Blog

How can inclusion work if it leaves out people?

Alarmingly, only 22% of people with disability (PwD), the elderly, and vulnerable groups in Indonesia have bank accounts, as per 2022 data from Otoritas Jasa Keuangan (OJK). This points to a vast chasm that lies in contrast to Indonesia’s Medium-Term Development Plan (RPJMN) target of 98% financial inclusion by 2045. The Presidential Regulation No. 114/2000 also included PwD and the elderly in social welfare programs, yet their access to financial services has not kept up with their increasing economic participation.

With the rise of digital financial services, PwD face challenges and gaps when they attempt to access financial products. This is why interventions must be prioritized to enhance digital financial literacy and disability-inclusion sensitivity. OJK released the SETARA Guideline to address this growing digital divide. It provides a comprehensive framework to enhance financial inclusion for PwD in Indonesia. Yet, the implementation lacks actionable steps with defined targets from financial service providers (FSPs), regulators, and the government.

What did the DFAT-funded study reveal?

The DFAT-funded study conducted by Opportunity International Australia (OIA), MicroSave Consulting (MSC), and Koperasi Mitra Dhuafa (KOMIDA) finds that digital financial services can significantly improve financial access for PwD. Services, such as digital bank account opening, reduce the need for physical mobility, while FinTech lending offers simpler, more accessible alternatives to traditional bank credit.

Some apps have integrated screen readers and text-to-speech functionalities, though their adoption remains limited. DANA, OVO, and GoPay have started implementing these accessibility features. Despite this development, PwD still face challenges when they access financial services, which include biometric and e-KYC processes incompatible with specific impairments, business loan applications, and discriminatory treatment from bank staff. Until these systemic issues are solved, FSPs cannot be called inclusive.

Tailored solutions to drive PwD’s financial inclusion

Microfinance institutions (MFIs) have managed to offer grassroots solutions to reach PwD in villages and low-income communities. KOMIDA, for example, has approximately 15,000 female clients with disability spread across 13 provinces in Indonesia. These groups encourage the institutions to develop tailored products that include loan products for assistive technology, home and business renovation, and education savings for family members to access special education.

FSPs should also strengthen their efforts to enhance inclusivity. Accessible infrastructure, such as ATMs, bank branches, and trained staff is essential, but it needs more targeted interventions. These must include organization-wide gender and disability sensitization, alongside the development of tailored financial products for PwD.

The way forward for inclusion

MSC’s collaborative study has highlighted three strategic priorities, “the 3Ms,” to accelerate disability inclusion in Indonesia’s financial services.

Mainstream: All financial platforms and products must integrate universal design to drive innovation. This will ensure accessibility and inclusion for women, the elderly, PWD, people with low-income, and others with specific needs. The principle of “nothing about us without us” guides this. The increasing ageing population similarly faces barriers in terms of access to financial services. For example, television subtitles, originally designed to support individuals with hearing impairments, have also proven valuable for older adults and people who multitask—demonstrating how inclusive design can benefit a wider audience.

Mobilize: Mobilizing ecosystem collaboration will enable disability equity and rights. The private sector can lead by mainstreaming disability inclusion. It can improve ESG performance, integrate PWD into the workforce and supply chains, and offer inclusive products and services to reach underserved markets. The social sector, in particular, organizations of persons with disability (OPDs), should be engaged in advocacy and as expert service providers to support disability mainstreaming and enable meaningful employment and entrepreneurship.

Measure: Governments and regulators must establish clear and measurable targets to advance disability inclusion. The success of disability mainstreaming hinges on formal government endorsement, accountability, and sustained commitment. The Australian government offered tax incentives to organizations that hire or serve people with disability and mandates that all DFAT (Department of Foreign Aid and Trade)-funded foreign investments align with gender equality, disability equity, and rights. This model proves how policy can drive systemic inclusion through public, private, and social sector collaborations, regular disability inclusion sensitization, monitoring, and independent evaluations to ensure sustained progress.

People with disability have immense economic potential, but systemic exclusion has limited their potential. They are too often viewed through a charity lens, but they are entrepreneurs, workers, consumers, and vital contributors to national growth. This systemic exclusion represents not merely a rights issue but a missed economic opportunity for them.

Financial systems designed with accessibility and equity at their core can uphold financial inclusion. They have opened new markets, driven local economies, and fueled national productivity. Inclusion must now be directed beyond doing the right thing, but as smart economics.

This article was first published on The Jakarta Post platform on July 18th, 2025

Smart payments for smarter business with governments

A pathway to smart public spending and optimum use of public funds

Every year, governments allocate vast sums of money toward social welfare, infrastructure, and development programs. However, despite these efforts, some funds remain unspent or underutilized due to operational challenges, fragmented systems, and limited administrative capacity for timely disbursal.

