MSC’s analysis describes how the DBTE model has several positive spillovers for policymakers, DISCOMs, and farmers. More importantly, it ensures resource sustainability of electricity provision. Through a thorough meta-analysis, we delve deep into political, regulatory, and infrastructural factors among select Indian states and chart out an assessment framework to identify the most primed states to adopt DBTE. We also discuss existing enabling or disabling policy and regulatory considerations for the uptake of DBTE and offer probable implementation strategies for policymakers and DISCOMs.

Blog

The role of financial service providers in supporting MSMEs in Kenya

MicroSave Consulting (MSC) is a boutique consulting firm that has, for 25 years, pushed the world towards meaningful financial, social, and economic inclusion. These podcast series are hosted by MSC for dedicated founders, start-ups, investors, and other stakeholders in the startup ecosystem. Through this bouquet of curated conversations around developments in the financial inclusion space, we offer insights and lessons based on our research and expertise.

Our podcast features Charlotte Ochieng, a manager, and Mandira Sharma, an analyst in MSC’s Banking and Financial Services sector. They discuss how financial institutions in Kenya should change the narrative to provide support to MSMEs. The institutions should improve access to markets, business knowledge, and access to advisory and mentorship for MSMEs.

How well do Indians use cash-in & cash-out (CICO) agents, and can this usage increase?

This strategic insights deck combines findings from MSC’s multiple national-level studies. It establishes that the CICO agents in India are still far behind their true potential. Qualitative insights from these studies unpack the “why” behind this. Based on these insights, we developed a set of practical recommendations for the service provider to help them increase customer footfall at agent points.

Lessons from Frontier Markets: Surpassing gender norms to build a tech-driven and self-starter marketplace model to onboard the next half-million rural women

This blog looks at Frontier Markets, part of the Financial Inclusion Lab accelerator program, which receives support from some of the largest philanthropic organizations worldwide—Bill & Melinda Gates Foundation, J.P. Morgan, Michael & Susan Dell Foundation, MetLife Foundation, and Omidyar Network.

A journey well begun

In 2011, Frontier Markets started with a simple idea—to serve the last mile market using tech-based solutions and make life easier for rural households. Its mission led the startup to build a phygital platform to provide retail and financial solutions for the last mile.

Frontier Markets has had an impactful journey since it started. Our previous blog tracked how it adopted a robust strategy to onboard rural women and train them as Sahelis—digitally skilled local and rural women entrepreneurs.

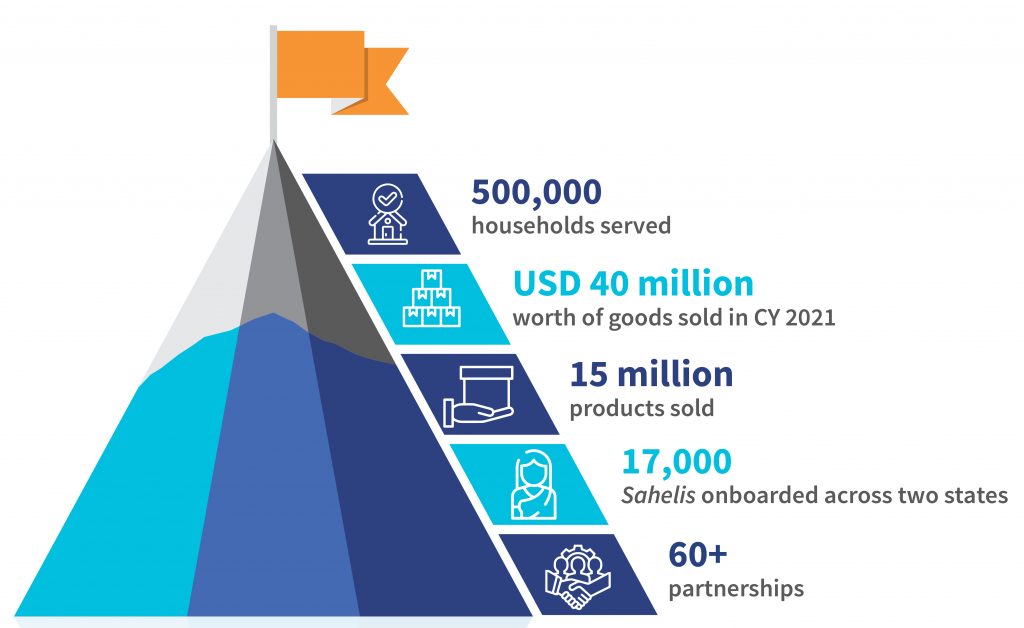

Figure 1: Progress of Frontier Markets since its inception in 2011

The path to scale-up

Indian rural market’s potential is 10 times that of all the Indian unicorns combined. Since 2017, rural India’s internet user base has risen sharply by 197%, from 113 million at the beginning of FY 2016-17 to 336 million by Q2 FY 2021-22. The total number of rural smartphone users increased from 50 million to 109 million between 2017 and 2021. The increasing technology awareness and product affordability in rural India have fuelled the growth of the assisted e-commerce market.

