“Train me like this”: Lessons from the pilot on IIBF BC/BF certification

by Akhand Tiwari, Moinuddin Mohammed and Ravi Kant

by Akhand Tiwari, Moinuddin Mohammed and Ravi Kant Jan 21, 2022

Jan 21, 2022 5 min

5 min

Between 2012 and 2021, out of approximately 300,000 agents, who appeared for the IIBF BC/BF exam, only 62% passed the exam. This blog details out the challenges faced by BC agents in passing the IIBF BC/BF exam. It also offers suggestions to policymakers on graded certifications based on the type of services offered by BCs.

“I scored 28 marks in my first attempt,” says Vikas Kumar, a 32-year-old business correspondent (BC) who finally cleared his Indian Institute of Banking & Finance’s Business Correspondents/ Facilitators (IIBF BC/BF) examination. This was his second attempt in the mandated certification examination to become a cash-in cash-out (CICO) agent. Vikas is among hundreds of other registered business correspondents who must qualify to operate as a CICO agent. However, he had to invest INR 1,200 (USD 16) to get through the examination—INR 800 (USD 10) for the first attempt and INR 400 (USD 5) for the second attempt.

The conundrum of IIBF BC/BF examination

In 2018, The Reserve Bank of India (RBI) authorized the Indian Institute of Banking & Finance (IIBF) to conduct the examination and certify CICO agents (see the rules and syllabus). The IIBF is a registered training body for the banking industry. The regulator introduced the certification to ensure that all BC agents had the basic knowledge of banking operations. The examination tests BC agents on topics, such as the basics of banking, types of interest rates, understanding of financial inclusion products—such as Pradhan Mantri Jan Dhan Yojana, Pradhan Mantri Suraksha Bima Yojana, Pradhan Mantri Jeevan Jyoti Bima Yojana, Atal Pension Yojana, and complex concepts like cash flow.

Between 2012 and 2021, out of approximately 300,000 agents, who appeared for the IIBF BC/BF exam, only 62% passed the exam. Therefore, an estimated number of about 1.3–2 million agents lack the IIBF BC/BF certification[1]. The inability to clear the examination affects BC agents and Business Correspondent Network Managers (BCNMs). While the agents lose their livelihood, BCNMs or Banks lose active agents and spend additional resources recruiting and training new agents. Further, changing an agent reduces the trust locals have in the BC channel.

To overcome challenges in clearing the examination, MSC ran a pilot with the Centre for Development Orientation and Training (CDOT)—a BCNM that operates across eight states and 3,000 villages in India.

As most agent network managers in India have a dedicated team to train agents, we used the existing training structure at CDOT but modified the pedagogy and content. The interventions improved the conventional training method that handed over a guidebook or translated version of prescribed content to the BC agents earlier.

A design thinking approach to create an agent-centric solution

The MSC team observed that the current IIBF BC/BF module was complex for many potential agents. The technical terms and complex concepts often confuse the agents when they read the module. Further, they could not find answers to their questions in the module. For example, agents may know some commonly used English words like “fixed deposit” and “fund transfer,” but their Hindi translations are complex and archaic. In addition, from our interviews, we found out that most agents had never heard of concepts like “cash flow.” To tackle this, we divided the monolithic learning session into smaller, manageable modules and conducted counseling sessions for the agents.

The BCs were trained in smaller groups using a virtual classroom setup (Zoom/Google meet). The training was conducted in a counseling mode, and the content was shared upfront with the agents. The counselor (trainer) discussed the concepts and addressed questions in a session. The counselor encouraged the agents to discuss concepts and terminologies and highlighted the best approaches to attempt the exam and the commonly asked questions.

Enhancing agent certification rates by more than 43%

The immediate outcome of the overall intervention was encouraging.