These idle funds, also called float, lie unused in program accounts and incur interest cost as part of the government’s borrowing. They reflect a significant opportunity for governments to further strengthen public financial management (PFM). As India steps into an age of digital governance and fiscal transparency, we see strong momentum and readiness to enhance the efficiency and effectiveness of public fund use. The country is well-positioned to address these long-standing inefficiencies and unleash the full potential of public spending.

In the past, audit reports and union budgets have highlighted issues, such as delays in disbursals, manual processing bottlenecks, underutilization of allocated budgets, and accumulation of idle funds. The Union Budgets, in the past, through Statement 4A have been reporting unspent funds under Centrally Sponsored Schemes (CSS). [1]

For instance, the unutilized funds in FY 2022-23 amounted to about USD 1.7 billion and USD 2.0 billion in FY 2023-24, based on the difference between actual expenditure and revised estimates.[2] However, for the first time, the Union Budget 2025–26 brought attention to this issue by releasing Statement 4AA, which publicly revealed a program-wise breakdown of unspent funds in State Single Nodal Agency (SNA) accounts.

A new era of transparency: Statement 4AA

Statement 4AA represents a milestone in public finance transparency and intends to achieve optimal expenditure management. It revealed the total funds released for select CSSs and the unspent balances with designated SNAs or state treasuries as of 31st December 2024. This disclosure applies to programs with annual budget estimates of over USD 55 million.

Each program presents three key figures: The total release made by the center, the amount parked with SNAs, and the balance with state and union territory governments. This framework enables policymakers, administrators, and citizens to track public funds, from release to potential utilization, and identify where float accumulates in the system.

This kind of public accounting is critical because CSS accounts for nearly 10% (USD 63 billion out of a USD 590 billion budget per FY 2025-26) of India’s total government expenditure. Even a modest share of these funds can create large-scale inefficiencies. Delayed disbursals stall implementation of critical welfare services, while parked funds contribute to an avoidable interest burden for the exchequer.

Modern systems, but a long road ahead

In July 2021, the Government of India introduced the SNA model to address the issue of idle balances. Under this system, each state manages a CSS through one designated agency with a single bank account, which ensures better control and visibility over fund flow and improved cash flow management. The Public Financial Management System (PFMS) enforces drawing limits, links fund release to actual utilization, and has saved approximately USD 1.3 billion in interest costs by reducing float since FY22.

While the SNA model has driven significant progress, it has room to strengthen fund use timelines further across states. By December 2024, state governments had more than USD 18 billion in unspent balances. This balance accounts for roughly 10% of net borrowings in the Budget FY 2024-25. While project implementation often begins, disbursements are delayed due to slow approvals, manual processing, and verification issues. The gap between expenditure and actual progress highlights the need for faster, digital, and rule-based payments.

What leads to idle float?

Idle funds persist due to several key recurring factors. First, many departments continue to depend on semi-digital program management systems. Unstandardized data formats and the absence of an integrated, unified data source hinder smooth data exchange and payment validation. This may cause delays between work completion, payment processes, and final disbursement. As a result, even after tasks are completed, funds remain stuck in the treasury or transit.

Second, a disconnect between budget plans, spending capacity, and reporting leads to underutilized funds, even as yearly allocations increase. This may reflect a need for more dynamic alignment between budget projections and implementation capacity to optimize fund deployment.

Third, agencies earmark funds for operational activities, such as training or monitoring, which they spend gradually. This explains part of the float but does not account for the broader systemic delays.

The road ahead: A better model for the flow of funds

In January 2024, the Government of India launched SNA-SPARSH (System for Payments and Reporting Across Sectors Holistically) to upgrade the existing SNA model. This new system introduces a real-time or just-in-time (JIT) method of funding. The SNA-SPARSH module in PFMS makes fund flow more transparent, helps release money faster, and reduces idle funds by allowing both the Centre and States to pull funds. It also shows how funds are shared and tracks how money is used in real time.

Some CSSs have already implemented SNA-SPARSH. For example, the state of Rajasthan adopted it for the Pradhan Mantri Gram Sadak Yojana (PMGSY), a program with one of the highest unspent funds worth around USD 1 billion nationally, as per Statement 4AA. With this new model, fund transfers are expected to align more closely with implementation milestones.

While the upgraded system enhances oversight and fund tracking, the next frontier is to translate this improved visibility into consistent, time-bound actions. The new SNA-SPARSH module of PFMS, layered with a rule-based program management system, can fill this gap. It can transform government payments from near-just-in-time (JIT) to true JIT payments.

Such module will enable agile processes and rule-based triggers to uncover the full benefits of PFM reforms, enhance monitoring, and ensure more timely payments.

From oversight to real-time action

The way ahead involves the use of an intelligent, rule-based program management system- one that operates on clear “if-then-else” logic to deploy autonomous triggers based on predefined milestones and compliance conditions. An innovative, rule-based payment system that is embedded in PFM principles, such as observability, JIT funding, and a single source of truth, can improve expenditure management and overall fiscal efficiency.

