this gap.

Leave comments