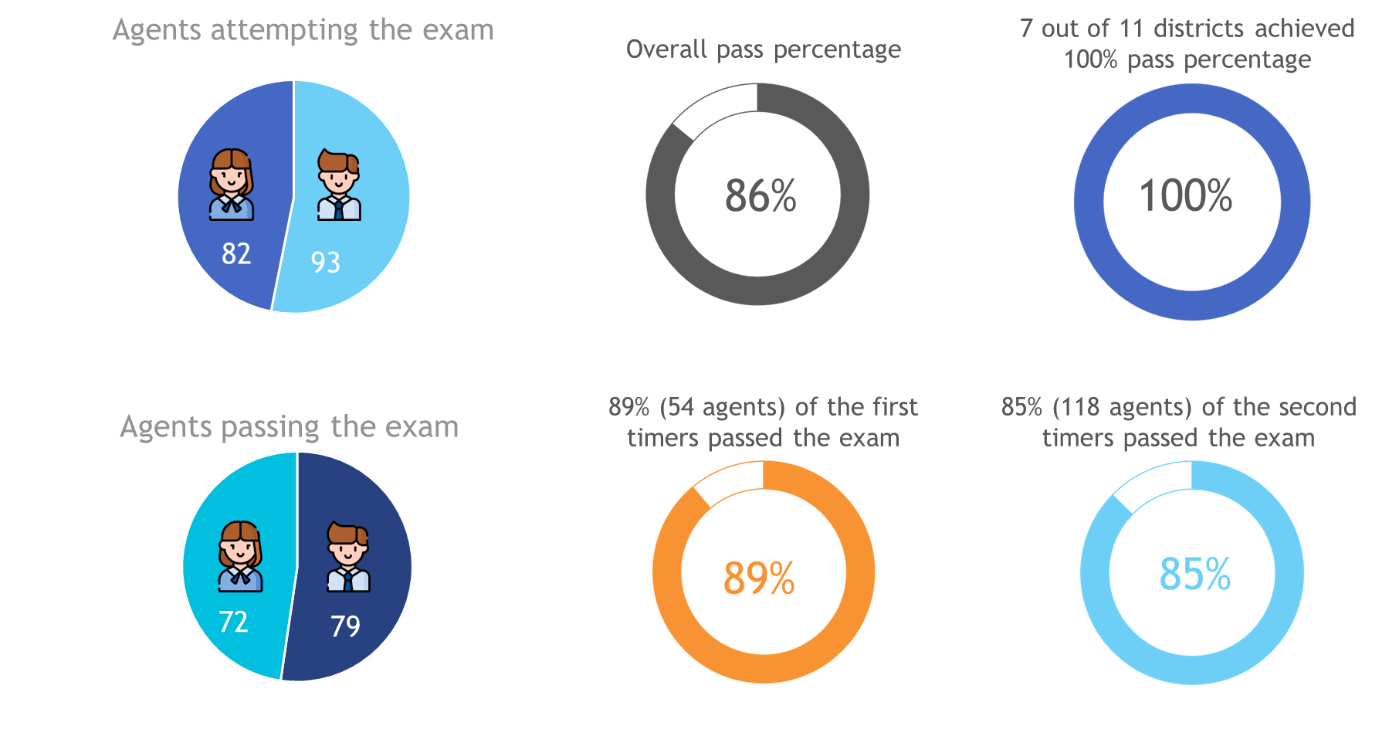

CDOT’s 175 agents appeared for the exam (see figure above). Of them, 151 (86%) passed the exam—a significantly higher number than earlier experience and comprehensive market data. The commission of certified agents also improved substantially.