Such a system would improve cash flow, reduce administrative work, and give officials more control over spending. It can also help with better planning, budgets, and expenditure management, which would lead to improved accountability at both the central and state levels. Over time, the program management system would support better fund use and tracking across CSS programs, enhancing administrative capacity. It also supports a more transparent and results-driven public finance system.

The model has already shown promising results. In 2019, MSC designed the “smart payments solution” piloted under the MUKTA (Mukhya Mantri Karma Tatpar Abhiyan) program in Odisha across 115 urban local bodies (ULBs). This allows instant payments once verified milestones are achieved. An impact evaluation in January 2024 reported that pilot ULBs (Jatni and Dhenkanal) reduced payment delays by 57% and eliminated float in the pilot ULBs. The system used autonomous, rule-based processing to reduce administrative burden and ensure faster, more accountable delivery.

The Department of Food and Public Distribution uses the SCAN portal (Subsidy Claim Application for NFSA) to enable smart payments. SCAN offers a single window through which to settle food procurement claims from states. It uses rule-based checks and automatic calculations to release subsidies on time. These efforts show a move toward real-time financial management. Digital systems and rule-based triggers now help ensure funds move only when and where needed.

What next?

India’s recent public financial reforms have delivered results through their shift from static fund allocations to dynamic, milestone-linked disbursements. The introduction of SNA-SPARSH, built on JIT principles, marks a key milestone in the government’s commitment to reduce idle balances, improve transparency, and enable real-time fund tracking.

SNA-SPARSH’s transformative potential can blossom. But it must be paired with an end-to-end smart governance layer that digitizes and automates the full program management and payment lifecycle based on predefined rules-driven triggers. Such a pairing would pave the path to more innovative and responsive public finance.

[1] Centrally Sponsored Schemes (CSS) are programs funded by the central government but implemented by states. These schemes cover a wide range of sectors, including health, education, and rural employment.

[2] The conversion from INR to USD is based on the exchange rates at the time of writing.

Fast-tracking female founders: Have we found the winning formula?

As of December 2024, India boasted more than 73,000 startups with at least one female director. However, the picture is bleak when it comes to India’s unicorns—only 15% have at least one female founder. This gender gap in leadership is more evident in sunrise sectors, such as climate tech, where female startup owners comprise just 39%, against a national sector-agnostic average of 48%.

At MSC, we have a rich history of supporting the acceleration and incubation of entrepreneurs who work toward financial and digital inclusion. This time, we designed WEP-उन्नति (Unnati)—a collaborative program by MSC, the NITI Aayog’s Women Entrepreneurship Platform (WEP), and the Small Industries Development Bank of India (SIDBI). WEP-उन्नति (Unnati) is dedicated to accelerating the entrepreneurial journey of women who create solutions for a greener planet.

As part of its inaugural cohort in February 2024, WEP-उन्नति (Unnati) called for applications across India and selected 15 women “greenpreneurs.” They represented 12 Indian cities and 11 industries, which include renewable energy, agro-waste management, climate-smart animal husbandry, sustainable fashion, and eco-tourism, among others. We provided them a continuum of support to address six ecosystem needs recognized by MSC and WEP’s research as essential for the growth of women-owned businesses.

In this piece, MSC offers up several “cheat codes” for entrepreneurship support organizations (ESOs) looking to dip their toes in empowering women-led climate startups.

What did WEP-उन्नति (Unnati) teach us?

Cheat code #1: Mentorship guarantees the best results—if done right

Our research reveals that only one in every four Indian women entrepreneurs can access entrepreneurial mentorship. Existing mentorship support lacks targeted goal setting and periodic monitoring, yet fails to set a fixed number of sessions to maintain structure. This dearth of clarity and regular check-ins often results in disengaged mentors and mentees who coast. Yet the biggest misstep is failing to adapt as strong programs evolve only by learning from the cohort’s feedback and refining their experience continuously. Providing a four-month-long, one-on-one mentorship then became an evidence-informed choice for us—one designed thoughtfully to avoid these common pitfalls.

“My engagement with a WEP-उन्नति (Unnati) mentor who helped me precisely where I needed was the best thing to happen to my business”, shared Vandita, whose flagship product is a nutrient-rich, chemical-free growing medium made from tender coconut waste.

We invited each entrepreneur to share the top three growth-related challenges. We then carefully matched all 15 founders with 12 industry experts (handpicked from a pool of 100+ experts) who could guide them to resolve these specific challenges. Together, our mentors brought 250+ years of industry and 100+ years of mentoring experience. They collectively have guided 12,000+ entrepreneurs, 56% of whom were women. We facilitated meetings and followed up with the mentors and the mentees for feedback and course correction—a practice that helped make the engagement more meaningful.

Our mentors triggered a shift towards profitability for 80% of the cohort. Saloni Godbole, a producer of nutraceuticals for livestock, notes, “I came to WEP-उन्नति (Unnati) as a scientist but am leaving here as an entrepreneur.” Her cattle clients were the only ones who survived a statewide epidemic in Maharashtra.

