Manoj Sharma

Manoj Sharma

DirectorManoj Kumar Sharma is a Director at MSC. He is a development and inclusive finance expert with over 28 years of experience.

Manoj has worked in Afghanistan, Bangladesh, India, Indonesia, Italy, Kenya, Lao PDR, Nepal, the Philippines, Papua New Guinea, Sri Lanka, Myanmar, Sweden, and Vietnam. Manoj oversees the Institutional Development & Support; Digital Transformation, FinTech-related initiatives, Value Chains Financing & Development; SME; Environment Financing and Capital Advisory Services Practice Groups at MSC. He leads downscaling projects for commercial banks, developing sustainable savings products for small entrepreneurs and clients, and building institutional capacity of MFIs. Manoj played a key role in mainstreaming loan portfolio audits in MFIs as a tool for banks to assess lending and investment decisions. He led the preparation of an organizational development toolkit for financial institutions and a business lending toolkit. He has played a leading role in MSC’s digital financial services domain, supporting strategy development and agent network management for a variety of banks in India, the Philippines, and Papua New Guinea. His areas of interest include assistance to start-up microfinance institutions, product development, market research, and urban microfinance. Prior to joining MSC, Manoj was an Assistant General Manager at the Small Industries Development Bank of India (SIDBI). During his time at SIDBI, Manoj was a part of the SME financing team, which negotiated a USD-225-million private sector support assistance package with the World Bank (lead investor), DFID, KfW, and GTZ. Manoj was responsible for managing the fund and a USD-22-million technical assistance to design and implement the program in clusters. He also worked extensively to design and implement programs to promote micro-enterprises and create livelihood opportunities in rural areas. The program was underway in more than 65 locations and has promoted more than 17,500 enterprises. Manoj has a Master’s of Science in Environment degree from Sikkim Manipal University, India. He is fluent in English and Hindi.

Posts by Manoj Sharma

Publication

Publication

Manoj Sharma, Graham Wright and Pawan Bakshi

How a 1% DBT Commission Could Undermine India’s Financial Inclusion Efforts

Publication

Publication

Aishwarya Singh, Manoj Sharma and Mukesh Sadana

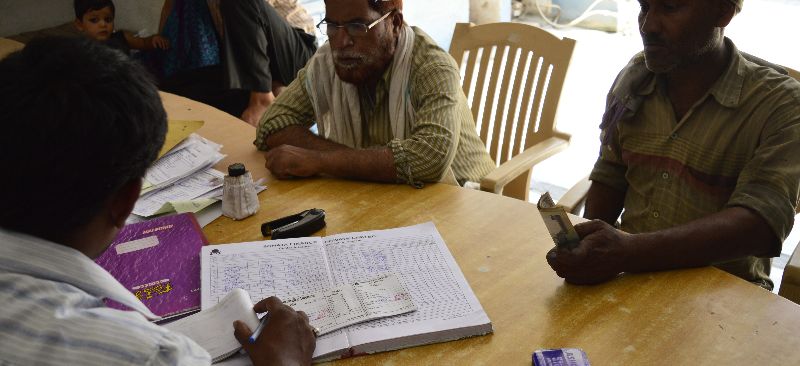

Assessing the most ambitious public financial inclusion drive in history An Early Dip-Stick Assessment of Bank Mitr’s under Pradhan Mantri Jan Dhan Yojana

Blog

Blog

Denny George, Abhishek Anand and Manoj Sharma