Rural women can catalyze this market by helping rural households source required products and run their enterprises from their home locations. In the past few years, many players have entered the ecosystem to support the rural e-commerce market’s growth in different parts of the value chain. Some players help build women’s capabilities in manufacturing products, digital and financial literacy, and provide market linkages, such as Meesho, GlowRoad, and Sheroes.

Frontier Markets remains one of the major players in India’s village-level entrepreneurship (VLE) space. Other players with VLE models have the potential to scale, contribute to India’s rural e-commerce ecosystem, and empower rural women to make economic decisions and grow as entrepreneurs. The upcoming VLE models in India can take a MSC recommended five-step SCALE approach to achieve this growth.

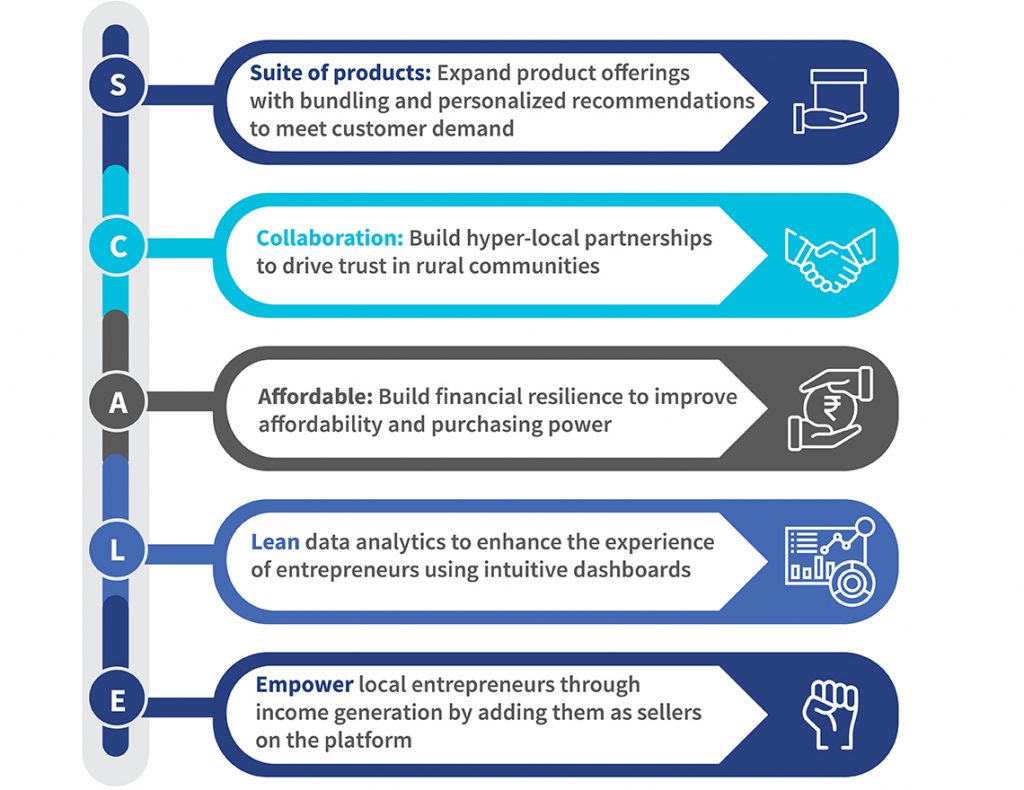

Figure 2: SCALE approach for VLE models to expand their entrepreneur base

The SCALE approach can work as a playbook for the village entrepreneurship model in India. It can help village-level entrepreneurs tap opportunities and uncover business propositions. Upcoming players can use Frontier Markets’ lessons and the SCALE approach to expand in new geographies, gain market share for distribution channels across different states in India, and build a sustainable model as they onboard rural women entrepreneurs.

1. Suite of products to meet different customer needs:

The customer demand varies in two ways:

(i) When the customer orders products for a large family or a family function, and they prefer ordering higher quantities currently limited on existing platforms; or

(ii) When the customer orders a specific set of products altogether. If items are not in stock due to their limited availability, the customers have to then purchase those items from the physical marketplace.

The inability to order high quantities or lack of products leads to dropouts along the order process for customers.