We had two key takeaways from this experience for those of you who want to empower entrepreneurs. One, look for industry experts who match the entrepreneur’s most pressing needs and are sensitive to working with someone at that stage of business. And two, spend time setting the table right so the mentors and mentees know exactly what to expect from each other.

Arundhati Kumar, sustainable fashion mentor, said, “This has been one of the best program-managed accelerators I have been part of, both as a mentor and a participant. Thank you for the rigor you brought to the process. It has helped the mentees and mentors stay accountable and committed.”

Cheat code #2: Networking improves confidence, but most entrepreneurs’ networks are poor.

Our cohort gained direct benefits from networking, such as discussions with industry leaders, soft commitments from financiers, connections with government officers, and trust in civil society. However, since this skill does not come naturally, we made an intentional effort through networking mixers, training sessions, and meetings with important public, private, and civil society stakeholders.

As an outcome of WEP-उन्नति (Unnati) introductions, Vanita Prasad, who had enjoyed the first-mover advantage with her cocktail of wastewater treating microbes, went on to build great advocacy for her industry niche in India and abroad. She connected with relevant public and private sector stakeholders, spoke at roundtables in state capitals and remote areas, and demonstrated her solution’s efficacy in front of industry giants, such as Reliance Industries.

Our research finds that women entrepreneurs in suburban and rural markets need greater networking opportunities than their male counterparts. A couple of WEP-उन्नति (Unnati) entrepreneurs also came from Tier 2 towns and echoed our findings. In the case of Pooja, these networking opportunities permitted her to export her offerings. Meanwhile, for Neha, it led to the birth of an eco-village.

The networking sessions improved confidence and risk-taking abilities in 100% of cohort participants. The WEP-उन्नति (Unnati) brand also unlocked positions in many other accelerators for the cohort, such as IIM-Bangalore’s NSRCEL.

Cheat code #3: Striking the correct balance between domain-specific and general entrepreneurial skills training

Our cohort, which includes biotechnologists, chemists, and teachers, had sector expertise but lacked foundational business knowledge. For Pooja, learning to build resilience to climate-induced risks that doom her mushroom supply chain was as crucial as learning to brand, market, and deliver elevator pitches to investors. But for artisanal products retailer Aastha Ratan, only learning to brand, market, and pitch was key. This is why we had laid out our basket of 21 intensive group sessions, which amounted to 600 person-hours, with some that built climate expertise and others that focused on legal, compliance, go-to-market strategy, alongside psychosocial challenges, among other aspects. We also ensured each trainer who was onboarded onto WEP-उन्नति (Unnati) was available to discuss the cohort’s unique business challenges one-on-one.

What were our big wins?

When we started working with the cohort, we found them short of practical revenue models, such as bookkeeping hygiene, sales trackers, financial projections, and legal requirements that would have made them financeable. Therefore, our training sought to strengthen the cohort’s credit and investment readiness, which led to impressive results. By the time we finished, six out of 15 women “greenpreneurs” had secured funding.

Such was the case of Renu Tupsamudre’s pitch for a cleaning agent to wash containers for reuse, which raised INR 50,00,000 in seed funding and bagged her the WEP-उन्नति (Unnati) “Greenpreneur of the Year” title. Meanwhile, Victoria D’Souza’s recycling business raised INR 35,00,000.

Even those who could not raise funds showed they were on the right track. Prerna’s ecotourism aggregator platform achieved her highest turnover to date, while Vanita saw a 50% increase in quarterly revenues. Shilpi’s sustainable clothing company achieved its annual turnover target in just five months, and 100% of the cohort could decide which funding instrument was, or would be, best for their business. This was made possible by triggering a shift from prioritizing social and environmental impact (a global behavior that has a greater incidence in women than men) to balancing it with economic gains.

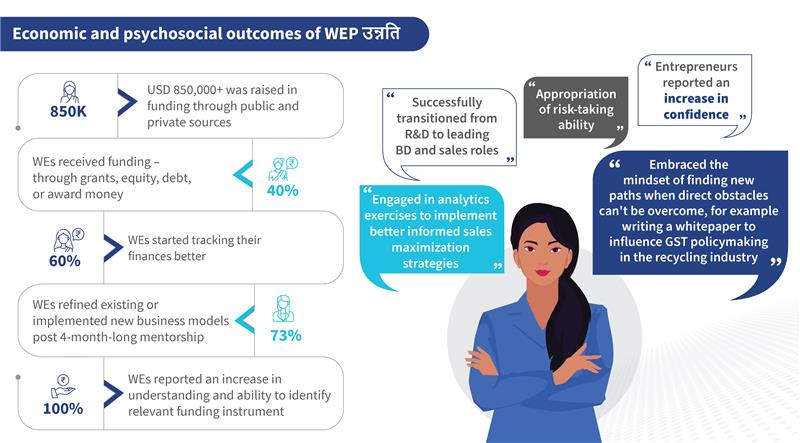

The graphic below shows a snapshot of the programmatic (economic and psychosocial) outcomes of WEP-उन्नति (Unnati):

Lessons from WEP-उन्नति (Unnati) highlighted that high-growth women entrepreneurs, especially in niche areas, such as emissions reduction, circularity, and renewable energy, need support curated across key needs of domain-specific training, finance, market linkages, networking, mentorship, and compliance. This support must be sequential and fit for purpose based on their entrepreneurial stage, appetite for risk, growth, and expansion, as well as industry trends.

