This presentation on awareness, communication, and outreach highlights the need for the integration of key communication components for effective implementation of SPPs.

For well over a decade, MSC (MicroSave Consulting) has assessed and analyzed a broad range of government payment programs across Asia and Africa. Government welfare programs often suffer from the intention-impact gap—largely a consequence of poorly planned or executed communication. As a result, crucial information either becomes distorted or fails to reach recipient families.

This blog explores the intricacies of government communication using case studies and best practices from welfare delivery programs across various countries.

Live and learn: Case studies

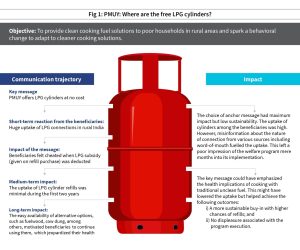

The Pradhan Mantri Ujjwala Yojana (PMUY) is a widely promoted welfare program in India that provides low-cost and subsidized liquefied petroleum gas (LPG) cylinder connections to more than 80 million beneficiaries. The program offers beneficiaries LPG connections and equipment kits, including a stove and pipe, at a 50% subsidy. Beneficiaries could pay the remaining 50% either upfront or in installments. However, if the beneficiary opts to pay in installments, they would not be provided the promised subsidy on the purchase of LPG refills until they finish paying the installments to settle the full amount.

The government had promoted the program heavily through both print and electronic media, including advertisements using public hoardings and TV commercials. However, publicity at the local level through “word of mouth” erroneously declared the connection free of cost. As a result, most beneficiaries felt cheated when their subsidies on the purchase of LPG refills were deducted. The identification of local influencers and clear definition of the offering—clean and subsidized but not free cooking fuel, would have kept the message on track and set correct expectations. Figure 1 unpacks some of the avoidable hiccups in the promotion of PMUY.

The government had promoted the program heavily through both print and electronic media, including advertisements using public hoardings and TV commercials. However, publicity at the local level through “word of mouth” erroneously declared the connection free of cost. As a result, most beneficiaries felt cheated when their subsidies on the purchase of LPG refills were deducted. The identification of local influencers and clear definition of the offering—clean and subsidized but not free cooking fuel, would have kept the message on track and set correct expectations. Figure 1 unpacks some of the avoidable hiccups in the promotion of PMUY.

Under the successful “Give It Up campaign” of 2016, the government appealed to affluent LPG consumers capable of paying the market price to surrender their LPG subsidies voluntarily. The program inspired 10 million well-to-do households to surrender their LPG subsidies, which can then be channeled to poorer households. The withdrawal of subsidy is a tricky issue that governments in the past have failed to address. Then why did it succeed this time?

The “Give It Up” campaign was primarily successful due to two factors. Firstly, the target audience was presented with a clear picture of the problem and the proposed solution. Secondly, the citizens who gave up their subsidies received individual recognition in the scroll of honor. Unlike transient promotional content on mass media, individuals had a proud proof of their contribution, which sparked mass philanthropy. The voluntary nature lent the mantle of a good samaritan to the citizens and inspired better engagement. Figure 2 depicts the objectives of the campaign and the behavioral levers it used to succeed.

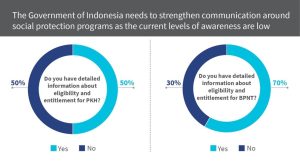

MSC’s assessment of G2P programs in Indonesia highlights the need to optimize communication for social protection programs. For instance, our study of the Program Keluarga Harapan (PKH), a conditional cash transfer that targets poor households, revealed that poor communication limited its success. 50% of respondents did not know the exact details of their entitlements and the withdrawal process. Even frontline workers lacked adequate program information as they encouraged beneficiaries to withdraw their benefits as soon as possible. This led to a misconception that the government would take the money back if any balance remained in the accounts of beneficiaries.

Similarly, beneficiaries of the Bantuan Pangan Non-Tunai (BPNT), a food assistance program for the poor in Indonesia, also highlighted communication gaps related to entitlement and eligibility. The government developed targeted communication and training material for frontline workers and field facilitators. However, it could not promote these well, as many frontline workers reported no awareness about the information material.

The case studies mentioned above suggest that poor communication impedes program and system-level functions despite intensified efforts to strengthen welfare delivery programs across the globe. At the program level, communication and outreach need to be robust to disseminate information related to targeting, benefit delivery, payment methods, monitoring, evaluation, and grievance resolution. At the system level, the focus must be on synchronizing the efforts of various stakeholders to reduce information gaps and overlaps.

A structured approach: Recommendations

A structured approach: Recommendations

Well Made Strategy has outlined six steps to strategic communication that can be used as a clear checklist to reduce communication gaps in the welfare delivery programs.

1. What is the desired change?

Clarity on the objectives of communication is imperative. Steps to achieve the same are as follows

2. Who is the target audience?

Identification of various stakeholders whose engagement will help fulfill the communication objectives is essential for the judicious use of resources. These stakeholders may include existing and potential program beneficiaries, frontline workers, local opinion leaders, and NGOs, etc.

The knowledge of their cultural specifics, socio-economic situation, and perception of the campaign objectives helps create a more effective reach. Customize the content and frequency of communication, based on the nature and involvement of stakeholders—direct stakeholders need to be informed more frequently due to their direct engagement with the last mile.

3. How can you best connect with the audience?

3. How can you best connect with the audience?

A study of the target audience, their life cycles, and typical aspirations for the program will help identify the messages and channels suitable for them.

4. What do you want them to know and do?

Messaging should be focused and not generic. The significant difference in demographics and socio-cultural situation of people in rural geographies and their urban counterparts are necessary to consider. Beneficiaries should have access to clear and concise information about their entitlements, eligibility, and other program-related nuances in the most simplified manner. The messages should be in the local language and designed to overcome exclusion factors, such as illiteracy, disability, etc.

5. What communication channels should you use?

Communication channels should be selected based on their reach, frequency, and credibility. The use of multiple communication channels can help target a variety of audiences across gender, age groups, literacy rates, and location—urban or rural.

6. How do you know whether you have influenced the audience?

6. How do you know whether you have influenced the audience?

The monitoring and evaluation of the impact of communication efforts are important. Collect feedback on the effectiveness of the communication aspects of G2P programs. This would help feed lessons and improve the overall outcomes of the program.

While the framework detailed above is an effective tool to craft a good communication strategy, its use is not limited to welfare delivery programs. Today, governments across the globe face the herculean task of managing the COVID-19 crisis. Keeping the citizens calm and informed about important details is one of the key goals. Since the onset of the pandemic, governments have taken several initiatives to make communication more clear, effective, and timely. We will analyze the highs and lows of their journey so far in the next blog of this series.

Though India is among the top crop-producing countries across the globe, it suffers from lower crop yields. The major reasons behind this are systemic issues and the lack of micronutrients in Indian soil.

This publication explores various natural and human-induced factors that affect the availability of micronutrients in Indian soil and factors that influence the improper use of micronutrients. It also provides policy-level recommendations to boost the government’s efforts to increase agricultural productivity and its aspiration to achieve the Sustainable Development Goal of “Zero Hunger.”

The Government of India undertook various reforms to improve the fertilizer subsidy distribution system, including the introduction of direct benefit transfers. Despite improvements in the distribution of fertilizers, it faces various challenges in the implementation of direct cash transfers (DCT) in fertilizers. This publication highlights these challenges and provides an approach for the government to resolve the barriers in a planned, stepwise manner before the national rollout of DCT in fertilizers.