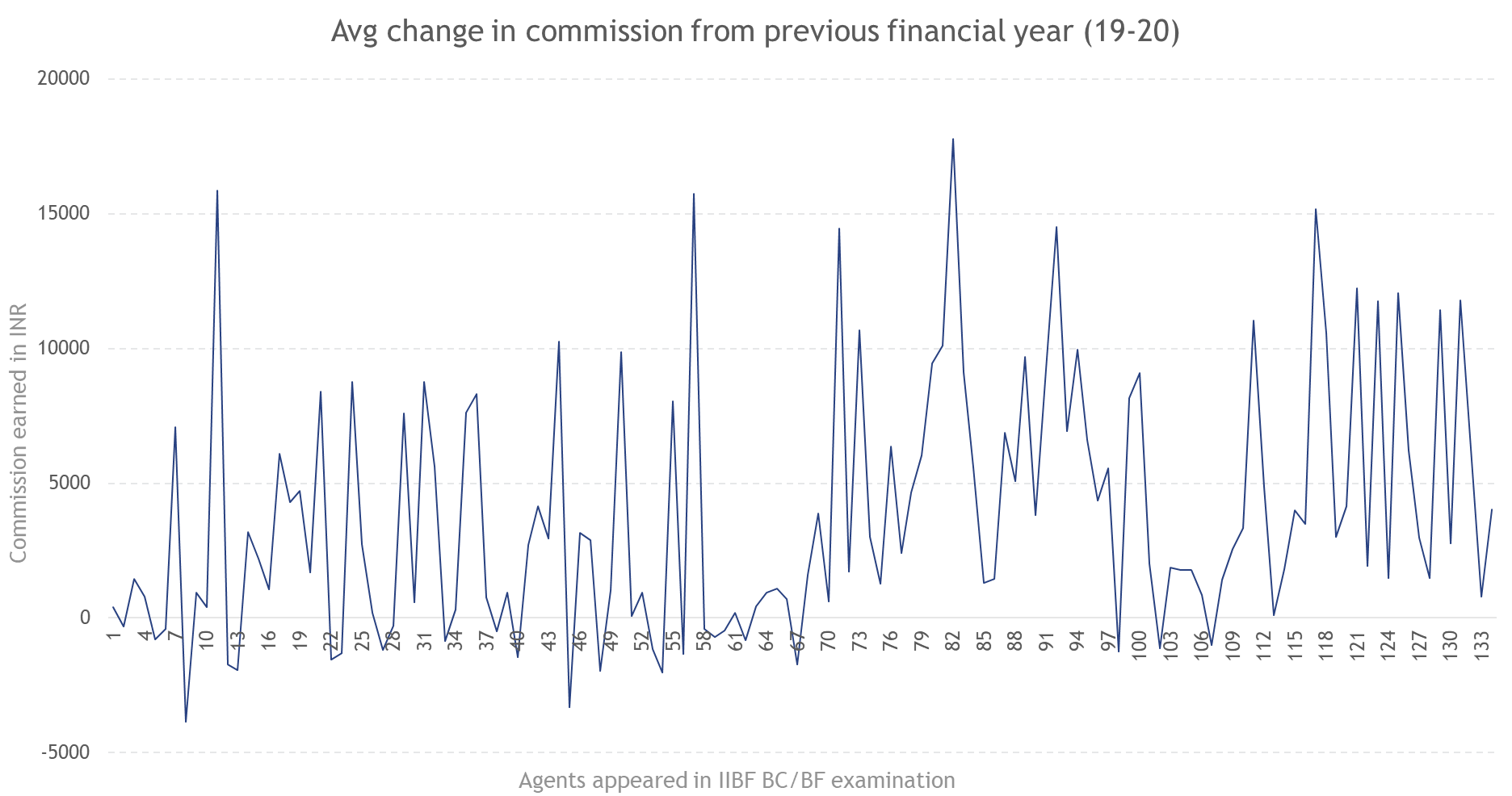

In 2020, 128 agents saw an increase in revenue compared to 2019, with a median increase of INR 3,855 (USD 50)—150% from the previous year’s commission income. Of these, 110 (86%) had passed the exam. The remaining 18 agents, who failed the exam, only saw an increase of INR 2,014 (median increase of 67%).

In the few cases where agents’ income declined, the reduction in revenue over the past year was lower for the agents who passed the exam (median decrease of 27%, INR 1,330 (USD 17)) than for those who failed the exam (median reduction of 35%, INR 1917 (USD 25)).

“Earlier, I was afraid of cash handling matters. Now I can deal better with the customers as I am aware of products better. I provide services in the entire panchayat area.” (A CDOT agent in Bihar).

CICO agents in India have specific characteristics. These include their diversity (see figure below), the contexts in which they operate, the varied bouquet of services they offer, and the associated risks posed by the different technologies they use.

Figure 1: India has different archetypes of Business Correspondents (BCs)

With an overwhelming 90% of the existing BC ecosystem providing essential CICO services, policymakers may like to relook at the level of competency or the skill set required. One way to look at the solution is to have graded certification for different levels of BCs. The graded certification can vary by the type of services offered by BCs, as is available for payment banks (PBs) agents. The agents of PBs can pass the first module and start working as agents of PBs, while they offer restricted services. Then, the agents can graduate to the next level if they want to serve as agents for universal banks.

Finally, we believe that the providers must take a long-term strategic view to build their agents’ skills, considering adult learning principles and agent needs. CDOT’s pilot is an early indicator to adopt the counseling-led training model that increases agent income and reduces agent drop-out.

[1] As of December, 2020, the RBI provisional data suggests that there are 1.5 million agents countrywide. The industry estimates and some extrapolation based on NPCI unique device (AePS) activities suggest 2.3–2.4 million agents in India. Since 2012, 187,667 agents have passed the IIBF BC/BF examination. Hence, the number of agents without certification ranges from 1.3 million to 2.1 million.

Leave comments