Today, more than 50% of the cohort successfully mobilized funds upward of INR 7.5 crores (USD 850,000). With this among other achievements, the WEP-उन्नति (Unnati) program has established strong proof of concept that such ecosystem-enabling entrepreneurship programs are effective and work well to serve the clients in desperate need of capital. Through WEP-उन्नति (Unnati), women can now give flight to their wings and build a brighter future for themselves, their families, and their community.

A race against cyber threats: Biometric adoption in Southeast Asia’s banking sector

An older man in Vietnam from a low-income background lost his entire pension due to a fraud that has become all too common in the developing world. He received a call from someone who had posed as a bank employee and asked the older man to share his OTP over the phone. He fell for the scammer’s pitch and soon, his precious pension vanished from his bank account.

Cyber scams now generate more than USD 43.8 billion annually across Southeast Asia. As digital finance proliferates, cybercriminals are now more advanced. They use tools, such as artificial intelligence (AI), deepfakes, large language models (LLMs), and malware to steal data, impersonate individuals, and bypass security systems. In response, banks across the region have raced to adopt biometric authentication. Banks now use customers’ fingerprints, faces, or voices to verify identity and to protect against these evolving cyber threats.

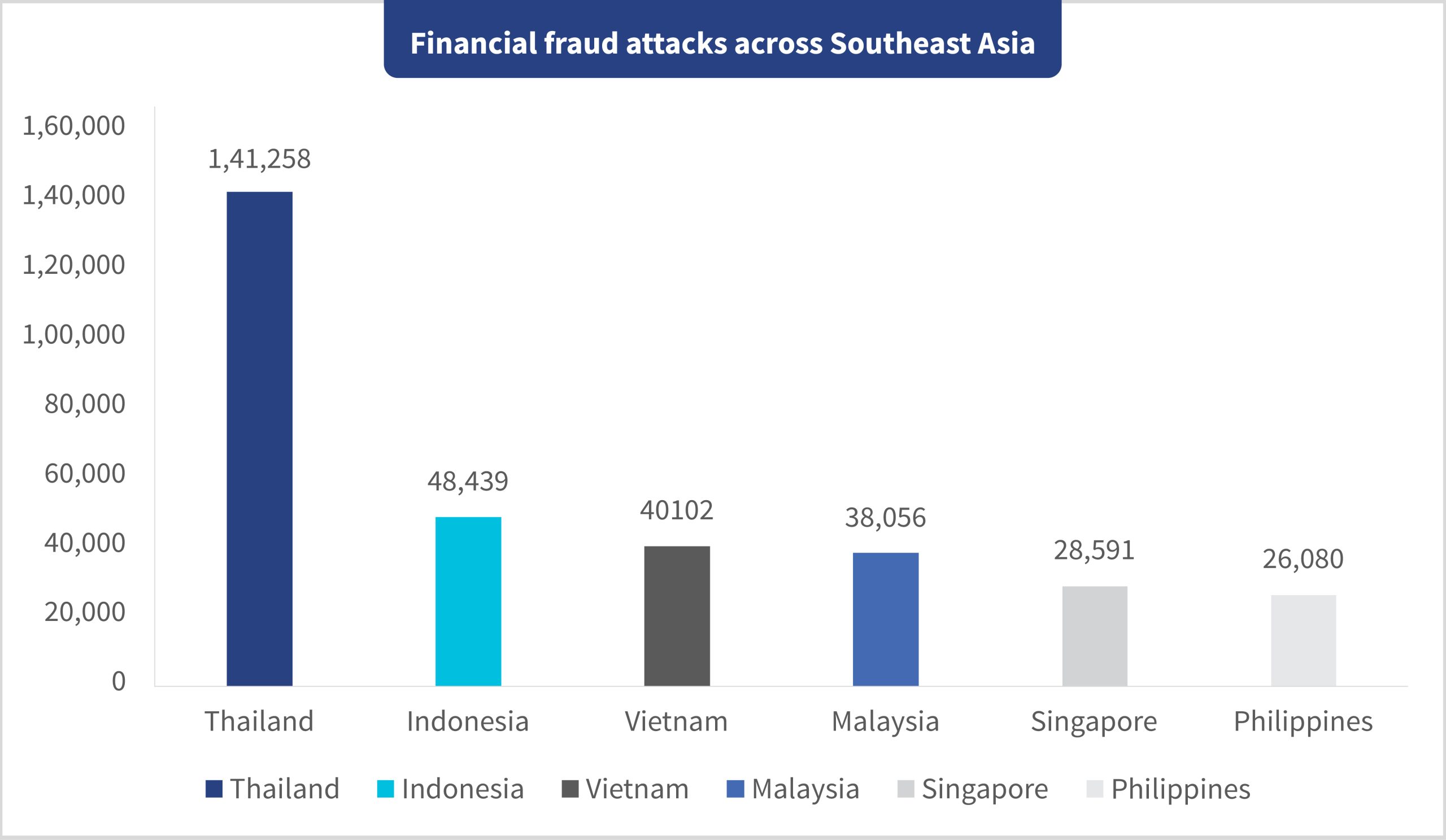

Online financial fraud has surged across Southeast Asia in recent years. In 2024 alone, Thailand recorded more than 14,000 cases, which makes it a regional hotspot, followed by Indonesia with 48,000. Thailand’s high rates of fraud stem from low public cyber awareness and scam operations in neighboring countries, such as Cambodia, Lao PDR, and Myanmar. Scammers have started to use smart devices and sophisticated tactics widely, which escalates the issue.

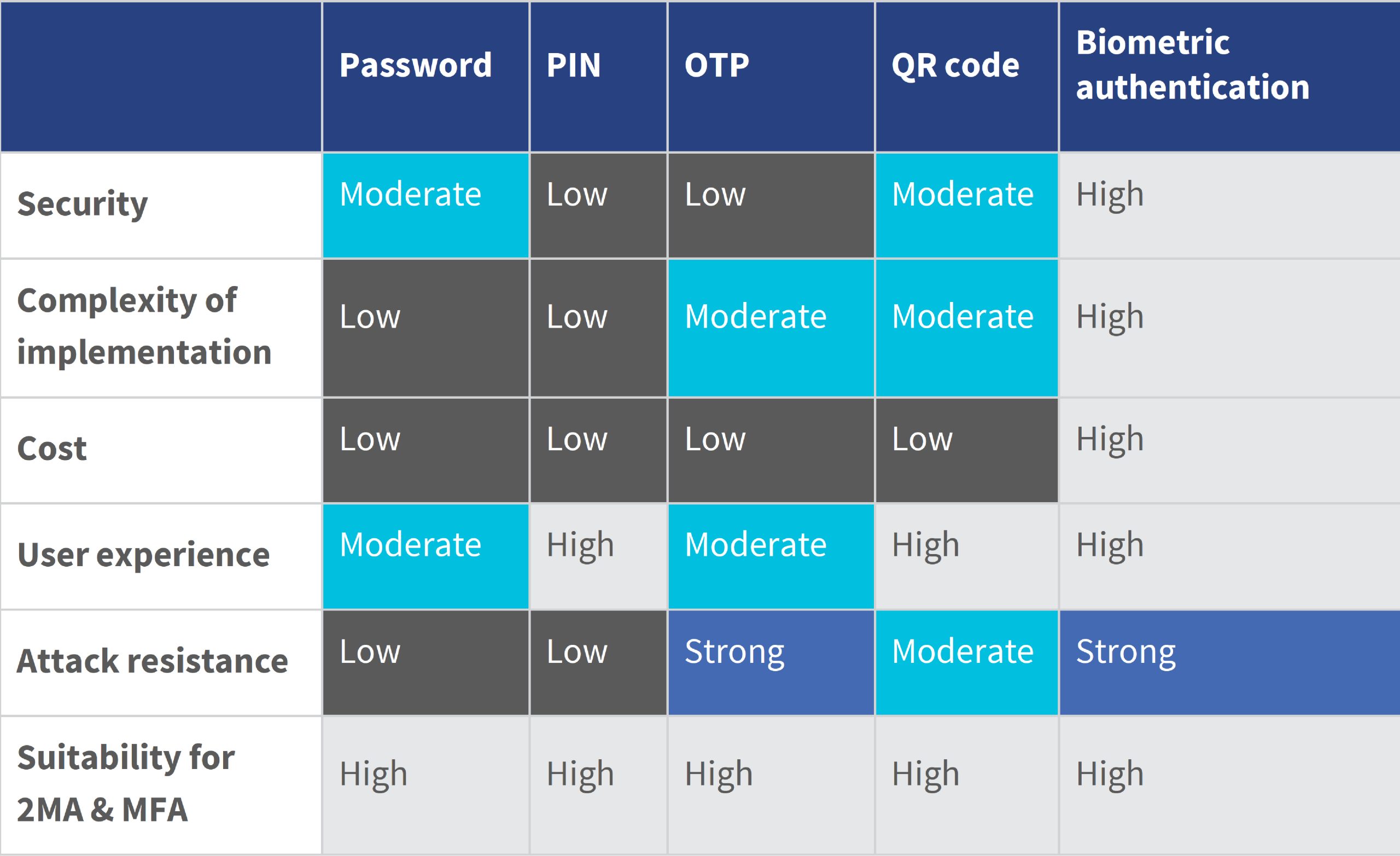

Southeast Asian countries have taken measures to safeguard their citizens against cyber fraud, particularly in finance, which is a primary target sector. In response, financial institutions and FinTech companies have adopted advanced methods to authenticate customers and ensure secure services. However, traditional authentication methods still face limitations. Passwords, which are one of the standard knowledge-based authentication (KBA) methods, are often reused and forgotten by users. This exposes users to phishing or data breaches that increase cybercrime risks and user friction. Cyber attackers can manipulate PIN codes through simple methods, such as social engineering.