VLE players can build a customer profile using data that includes family size, product category preferences, order frequency, and more when customers place their first order. Based on a few consecutive orders, the players can then revise the permitted quantity the customer can order. Over a longer duration, they can start suggesting and offering product bundles to the customers to reduce dropouts of loyal customers, increase the entrepreneurs’ income, and elevate the platform to become a customer’s preferred choice, thereby increasing customer retention.

2. Collaboration: Build hyper-local partnerships

Trust is the glue that holds rural communities together. Anyone outside these close-knit communities struggles to expand in the rural markets and introduce new employment opportunities for women. Raising awareness through training and workshops is crucial but not enough to onboard new women entrepreneurs.

Engaging with community leaders and influencers through partnerships with local bodies and organizations is crucial to getting a foot through the door. These community members can build confidence and influence the households’ decision-making. For instance, Frontier Markets engages with State Rural Livelihood Missions (SRLMs) and government departments to build trust and get women on board.

Other VLE players can further enhance this by including cooperative societies, networks of BC Sakhis, microfinance institutions, local schools, and college teachers as they expand into local markets. Identifying and collaborating with these local networks is vital as any VLE player scales up its operations to new geographies.

3. Affordable: Build financial resilience to improve customers’ purchasing power

Low and unstable income patterns and lack of savings are critical barriers for customers to order products and pay the full amount on delivery in rural markets. Semi-durable and durable products remain a significant expenditure for rural households.

VLE players can collaborate with other FinTechs, offering goal-based savings to enable their customers to build a corpus for purchasing high-value products. Introducing goal-based saving products for the customers’ short-, mid-, and long-term goals can make many aspirational household purchases affordable.

Customers can also get buy-now-pay-later (BNPL) offers based on their existing purchases and credit history. Consumption has been rising countrywide alongside high smartphone and internet penetration in rural India. Meanwhile, the BNPL market will grow at 66% CAGR over the next five years. At this juncture, VLE players can serve their customers and the network of women entrepreneurs through partnerships.

4. Lean data analytics to enhance the experience of women entrepreneurs with intuitive dashboards:

The women entrepreneurs receive commissions in their bank accounts as they receive their orders. VLE players should build intuitive dashboards with details of earnings over months, sales, and performance across different product categories to inform them of their income.

Using BI dashboards with key metrics can help improve performance, provide a customized experience, and help the entrepreneurs observe trends across different parameters. Such dashboards can reduce information gaps in receiving monthly commission details, improve decision-making, reduce dependence on the VLE platform field staff for commission details, and improve performance over time.

5. Empower local entrepreneurs by providing market linkages:

Many women in rural areas of India are skilled at handicrafts, making local food items, or other saleable products. Yet most women have no or limited understanding of market access to sell their products.

Entrepreneurs on VLE platforms like Frontier Markets’ Sahelis are well trusted and belong to these women’s local communities. These platforms can onboard these micro-entrepreneurs and provide them with market linkages, allowing customers to buy the products from a shared marketplace with doorstep delivery.

Onboarding micro-entrepreneurs will build a localized e-commerce platform and a high-trust community comprising these women and their customer base. These women play a crucial role in pitching or selling their products and taking ownership of any issue during order delivery, building an enabling ecosystem at the micro-level in their community.

So far, Frontier Markets has impacted the lives of its Sahelis in ways they could never imagine. Its VLE-model has the power and potential to scale the number of such empowered women across rural communities in the country.

Figure 3: Anecdotal evidence from the Sahelis of Frontier Markets

Frontier Markets has established its foothold in Rajasthan, India. It can use lessons learned in Rajasthan to scale up its operations in the upcoming markets of Uttar Pradesh and others states. The startup can follow the same approach and customize it to the nuances of the local women’s community.

The FI Lab (CIIE.CO and MSC) supported Frontier Markets as one of the startups selected for its accelerator program. The Lab helped Frontier Markets build a comprehensive communication strategy playbook that focuses on the lessons learned and outlines a clear pathway to expand effectively over time as it explores new markets in India.

The SCALE approach can help expand Frontier Markets’ operations in new markets and support other VLE platforms to solve gaps for customers and entrepreneurs by empowering them and building their self-confidence and capabilities.

