Anup Singh

Anup Singh

Associate DirectorAnup Singh leads MSC’s regional office in Anglophone Africa and heads the Helix Institute based in Nairobi, Kenya. With 16 years of experience, his expertise includes the digital transformation of financial institutions, digital readiness assessment of social protection programs, digital credit scoping, design and policy, training programs, and FinTech mapping, scoping, and policy design.

Anup has advised more than 150 institutions, including governments, FinTechs, financial institutions, investors, and multilateral organizations in Kenya, Uganda, Rwanda, Ethiopia, Nigeria, Malawi, Tanzania, Zambia, and South Africa in the African continent, and India, Sri Lanka, Bangladesh, Nepal, Vietnam, Myanmar, China, Papua New Guinea in the Asian continent. He has also trained at the Boulder Institute of Microfinance, Italy, in 2017, 2018, 2019, and 2021.

A few examples of his recent work are as follows:

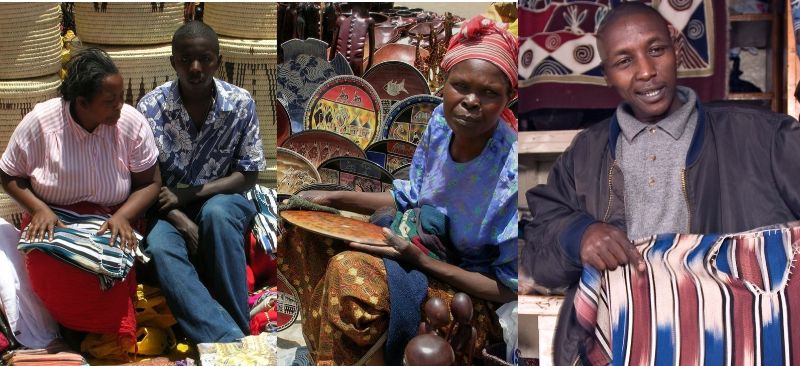

- Quality and usage of digital financial services by open-air market and cross-border women traders in Kenya for the Bill & Melinda Gates Foundation. (2021-23)

- Assessment of best practices in digital credit by micro-entrepreneurs for the Bill & Melinda Gates Foundation. (2022)

- Landscaping of agent lending and recruitment practices for the Bill & Melinda Gates Foundation. (2022)

- Development of East Africa strategy 2022-30 for the Financial Services for the Poor (FSP), Bill & Melinda Gates Foundation. (2021-22)

- Assessment of agent network management in Kenya, Côte d’Ivoire, and Mozambique for GSMA. (2021-22)

- Research on personal financial investment and wealth management for FSDU in Uganda. (2021)

- Technical assistance to the Financial Technology and Service Providers Association (FITSPA) members to comply with the NPS Act and regulations for FSDU in Uganda. (2021)

- Strategy and digital transformation plan for SMFI-Shabelle Bank funded by Mercycorps in Ethiopia. (2021)

- Conducted an assessment of additionality and customer protection risk of the African Guarantee Fund (AGF) for CDC. (2021)

- Development of Awash Bank’s digital financial services strategy and implementation plan funded by Awash Bank in Ethiopia. (2020-22)

- Development of an Integrated Farmer Services platform investment for the Bill & Melinda Gates Foundation in Rwanda. (2020)

- Strategy development for the CRDB Foundation to focus on corporate social responsibility activities for CRDB Group in Tanzania. (2020)

- The feasibility of building an interoperable state-wide digital payment infrastructure funded by the Bill & Melinda Gates Foundation in Kaduna state, Nigeria. (2020)

- Formulation of the proof of concept for Responsible Digital Transformation Lab (ReDiLab) funded by AFD across the globe. (2020)

- Feasibility study for the transformation of BRAC Liberia and BRAC Sierra Leone to deposit-taking institutions funded by BIHBV. (2020)

- Design thinking to refine personal retirement programs for the mass market funded by ICEA LION in Liberia and Sierra Leone. (2020)

- Development of customer journeys and wireframes for the product roadmap of the Rwanda National Digital Payments Strategy, funded by Access to Finance Rwanda: Led the team that built the user journey and interface for the Rwanda National Digital Payments Strategy. (2019-20)

Posts by Anup Singh

Uncategorized

Uncategorized

Many MSMEs are dying—can we realize the full potential of the digital revolution to save them?

Publication

Publication

Diana Siddiqui, Aparna Shukla and Anup Singh

Impact of the COVID-19 pandemic on micro, small, and medium enterprises (MSMEs)- Kenya report (round 3)

Publication

Publication

Diana Siddiqui, Aparna Shukla and Anup Singh