Mobile money and microfinance: A match made in heaven or marriage gone awry?

by Lokesh Singh and Nishant Kumar

Sep 9, 2014

5 min

Though most of the microfinance and mobile money partnerships have failed to scale-up in India, it is helpful to understand the challenges. This blog studies such partnerships in India share key takeaways.

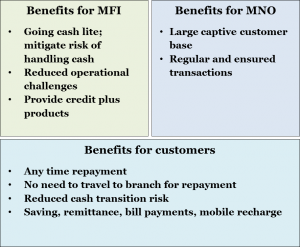

Use of mobile money in microfinance seems to be an idea whose time has come. It has also figured in our publications as potentially the next big idea in financial inclusion (see Can MNOs Lead the Way for Banking the Excluded 1 and 2 as well as Mobile Money – Influencers of Success and Speculation on the Future of Financial Services for the Poor in India). On the face of it, it seems to be a “no brainer” as it offers tremendous value propositions for all parties involved. These propositions are the basis of a few such partnerships that took place in India.

MicroSave has been closely involved to study such partnerships in India. The most recent one was a pilot test in Uttar Pradesh between a large MFI and an MNO. However such partnerships have not yielded expected results. In most of these cases, MFI and MNO partnerships are built on the following assumptions:

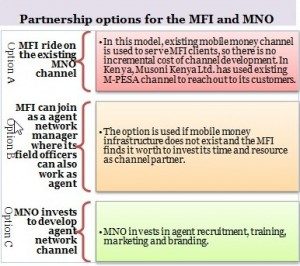

- “Option C” (see diagram) was chosen for partnership due to limited other alternatives.

- MFI provided initial support in marketing and building a customer-MNO relationship.

- MFI repayment was positioned as the anchor product with additional services like saving, payments and fund transfer.

Challenges in Mobile Money for Microfinance Uptake

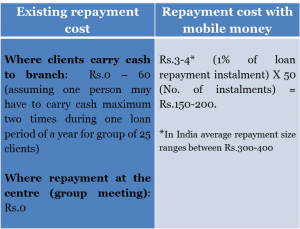

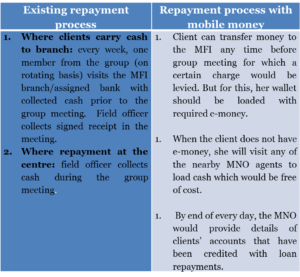

Clients are reluctant to pay mobile money charges: MFI is in the business of extending loans at clients’ doorstep with largely manual approaches. The clientele is low income and often they are not quick to adopt new technology. In addition, they are highly cost conscious. As long as these charges are lower or equivalent to the current transaction cost (including opportunity cost), they are likely to shift to this option; otherwise, they are unlikely to do so. Clients living close to an MFI’s branch, in particular, are unlikely to see any compelling reason to shift to mobile money.

Initially, partners wanted to test the water and understand clients’ inclination to pay the MFI repayment fee. But when clients were reluctant, neither MFI nor MNO wanted to bear those charges. MFI viewed clients’ mobile money usage and subsequent efficiency gain and additional revenue generation (if any) only in the long run. While the MNO had to bear the cost of channel management and did not want to forego revenue. Also, it considered that as a channel partner, the MFI should either bear the cost or at least pressure clients for mobile repayments. But the MFI feared that pressuring clients could impact their credit business.

- No compelling anchor product: MFI repayment was not a compelling enough anchor product to pull customers to use mobile money. MFI clients are accustomed to their manual repayment process and for economic reasons outlined above do not want to shift to the new channel. Other products like saving, remittance, mobile recharge and bill payments could not be pitched as most partnerships faltered in the initial stage.

- Low penetration of MNO points: Even when clients wanted to try MNO for repayments, (typically where branches were far from the center – the meeting point of MFI client groups), they demanded that the agents should not be more than two-three kilometers away from the centers. But for the MNO, this would require considerable investment in infrastructure, training cost and other expenses to set up agents.

The HelixInstitute of Digital Finance estimates that the total cost of setting up an agent varies between $300->1,000 depending on the market in which they are operating. Some of these costs are borne by the agents themselves and their master agents, but MNO still has to make significant investments. MNO wants to see the proof of a business case before investing, whereas MFIs insist that business would only come if there are enough points close to the users.

Conclusion

Though most of the partnerships have failed to scale-up in India, it is helpful to understand the challenges. Specific takeaways that should be considered to scale-up these initiatives are as follows:

a) Ride on an existing mobile money network: Building an agent network from scratch for MFI repayment is a costly and complex proposition, that can yield many benefits (see NBFC-MFIs As Business Correspondents – Who Benefits? (Part-II), but has its fair share of challenges and draw-backs NBFC-MFIs As Business Correspondents – What Will It Take?. On another hand, many MFIs do not want to start as an agent network manager (business correspondent) since this is complicated and removes takes away the key value proposition of de-risking cash handling. For smaller MFIs, a better proposition for an MFI and MNO partnership is to ride on existing network (please see BanKO example in the Philippines or Musoni in Kenya).

b) Choice of an anchor product: A client bears limited economic and opportunity cost since she carries cash to the branch only 2 times in a year. Especially in rural areas, MFI repayments also provide an opportunity for women members to visit the town and many times they do not consider traveling as an additional cost. An MNO and MFI partnership has a greater probability to succeed if the anchor product is chosen carefully after studying the paint points of the consumers.

c) Building new behavior takes time: Success in case of technology adoption requires a change in customers’ existing behavior. Thus, we should provide adequate time for a client to grasp changes in the repayment process, adapt to using technology and build capacity to facilitate behavior change. It is difficult to put a defined timeline for this and it will depend on clients’ socio-economic background. A pilot test and subsequent reviews should provide an indication as to whether clients are demonstrating the behavior, or need more nudges in form of product promotion, incentives or new and refined financial literacy (How To Make Financial Education Better.. May Be).

Under the current circumstances in India, where mobile money market is still evolving and agents are widespread only in certain pockets, MFI and MNO partnership could entail a huge cost to build the required infrastructure. Thus their partnerships should be built on solid value propositions by putting clients’ needs and requirements at the center. There is no doubt that MFI and MNO will benefit, but in the end, clients need to see enough value proposition to shift from the existing channel. Mobile money could attract the clients, provided (and only if) it solves a compelling problem for them and MFI-MNO are willing to invest in building clients’ capability to use it.

by

by  Sep 9, 2014

Sep 9, 2014 5 min

5 min

Leave comments