This blog post is part of a series covering promising FinTechs making a difference in underserved communities. These startups receive support from the Financial Inclusion Lab accelerator program. The Lab is a part of CIIE.CO’s Bharat Inclusion Initiative, co-powered by MSC. #TechForAll #BuildingForBharat

The Mool mantra: Simplifying financial services for the masses

The genesis of Mool—a one-stop solution to help the low- and middle-income segments in India improve their financial health

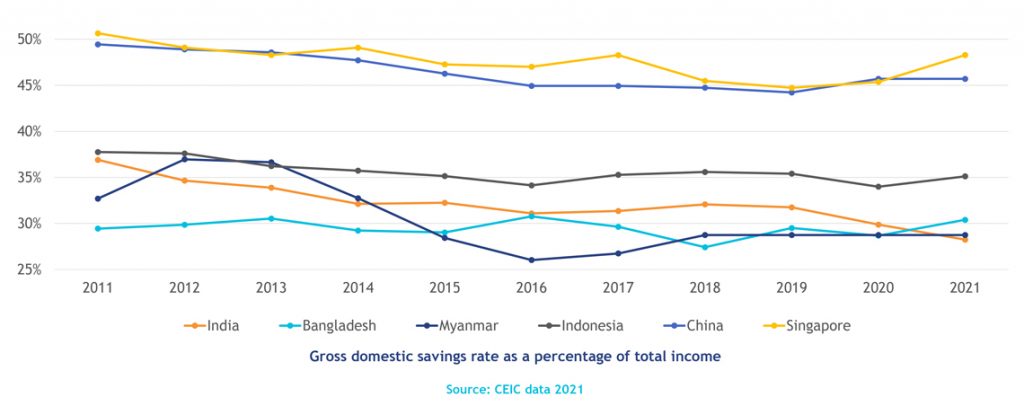

Major banking and economic reforms in India improved the condition of the average Indian household considerably in the past few years. However, CEIC data shows that the rates of gross domestic savings in Asian countries like Bangladesh (30.4%), Myanmar (28.8%), and Indonesia (34.1%) are close to India’s gross domestic savings rate of 28.2%. Yet, this number remains much lower compared to economically stronger Asian nations like China (45.7%) and Singapore (48.3%) (see figure below).

Despite record savings during the COVID-19 pandemic, the comparison shows that Indian households have the scope to save more. Moreover, if average Indians wish to grow their household wealth and improve their livelihood, they need to save through risk-adjusted investments. This need struck a chord with a Yale and Oxford graduate, Abhinav Nayar, who began his journey of building Mool.

Despite record savings during the COVID-19 pandemic, the comparison shows that Indian households have the scope to save more. Moreover, if average Indians wish to grow their household wealth and improve their livelihood, they need to save through risk-adjusted investments. This need struck a chord with a Yale and Oxford graduate, Abhinav Nayar, who began his journey of building Mool.

Abhinav always wanted to work for the betterment of the lower-income “Bharat” segment that typically lacks access to financial services. He used his experience in economic strategies and public policy to design a platform that can easily aggregate all financial aspects of a person’s life and help make sound financial decisions. Through his efforts, Mool came to life.

Mool’s offering—to advise the world’s largest cohort of new savers

Mool focuses on the low- and middle-income (LMI) segment of the Indian population. Households in this segment typically earn USD 2,300-15,000 each year and face several financial hardships due to the lack of money or mismanagement. Let us assume that LMI people in India save a decent share of their net income. Yet, which channels do they use for savings and investments? Some of their wealth resides in banks as savings bank accounts or fixed deposits.

In many cases, they invest a part of their wealth in real estate or physical gold. However, most of it sits in informal savings modes like rotating saving and credit associations (ROSCAs), with informal savings collectors like munshis (clerks), or as cash reserves at their homes. Overall, this savings and investment pattern should imply that Indians’ wealth has increased steadily, right?

Wrong. Here is why.

When we look at the interest earned on savings, we understand only one aspect of the equation. Currently, the maximum interest rate one can make on fixed deposits with a leading bank in India is about 5% for a year, while the average inflation is above 6%. The actual return on basic savings accounts at banks is around negative 3% even before we account for taxes levied on interest earned. Traditional bank deposits erode wealth. Even if we consider real estate and gold, one can earn up to 10% and 3%, respectively. The actual return decreases to 4% and negative 3%, respectively, when adjusted against inflation. However, we must note that most Indians do not wish to liquidate their gold and real estate investments. They invest in these only to ensure tangible asset ownership.

Mool offers real value alternatives.

The neo-banking platform opens a digital bank account for its users with State Bank of Mauritius’ (SBM) support and provides them with financial advisory services. Moreover, Mool obtains users’ consent and uses preset conditions to automatically sweep funds from their savings account and invest the money in high-return mutual funds, enabling them to increase their wealth. The user can request to liquidate these funds immediately at any time. Mool also provides them with a credit score-builder card issued by SBM that doubles as a debit card. While the primary focus is on savings, Mool intends to expand to other financial products and services and offer a complete suite of banking products.

