Entitled: A synonym for empowerment of blue-collar workers through customized financial services

by Tenzin Varma, Devraj Hom Roy, Anshul Saxena and Anil Gupta

Aug 11, 2021

6 min

Entitled is a startup that works to build a one-stop platform for the financial needs of blue-collar employees in India. With an engine that recommends the right financial product starting from credit and insurance to savings, Entitled handholds customers to achieve their financial goals. The company’s efforts have resulted in a positive impact on its early customers. Read its success story here.

This blog talks about a start-up called Entitled, part of the Financial Inclusion Lab accelerator program, which is supported by some of the largest philanthropic organizations across the world – Bill & Melinda Gates Foundation, J.P. Morgan, Michael & Susan Dell Foundation, MetLife Foundation and Omidyar Network.

In India, more than 170 million people are classified as blue-collar workers. Most are semi-educated migrants from rural areas, who often lack formal financial history. Most blue-collar jobs do not provide any form of social protection, unlike white-collar jobs in the country.

A combination of a lack of financial literacy, low income, and lack of financial data has rendered this segment extremely vulnerable. The recent migrant worker crisis in India, brought about by COVID-19 further amplified this vulnerability. Traditional financial products that are designed for the top-of-the-pyramid customers often fail to meet the needs of this segment, leading to their exclusion.

Sana Qureshi is a 23-year-old woman who works at a healthcare platform in Mumbai. She faced the pain of such exclusion when she could not source a loan for her sick father’s medical treatment. Information asymmetry and fear of getting scammed worsened her conundrum as she searched desperately for options. This is when Sana came to know about Entitled—something that she recalls, “gave her hope”.

The fintech was founded by Anshul Khurana, Krishna Yadav, and Arpan Jain in 2019. It uses technology to provide access to a range of financial products, such as health insurance, emergency credit, and savings solutions for blue-collar workers, such as Sana.

It takes three to tango

This spurred the idea of a platform to engage employees through financial products.

Solving problems for employees: What Entitled does

The two co-founders had another profound learning. They realized that they should focus on two interconnected aspects to solve these problems for the workers. The first is to educate them about financial management. The second is to counsel them to bring about effective lifestyle changes through a mindful selection of financial solutions suited to their context and needs. So, they started looking for a “partner-in-crime” who could help them add this dimension of education and counseling for their targeted customer segment.

Fortunately, they soon crossed paths with Arpan who shared the vision to support blue-collar workers. The trio was completed and their brainchild was formally given a name, Entitled. Combining their expertise, they began to engage employers in Mumbai to gather employee details. Gradually, Entitled began to offer financial wellbeing products to empower workers while bringing cohesion and clarity in their financial lives.

Entitled: A full-service financial wellness platform for blue-collar employees

Entitled helps blue-collar workers to access a range of financial services and rewards through its financial wellness platform.

How does Entitled do this? It links up with employers to offer services on the platform as employment benefits to these workers. The product suite includes:

- Financial counseling;

- Access to emergency funds;

- Insurance;

- Long-term saving instruments; and

- Rewards programs for employees based on their use of financial products.

The platform uses the employment information of the workers to build profiles and map the appropriate services to the employees.

Figure 1: User engagement of Entitlement

Sana Qureshi, 23, who is employed at a healthcare platform in Mumbai was introduced to the Entitled team by her employer and became an early adopter of the platform. Entitled not only provided her access to credit but also handheld her through the onboarding process and helped her to learn and leverage other features of the platform.

How does Entitled ensure the efficacy of its platform?

While providing financial wellness products, Entitled also captures the impact they have on their users. Entitled maps impact against specific metrics and tracks them continually. For instance, these metrics:

- Gauge the convenience and simplicity of formal products for workers who access them for the first time;

- Map product usage patterns against employee awareness and knowledge to design similar products for other segments; and

- Benchmark each of the platform’s products and services against the market rates at which these can be accessed through formal banking institutions be it lending or savings products, as applicable.

Such impact assessment helps Entitled in multiple ways.

- Enable increased awareness or understanding of formal financial products

- Create and deepen financial history for its users

- Catalyze their users’ access to financial institutions in the future.

Impact assessment helps Entitled ensure the financial wellbeing of users like Sana Qureshi, who we met earlier in our blog even during the pandemic. The Entitled team provided her guidance and timely nudges to meet every repayment in full and on schedule. This improved her credit score, which will enable her to avail cheaper and easier loans in the future. Sana is one among many others whom Entitled have helped in their nascent journey—a fact that is not lost on happy employers.

Trials along the way

While some employers are yet to recognize the importance of offering financial health initiatives and providing workplace benefits to their workers. Others simply fail to prioritize the financial health of employees. This leads to delayed interventions and denies employees critical financial aid and advice.

The first significant challenge for Entitled is user capability. The employee’s lack of awareness about technology and financial products requires significant handholding. Owing to the COVID-19 pandemic, user engagement has deteriorated.

Secondly, regulations, such as the moratorium announced by RBI in March 2020, have diminished investor willingness to lend—which in turn has impeded customer traction for Entitled. Nevertheless, the resolve of the founding team is strong and the team has invented ways to overcome the hurdles. The team has quickly adapted and shipped new product designs to ease the onboarding flow in a self-service delivery model.

Support from the FI Lab:

Entitled has been part of the Financial Inclusion Lab accelerator program, which receives support from some of the largest philanthropic organizations in the world—Bill & Melinda Gates Foundation, J.P. Morgan, Michael & Susan Dell Foundation, MetLife Foundation, and Omidyar Network.

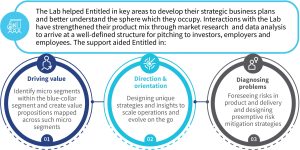

The Lab has offered a cohesive and holistic support package to Entitled, ranging from mentor hours and grant capital to field studies led by financial inclusion experts in the areas of consumer and market insights. This has helped Entitled to gain a deeper understanding of its customers and build resilient, impactful solutions for them.

Vision for the future

While the pandemic has had an impact on Entitled, the company was able to refine its strategy to move forward and engage with more users on the platform. Based

on its knowledge of users’ behavior and familiarity with WhatsApp, Entitled has designed a customized WhatsApp bot for digital on-boarding. Such an approach tackles the first set of challenges that new users face while onboarding in the absence of over-the-counter interactions.

Figure 3: Entitled’s WhatsApp onboarding flow

Entitled has taken an efficient path to move forward by remaining lean and agile with minimal operational staff and by prioritizing product development for features based on customers’ needs. It continues to move toward improved digital features on the platform through a mobile application. The mobile app will make interactions easier, more efficient, and explanatory for users while adding a positive dimension to the financial lives of their customers once on-boarded.

This blog post is part of a series that covers promising FinTechs that are making a difference to underserved communities. These start-ups receive support from the Financial Inclusion Lab accelerator program. The Lab is a part of CIIE.CO’s Bharat Inclusion Initiative and is co-powered by MSC. #TechForAll, #BuildingForBharat

by

by  Aug 11, 2021

Aug 11, 2021 6 min

6 min

Leave comments