Making Digital Money More Relevant, More Often – Part 1

by Ignacio Mas and Vartika Shukla

by Ignacio Mas and Vartika Shukla Oct 20, 2015

Oct 20, 2015 5 min

5 min

“How do we make mobile money more inclusive and relevant in the daily lives of people?” Part 1 of the blog series explores mass market customer profile.

Who are the Customers?

Adoption of digital financial services are growing year on year, across most developing country markets. GSMA, in its 2014 State of the Industry Report, states that mobile money is now present in 89 out of 135 markets, and in 16 countries the number of mobile money accounts exceeds the number of bank accounts.

However, the GSMA also reports that only a third of mobile money accounts are active. Most service providers accept that a vast proportion of accounts have zero or negligible balances. India’s ambitious PMJDY programme, for instance, reports that approx. 40 per cent of the accounts opened under the programme have zero balances.

The question we often hear service providers ask is: “How do I make customers use my product/service more?”

The fundamental question that seems to be ignored is, “How do we make mobile money more inclusive and relevant in the daily lives of people?” Through this series of blogs, we attempt to answer this question.

Part 1 of the blog series explores the profile of the mass market customer (mainly low income group) as a necessary first step in answering this question.

The mass market has a few typical characteristics: a large percentage of people do not have a regular fixed income; most do not have a defined (predictable) income flow. Because of the uncertainty which comes along with a variable income, people employ various methods to manage and organise their money.

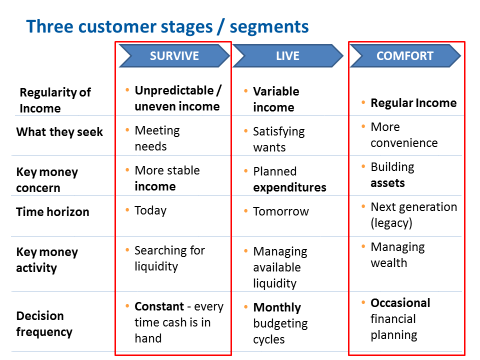

We can broadly classify people into the following three segments:

People in the ‘Survive’ category have unpredictable or uneven income. They are more concerned about meeting day-to-day needs. Their money matters usually have a very short time horizon since their objective is to ensure stability of income. They are constantly searching for liquidity and have to plan for what to do with money every time they receive it.

In the ‘Live’ segment, people have moved beyond daily survival and are looking at satisfying wants. The focus of financial behaviour shifts from fulfilling necessities to meeting aspirations and planned expenses. Income, even though much less uncertain may still be variable. They need to manage their available liquidity in order to meet their aspirations and are planning for these using monthly budgets.

The ‘Comfort’ segment consists largely of people with regular income. They seek to have more convenience in their lives and are building assets, particularly for their next generation. They do occasional financial planning to ensure that resources are directed to asset acquisition in order to keep their legacy secure.

Ideally, digital money should be useful for all the three segments. However, there may be less of a need to focus on the ‘Comfort’ segment as they already have suitable solutions in the market targeted at them. The comfort segment can manage their finances with traditional financial products and services due to the predictability of their income. The mass market, however, largely consists of the ‘Survive’ and ‘Live’ segments where incomes are unpredictable or, at the very least, variable. Mobile money offerings ought to cater to the complex methods, which people in the ‘Survive’ and ‘Live’ segments employ to manage their finances.

Below, we profile a customer, who mobile money service providers should be able to target if they are to make mobile money relevant for the mass market.

|

He is a part of an informal savings group (comprised of vendors from the locality where he runs his shop). Seema is a customer of a MFI operating in the area. She recieves small loans from the MFI. Ram Mohan also owns 5 chickens and a goat. Seema often tries to save small amounts of money to buy gold jewellery. She believes that it is an excellent investment. Ram keeps a part of his daily earnings with a supplier of FMCG goods who is based near his house. This allows him to keep some of his money at a distance, thus helping him save up for a bigger amount which is needed from time to time for paying the school fees of his children. Ram Mohan is a smartphone user and uses data services frequently. He is comfortable in using his smartphone and has an active data connection. His children access social media applications including Facebook and WhatsApp, and use the phone for gaming (Candy Crush Saga) and for offline entertainment purposes (music, movies, video clips) after getting downloads from a neighbourhood shop. Ram and Seema often discuss the ways by which they can achieve some stability in their income and expenditure. For now, they think that they need to continue to patch together various income sources to enable this. The diverse income sources coupled with the safety net of friends and families can help the family sail through any financial shocks that they might be faced with. |

Ram Mohan is a good representative of the mass-market customer. He employs a variety of mechanisms to meet his financial needs. He is also aspirational, and importantly, has access to a smartphone. If mobile money is to be relevant to Ram Mohan, it should enable him to shape his finances in a personalised way by representing the complex ways in which he manages his money at present, using tools that are easily available at his disposal.

In part 2 of the series, we will explore in more detail the money management mechanisms used by mass-market customers.

Written by

An example of a potential customer profile:

An example of a potential customer profile:

Leave comments