The Potential for Technology-backed Remittance Solutions in Malaysia

by Akshat Pathak, Priya Garg and Shreya Gupta

by Akshat Pathak, Priya Garg and Shreya Gupta May 25, 2018

May 25, 2018 7 min

7 min

The blog explores the potential for technology-backed remittance solutions in Malaysia.

Borhan is a Bangladeshi migrant employed at a bottling plant in the suburbs of Kuala Lumpur. He earns MYR 1,400 (~USD 334) each month. After covering his basic living expenses, Borhan is able to save MYR 750 (~USD 179) approximately. He remits this money to support his family back home in Dhaka. He uses informal channels, such as hawala and private money-changers for remittance, as he does not have a bank account in Malaysia. Although sending all his savings on a monthly basis through these channels is more expensive than sending only what is required, Borhan sees this as a better solution than keeping cash with him.

As Malaysia’s economy continues to expand steadily, an increasing number of Malaysians have started to opt for higher skilled jobs. This has created opportunities for migrants to play a crucial role in filling the gaps in low- and medium-skill jobs, which make up three-quarters of employment opportunities in Malaysia. Like Borhan, thousands of Southeast Asian migrants come to Malaysia each year in search of better opportunities. While the country has achieved one of the highest levels of financial inclusion among middle-income nations, the growing community of migrant workers continues to lack access to formal financial institutions and financial services.

A combination of factors like the increased adoption of smartphones, greater access to the Internet, and growing comfort in using technology have given rise to new and innovative financial solutions. These solutions allow the migrant workers to fulfil their basic financial needs – including the ability to send money home and build small savings in case of an emergency. This blog showcases the drivers for growth and the potential for technology solutions in the Malaysian economy.

Financial Inclusion is Growing

Financial inclusion is a key goal for Malaysia’s central bank, Bank Negara Malaysia (BNM) under the 2009 Central Bank Act of Malaysia. The country adopted a Financial Inclusion Framework under the Financial Sector Blueprint for the period 2011–2020. This blueprint aims to create an enabling and holistic ecosystem, which would allow and encourage the delivery of innovative products and services to the low-income segment in a safe, effective, and sustainable manner. As a result, most households in Malaysia now have access to a wide range of conventional and Islamic finance products and services. These households now have the ability to carry out electronic payments nationwide.

The Contribution of Migrants to Malaysia’s Development

Malaysia is on track to become a high-income nation by 2020. Migrant labour, both medium and low-skilled, continues to play a crucial role in the country’s development. As per Malaysia Economic Monitor 2015, there are 2.1 million registered migrants in Malaysia and likely over 1 million undocumented migrants, making up 15% of Malaysia’s workforce. However, the Malaysian Employers Federation estimates that the number of undocumented migrant workers could be closer to 4 million.

The migrant population is largely made up of workers from the neighbouring countries of Indonesia, Bangladesh, Nepal, Myanmar, Vietnam, China, and India. They find employment largely as third-party contract workers in sectors such as plantation agriculture, manufacturing, construction, and hospitality. Many workers who are undocumented migrants may earn less than the minimum wage.

As per statistics from BNM, remittance outflows have increased by more than 500% in the past 10 years. The growth in outward remittances from 2011–15 is depicted in figure 1.

The potential for Technology-backed Innovative Remittance Solutions

Access to formal financial institutions continues to be a substantial problem for the migrant labour force. A survey conducted by the World Bank’s Project Greenback 2.0 team finds that the level of bank account ownership is 22% for plantation workers and 55% for urban workers. While there are multiple reasons behind these numbers, the major ones include:

- Documentation: Many migrants cannot provide the required documents, particularly the guarantee letter issued by the employer;

- Wage Disbursement: Employers of migrant workers tend to make wage payments in cash;

- Cost: A required ‘minimum deposit’, in some cases as much as MYR 2,000 (~USD 476), is prohibitive to migrants who may earn an average of MYR 850 (~USD 203) per month;

- Convenience: Agriculture workers may be as far as 30 km from the nearest branch. This makes the process of travelling to banks or other regulated remittance channels time-consuming, besides involving significant opportunity costs and risks, as the workers need to carry cash.

| BNM’s Efforts to Build a Conducive Environment for Fintechs

BNM has been proactive in recognising fintechs as a catalyst for the development of progressive financial services. Its efforts have included an increasing focus on the use of technology. The central bank established the Financial Technology Enabler Group (FTEG) and issued a Financial Technology Regulatory Sandbox Framework. The FTEG has been designed as a cross-functional group to serve as the focal contact point on fintech-related queries. The sandbox framework grants regulatory flexibilities to financial institutions and fintechs to test new solutions in a live, contained environment within specified timeframes and parameters. |

Migrant workers prefer non-bank remittance service providers because they do not use formal financial institutions regularly, if at all. Theirpreference is rooted in the convenience of location, ease of transaction, and speed and reliability of the channel, as per Project Greenback 2.0.

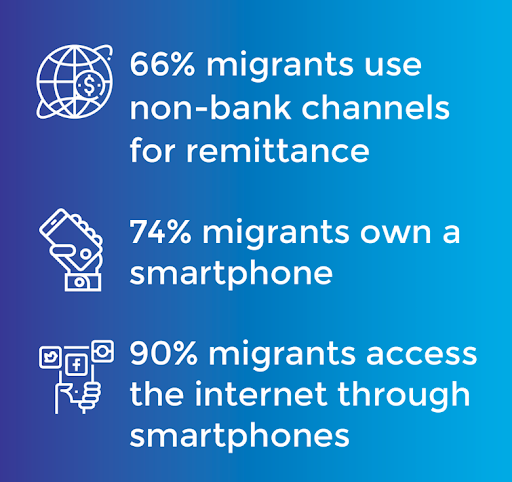

One of the most significant trends in technology among the migrant worker community in Malaysia has been the increase in smartphone adoption, largely driven by the reduced cost of smartphones and greater access to mobile broadband.