Mool’s unique pitch—helping LMI people in India make better financial decisions

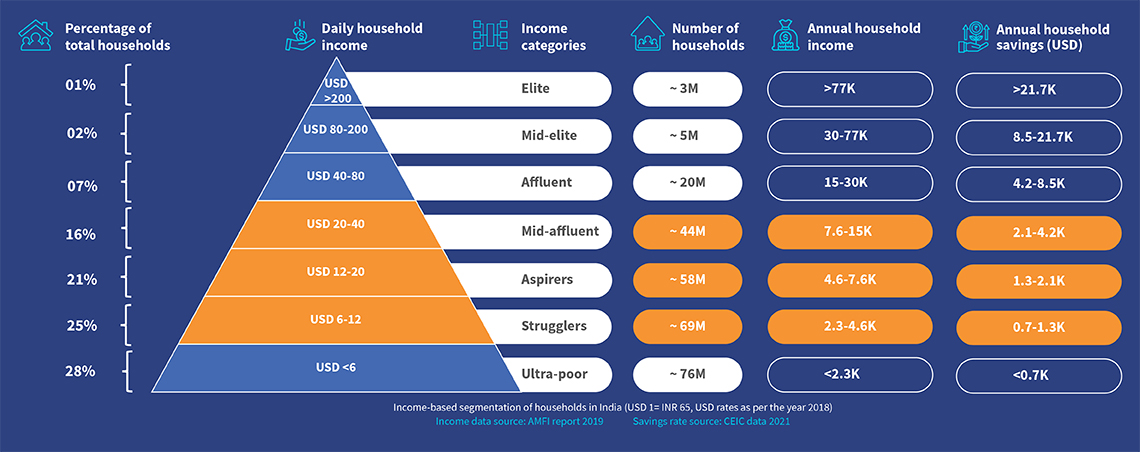

The LMI category has three main subsegments—strugglers, aspirers, and mid-affluent (see figure below). In its first phase, Mool targets acquiring users from the top two tiers of the LMI category: the “mid-affluent” and “aspirers.” These two subsegments find it easier to understand Mool’s sophisticated offerings.

Investments remain an aspirational goal for LMI people. They face many challenges, including limited disposable income to save, besides low awareness of formal financial instruments and access to them.

Source: MSC analysis

Currently, Mool has set a target to serve the 102 million households under the LMI segment with an annual income bracket of USD 4,600-15,000, with plans to cater to the “strugglers” sub-segment in its later phases. With a focus on this target segment and its challenges, Mool seeks to insulate its users against financial shocks by creating a better savings pool for each of them.

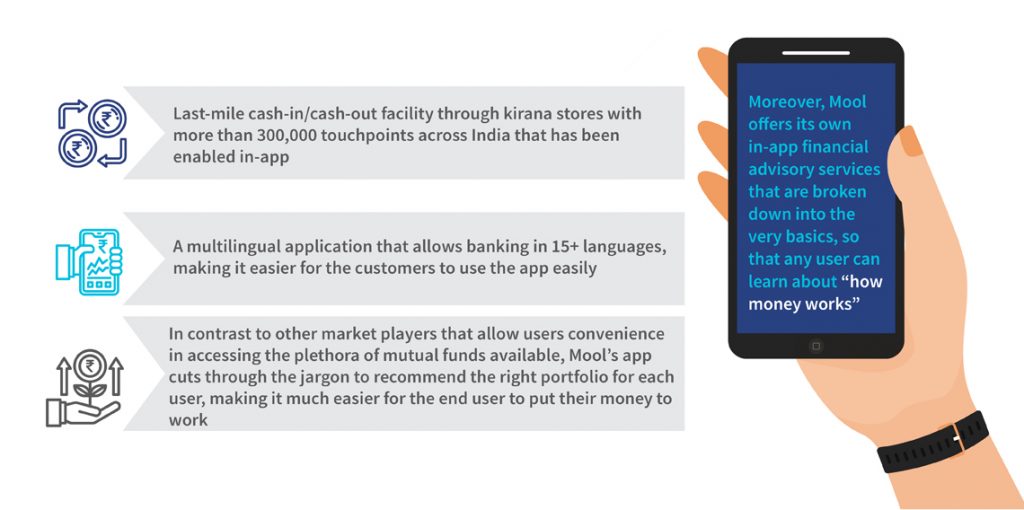

FinTech platforms offer several financial services to the LMI segment. These piecemeal solutions are available across silos scattered throughout the ecosystem. None provide a full-stack banking, investment, lending, and insurance system under a single umbrella in a way that the LMI segment can comprehend easily. This is where Mool distinguishes itself from other FinTechs (see figure below).