Meanwhile, possession-based authentication (PBA) methods, such as SMS-based OTPs, are easy to deploy but vulnerable to SIM-swapping. Similarly, QR code authentication poses risks as bad actors can copy or tamper with them. It relies on a separate scanning device and often fails in poor environmental conditions, such as low lighting.

Biometrics-based authentication has addressed the shortcomings of traditional security solutions and has emerged as a more reliable and secure technology in recent years.

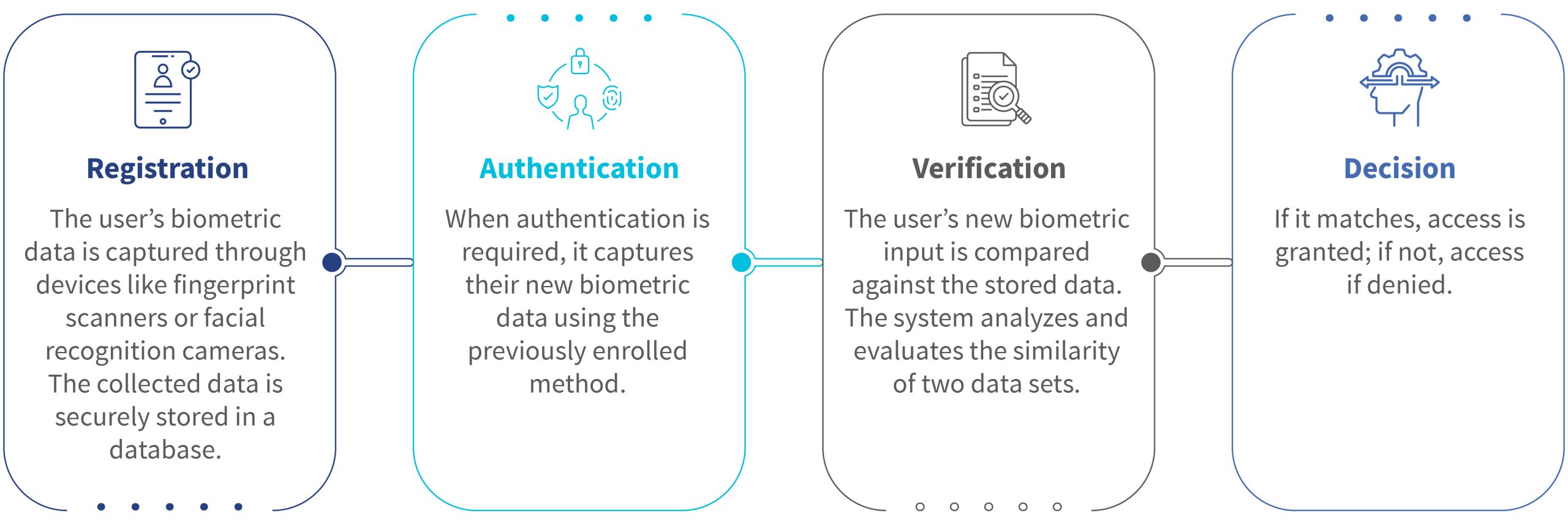

Biometric authentication verifies an individual’s identity through unique biological characteristics, such as fingerprints or facial features. Unlike passwords, biometric data is complex to imitate and not subject to human errors, such as forgotten passwords. Many banks now combine biometrics with other verification procedures to establish a multi-factor authentication (MFA) system, which improves customers’ experience and strengthens digital security.

Across Southeast Asia, governments have taken strong action to build a banking security ecosystem using biometrics. Malaysia has adopted biometric authentication to enhance payment security after Bank Negara’s 2023 directive to phase out SMS-based OTPs with more secure measures. Major banks, such as Maybank, CIMB, and Public Bank, use biometric features, such as facial recognition and fingerprint scanning, in their mobile apps and ATMs. These technologies allow customers to log in, make transactions, pay bills, shop online, and withdraw cash easily.

Decision 2345 by the State Bank of Vietnam implements high security solutions in digital and banking payments. As of July 2024, banks must adopt biometric authentication for high-risk transactions. These include money transfers worth more than VND 10 million or exceeding VND 20 million per day, and for first-time mobile banking use or access from a new device. Verification is based on the verification of customers’ biometric data with information stored in chip-based ID cards, which is the Vietnam Electronic Identification (VNeID) system, or bank databases.