The migrant community uses smartphones to access social media platforms to connect with their families back home. This comfort of using smartphones presents an opportunity for financial institutions to provide access to technology-driven, innovative remittance services.

Furthermore, the regulations are written in a way that is consistent with the earnings and remittance patterns of migrants. Under the Anti-Money Laundering and Counter Financing of Terrorism regulations in Malaysia, remittance service providers are required to conduct customer due-diligence for transactions of MYR 3,000 (~USD 719) and above. Remittance service providers are allowed to transact in amounts less than MYR 3,000 based on customers’ passports. These tiered regulations have augmented the growth of non-bank remittance service providers and have made it easier to serve the migrant worker segment.

Case Study: MyCash Online, an e-Marketplace for Migrant Worker

Riding on an increasing demand-side and favourable enabling environment, fintechs in Malaysia have been blending financial services and technology. One such example is MyCash Online, an online marketplace for blue-collar migrant workers in Malaysia.

MyCash Online offers easy, secure, and convenient online financial services including domestic and international airtime top-ups, money transfers, airline and bus ticket bookings, bill payments, and e-commerce. MyCash Online offers its mobile and web application in six languages. The language options support the uptake and use of services for migrants from Bangladesh, China, India, Indonesia, Nepal, and the Philippines. Since its inception in April, 2016, MyCash Online has served over 65,000 migrant workers and managed over 350,000 transactions valued at MYR 5.43 million (~USD 1.29 million). It has a network of 550 independent Mobile SalesPersons (MSPs)–MyCash agents.

MyCash Online offers easy, secure, and convenient online financial services including domestic and international airtime top-ups, money transfers, airline and bus ticket bookings, bill payments, and e-commerce. MyCash Online offers its mobile and web application in six languages. The language options support the uptake and use of services for migrants from Bangladesh, China, India, Indonesia, Nepal, and the Philippines. Since its inception in April, 2016, MyCash Online has served over 65,000 migrant workers and managed over 350,000 transactions valued at MYR 5.43 million (~USD 1.29 million). It has a network of 550 independent Mobile SalesPersons (MSPs)–MyCash agents.

To use MyCash, a user first needs to register at MyCash Online’s website or mobile application using a valid and unique identity number, usually their passport number. Once the applicant’s identity is verified, the MyCash Online team requires the user to confirm registration independently to avoid fraud.

Structured as a virtual bank account, MyCash Online allows migrant workers to deposit their cash at MSP outlets, which exist near the workers’ settlements or workplaces. The MSP then credits an equivalent amount of e-money into the migrant worker’s MyCash account. The migrant workers use this e-money for domestic and international airtime top-ups, airline and bus ticket bookings, bill payments, and e-commerce through a variety of vendors. The adjoining graphic illustrates the process.

How it Works

For international remittances, MyCash Online has partnered with Metro Exchange, a licenced money changer and remittance service provider. This has made its international remittance service cheaper and more convenient compared to incumbent remittance players in the market.As part of its future plans, MyCash Online has applied to BNM for a regulatory sandboxlicense. The sandbox would allow MyCash Online to test new business models and solutions that can improve customer value and experience, and bring about better efficiency andrisk management.

For international remittances, MyCash Online has partnered with Metro Exchange, a licenced money changer and remittance service provider. This has made its international remittance service cheaper and more convenient compared to incumbent remittance players in the market.As part of its future plans, MyCash Online has applied to BNM for a regulatory sandboxlicense. The sandbox would allow MyCash Online to test new business models and solutions that can improve customer value and experience, and bring about better efficiency andrisk management.

Looking Ahead

Fintech already plays an important role in driving financial inclusion in Malaysia. It is likely to accelerate because of BNM’s enabling approach. This approach has already resulted in three potentially ground-breaking initiatives.

- As part of recent developments, Malaysia’s largest financial service providers Maybankand CIMB have entered into a partnership with Ant Financial Services Group. Maybank and CIMB will act as settlement and merchant acquirer banks to enable the Alipay mobile wallet in Malaysia. Launched in 2004, China-based Alipay is the world’s largest online and mobile payment platform with over 520 million users.

- Earlier in 2017, CIMB launched an incubation programme known as Innochallenge to support the ideation and creation of new fintech solutions.

- RHB, another major Malaysian bank, became the exclusive partner of Startupbootcampwithin the Malaysian fintech space. It aims to evaluate, fund, mentor, and organise hackathons to promote digital innovations.

Considering BNM’s proactive stance and the active collaboration that exists between fintechs and incumbent financial service providers, we can expect technology-driven and innovative solutions to emerge in Malaysia that would create a differentiated and compelling suite of product and service offerings. These solutions will augment meaningful financial inclusion in the country and facilitate the integration of underserved segments into the formal financial services sector – including migrant workers.

[1] This document contains a few hyperlinks and readers are advised to read the document in conjunction with them.

[1] This document contains a few hyperlinks and readers are advised to read the document in conjunction with them.

[2] Hawala is an alternative remittance channel that exists outside of traditional banking systems.

Leave comments