Trials and tribulations along the way to becoming a breakthrough platform

In an age where people do not recognize the importance of financial health, a significant challenge is to nudge them toward products and services that can improve it. Currently, over 100,000 potential users have signed up for Mool’s early access program as the product is yet to launch But it needs to overcome specific challenges to become a major player.

First, Mool should bring down the users’ trust barrier and develop a good relationship with them. It must ensure a friendly UI and UX for the target demographic to transact on the app. Many users in the LMI subsegments belong to the “oral” category. These users need to feel comfortable using the app and trust it. Such users may even require an interactive voice response (IVR)-based model to work with, as some may struggle to operate Mool’s app-based UI.

Second, it must create an effective distribution network to reach the hinterlands easily. Mool’s upcoming nationwide network will prove crucial to ensure maximum outreach in the future.

Support from the FI Lab

As part of the Lab’s accelerator program, Mool received comprehensive technical assistance (TA) that included mentor hours, grant capital, and field studies in consumer and market insights led by financial inclusion experts. Our insights will help Mool launch its product at scale after it validates its hypothesis, understands the LMI segment’s growing needs, and designs suitable interventions to address them.

MSC also helped Mool identify potential high-priority sectors to tap into for its B2B2C customer onboarding strategy. These findings will help Mool explore partnerships with suitable employers seeking to extend the services to their employees. The findings will also help Mool scale up and expand its reach organically.

Where is Mool headed?

Mool currently focuses solely on providing customers with savings, investment, and insurance options. Its roadmap for future products includes account aggregation, personalized financial planning, and credit services. Mool also intends to grow its agent network from 300,000 kirana stores to 1 million by 2022 through partnerships with business correspondent networks. Mool has also been reaching out to thousands of small and medium enterprises (SMEs) to provide lifetime free salary accounts, payroll management, and financial wellness solutions for their employees. Mool has set on a path to empower up to 45% of the total Indian households and improve India’s financial landscape, one citizen at a time.

Listen to our podcast to know more about Mool and its plans to help the LMI segment discover better economic opportunities for its savings.

This blog post is part of a series covering promising FinTechs making a difference for underserved communities. These startups receive support from the Financial Inclusion Lab accelerator program. The Lab is a part of CIIE.CO’s Bharat Inclusion Initiative, co-powered by MSC.

#TechForAll #BuildingForBharat

How can FinTech TSPs support microfinance institutions to get on board the DEPA ecosystem?

Our previous blog examined how the Data Empowerment and Protection Architecture (DEPA) and account aggregators (AAs) could disrupt India’s banking and financial ecosystem. DEPA and AAs can also empower people from the low- and moderate-income (LMI) segment by enabling them to use their data and access better financial services. DEPA intends to democratize individuals’ data using a consent-based framework and allow the movement of trusted data between service providers with customer consent.

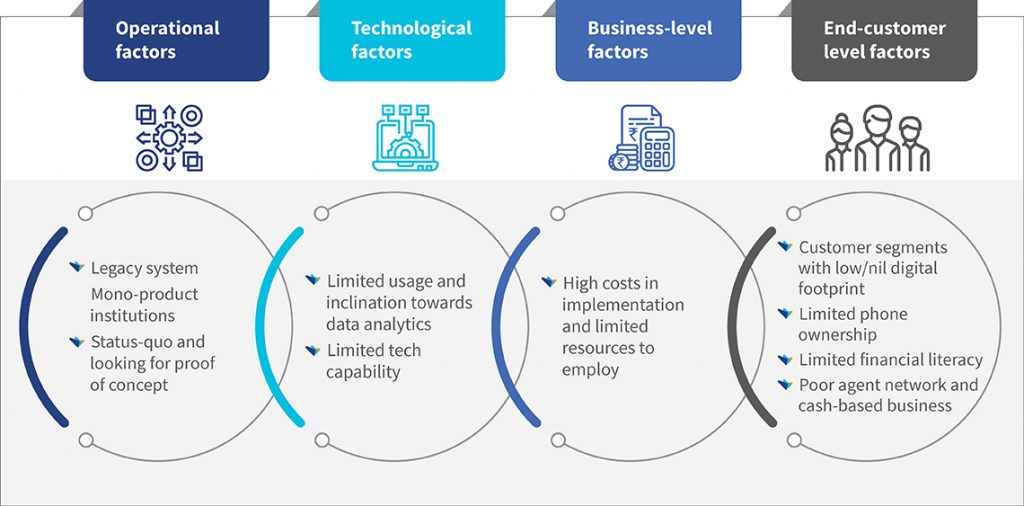

While DEPA is set to revolutionize the Indian financial ecosystem, financial institutions like MFIs may not find onboarding this framework “appealing” or “easy.” Our previous blog discussed the challenges microfinance institutions (MFIs) face while adopting DEPA. A recap of our previous blog:

Key factors hindering DEPA adoption by microfinance-based lending institutions

Some of the critical challenges above may take some more time to resolve. These include the uniform regulation of all forms of MFIs and the increased digital footprint of customers. With the increasing digitization of payments in India, more people will join the digital ecosystem.