Singapore promotes biometric authentication under the Payment Services Act 2019, which was enacted in . It requires robust customer and transaction verification for digital payment services. The Monetary Authority of Singapore (MAS) has also issued detailed guidelines that encourage financial institutions to adopt biometric technologies that help strengthen security and improve authentication. In response, banks, such as DBS, Oversea-Chinese Bank (OCBC), and United Overseas Bank (UOB) have implemented facial and fingerprint recognition features in their mobile apps and ATMs.

In March 2023, the Bank of Thailand mandated biometric authentication for high-value transactions. Starting June 2023, banks must use facial recognition for transfers worth more than THB 50,000 (USD ~1,350) per transaction or THB 200,000 per day (USD ~6,160). The central bank issued official guidelines on biometric technology in financial services, effective September 2023. In response, banks, such as Siam Commercial, Kasikornbank, and Standard Chartered Thailand, implemented facial and fingerprint recognition to ensure seamless, secure customer transactions.

The central bank of the Philippines, the Bangko Sentral ng Pilipinas (BSP), promotes advanced security technologies to replace the traditional use of OTPs, after the Anti-Financial Account Scamming Act. Banks such as the UnionBank, Philippine National Bank (PNB), and Asia United Bank (AUB) pioneer this area. It implemented voice, facial, and fingerprint scanning in its banking services.

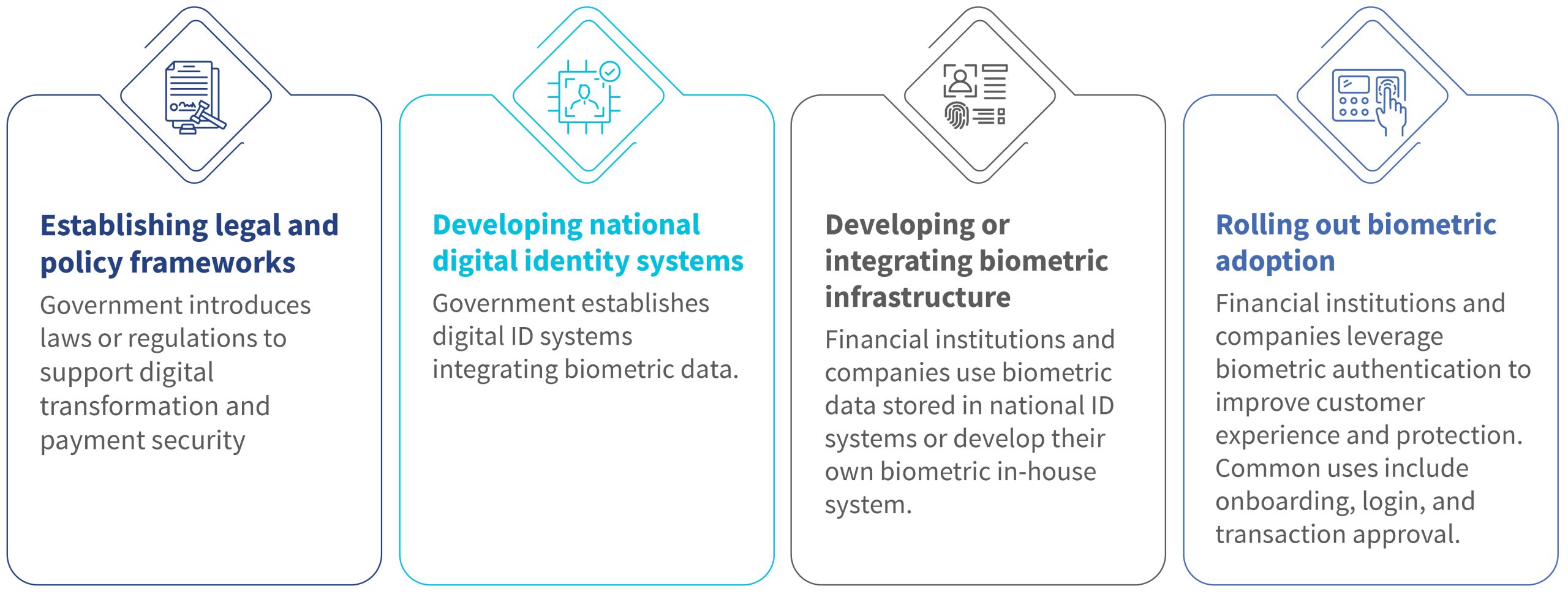

Step-by-step overview of biometric adoption in the finance sector across Southeast Asia

The adoption of biometric technology across Southeast Asia aligns closely with national goals for digital transformation and economic development. As digitalization grows globally, each Southeast Asian country has developed a national digital identity system that uses biometric data to serve its citizens. Citizens must navigate cyberspace securely and confidently to thrive in a digital economy, while banking systems must keep up to remain relevant and effective.

In the long run, biometric technology can serve as a secure gateway to financial inclusion. Banks can simplify access to financial products and services through biometric verification, especially for those previously excluded. With people’s needs at the center, biometrics offer a secure, efficient, and inclusive path toward safer digital finance.