Graham Wright

Graham Wright

Group Managing DirectorGraham A.N. Wright founded MSC (MicroSave Consulting) and is currently its Group Managing Director. He has 35 years of development experience underpinned by five years of experience in management consultancy. He is a reformed Chartered Accountant.

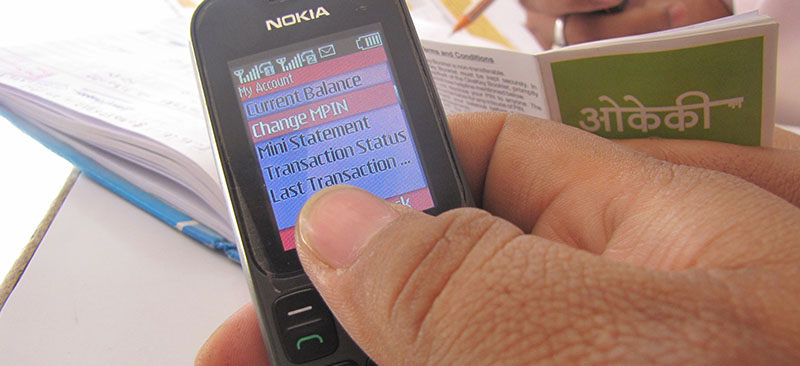

Graham has been deeply involved in digital financial services (DFS) since he supported M-PESA’s initial pilot-testing process. He has worked on DFS projects with governments, banks, fintechs, and telcos across Asia and Africa. These involved strategic planning, market research, product development, process analysis, agent network development, and marketing. Currently, Graham is leading MSC’s work on AI, climate change, locally-led adaptation, and agriculture, and how blended finance and DFS can play a catalytic role in these to enhance the resilience of climate-vulnerable communities. Graham is a regular speaker at conferences and has authored over 250 papers, blogs, and briefing notes, as well as an array of training materials on organizational development, DFS, and climate change.

Email: Graham@MicroSave.net

Posts by Graham Wright

Publication

Publication

Puneet Chopra and Graham Wright