MFIs will need to find ways to overcome the remaining challenges and subsequently adopt the DEPA framework.

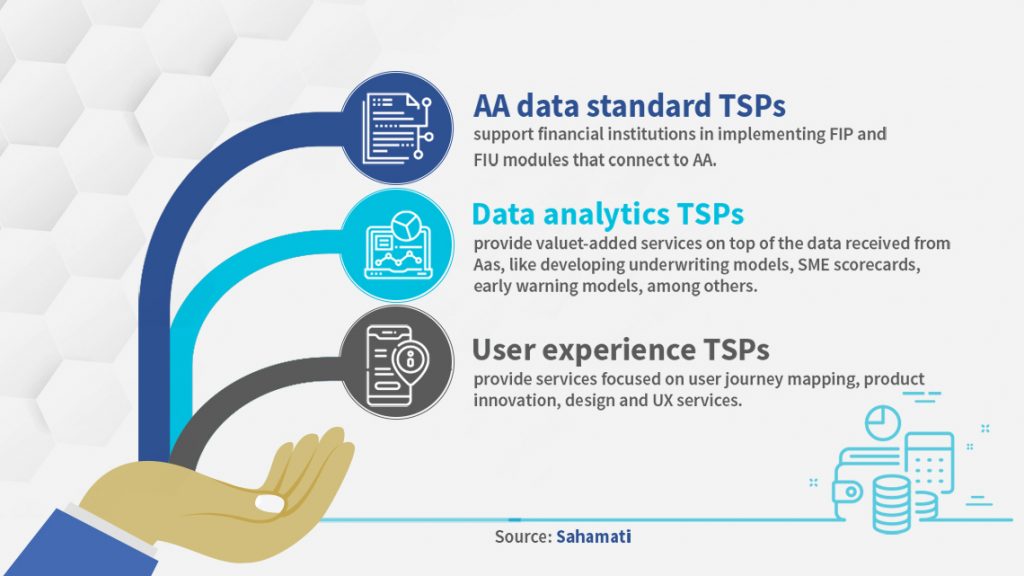

The role of emerging FinTech players is critical. The AA ecosystem brings together technology service providers (TSPs) that support financial information providers (FIPs) and financial information users (FIUs) to use the AA ecosystem through their tech infrastructure and data analytics capabilities.

A critical link in the DEPA framework is the nonprofit Sahamati, a collective of account aggregators that drives open banking in India. It allows individuals and small businesses to share their data with a third party, acting as a common platform to capture customer financial details in one place.

Sahamati has classified TSPs into three different categories based on their offerings:

As shown above, “AA data standard” TSPs can help MFIs initiate and implement the FIP and FIU modules. Whereas “data analytics” and “user experience” TSPs can provide value-added services to the institutions. These TSPs can help MFIs gradually embrace the available customer data and use it efficiently.

For any MFI, how do these TSPs score higher than any regular data analytics company?

A regular data analytics company focuses on the “data processing” part of the value chain, which means the MFI remains responsible for “data sourcing” and “data consumption.” For example, an MFI collects the customer data like bank statements from borrowers through documents or images and stores it in its system from which the data analytics company reads the data. After analysis, the results are stored in a database where the MFI can view or use them for further processing. Moreover, most data analytics companies offer generic analytics platforms. This means that MFIs must engage with these companies actively to decide the analytics they must carry out on the data. Many MFIs do not know this. Companies with niche analytics solutions often do not offer the flexibility of matching MFI needs, which differ significantly from other lenders.

MSC is the technical partner alongside CIIE.CO in the FI Lab of Bharat Inclusion Initiative. Finarkein is a promising TSP FinTech in this cohort.

MSC is the technical partner alongside CIIE.CO in the FI Lab of Bharat Inclusion Initiative. Finarkein is a promising TSP FinTech in this cohort.

How does Finarkein, a TSP in the AA ecosystem offer solutions for MFIs through its Flux platform?

Finarkein offers an end-to-end solution that has the flexibility of customization based on MFIs’ needs. The solution offers incremental change in the MFI business model instead of causing a wider disruption. For example, most MFIs today lack technological processes and rely on manual work for customer interaction, application, fulfillment, and post-servicing. Their workforce is familiar with documents. To support them, Finarkein has built a solution called “Flux” that fetches data from AA, processes it, and converts it into an easy-to-understand PDF file that the MFI workforce can use to act upon. It is curated primarily for technologically laggard NBFCs to encourage them to adopt the AA ecosystem. Flux allows Finarkein to integrate the MFIs with new technology while guiding them toward wider digital transformation.

Source: Sahamati—shows an increasing list of TSPs that help financial institutions embrace the AA framework

Onboarding as an FIU does not require MFIs to make any technological changes as Finarkein provides the technology. The only support needed from the MFI is to help the customer approve consent requests via calls or in-person engagement—Finarkein sends the customer an SMS containing the consent link. If a customer does not have a smart device, then consent can be taken on the MFI agent’s device too. In the future, consent approval can be done on WhatsApp or through phone calls too.

Finarkein can share output reports over email, which MFIs can use for underwriting. In this journey, the MFI does not build any new technical capability. Finarkein offers an end-to-end working solution that helps the MFI become an FIU and source data. Finarkein has also been working on a portal through which MFI agents can share the consent link with customers, further eliminating the need for technical integration. The company has structured it as a flexible pay-per-use model from a commercial perspective.

With the benefits that TSPs like Finarkein provide, an MFI can stop worrying about daunting technological integrations and focus more on its business.

How do TSP services further support the MFIs to build decisions based on data?

Building an early warning signal system through data analytics

Delinquency costs remain a significant pain point for MFIs. TSPs can help traditional MFI lenders manage their delinquency better with data analytics. Emerging FinTechs in the lending space use data analytics extensively to understand their portfolios and draw deep customer insights. TSPs can help traditional MFIs enhance operational efficiency by reducing customer monitoring costs, customer acquisition costs, and NPAs.

Early warning engine for debt collections using alternate data

Most MFIs’ lending portfolio is unsecured. While MFIs follow regimental processes, they lack clear insights into the borrower’s loan repayment intent. Once MFIs are onboarded onto the AA framework as an FIU, TSPs can enhance the prediction engine by importing additional customer data from other sources. Hence, integrating with AA platforms will facilitate building effective risk management solutions for MFIs.

Bounce alert reports using alternate data

The customer signs up for electronic loan repayment through the National Automated Clearing House (eNACH) for repayments. The bounce alerts system will flag if the customer has any pending dues. TSPs can help MFIs implement AI/ML-based models to study customers’ payment patterns of their loan products.

Reducing operational costs and increasing efficiency through better visualization

This is an area where TSPs can play a crucial role through their data visualization expertise. TSPs can support MFIs by analyzing customers’ pre-existing data and presenting it succinctly. They can support MFIs by building dashboards on internal and external data.

Dynamic collection scores using alternate data from other institutions and CRM data

This feature can automate and optimize the repayment collections management process, which would improve collection efficiency, minimize the risk of NPAs, minimize write-offs, and improve customer relationships, among others. Dynamic collection scores will also help reduce loan repayment collection costs due to the automated process.

AI/ML-driven personalization for customers

TSPs can provide MFIs with an AI/ML-powered platform to facilitate hassle-free and remote customer onboarding, customer screening, additional customer benefits through different interest rates, and other benefits. Moreover, it can offer the MFI better product management tools within a secure environment. MFIs can use natural language processing (NLP) through this platform to address the language barrier between new-age technology and their customers. TSPs can help develop a voice-assisted user interface for the MFIs’ application to ensure hassle-free usage by their LMI customers.

Cross-selling and upselling of credit-based products

MFIs can use TSPs to help upsell or cross-sell other credit-based products to existing or new clients. Backed by extensive data and behavioral analytics, TSPs can suggest that MFIs target specific customers to cross-sell or upsell third-party products like buy-now-pay-later facilities and credit cards.

MFIs need to examine the benefit that the DEPA ecosystem can offer. India Stack’s consent layer can potentially reduce costs and enhance the customer value proposition. It is time for MFIs to adopt data-intrinsic approaches to function efficiently in the digital age and drive financial inclusion. This is where the TSPs can come in handy.

Linking this back to where it started—we return to the story of lighting homes with electricity way back in 1882. After electricity entered homes and factories, many other inventions revolutionized the way we live, such as the induction motor, which transformed industries and further led to the power washing machine (1907), vacuum cleaners (1908), and household refrigerators (1912). These inventions led to the greater adoption and demand for electricity. The account aggregator framework will likely follow a similar path where financial service providers will be more interested in adopting it with evolving use-cases. Till then, entities like TSPs will continue to simplify the onboarding of FSPs onto the AA framework.