Puneet Chopra

Puneet Chopra

Managing PartnerPuneet Chopra is a Managing Partner at MSC. He heads the Banking and Product Development, Agriculture and Allied Services, and Private Sector Development Domain.

He is an expert in business planning, strategy and operations, consumer research, product development, and innovation. Puneet specializes in distribution channels, marketing, process re-engineering, and project and program management. With a career spanning over two decades, he has diverse experience in various roles and capacities across banking, financial services, insurance, telecommunications, information technology, media, entertainment, and transportation industries.

Posts by Puneet Chopra

Publication

Publication

Amit Joshi, Manoj Pandey, Puneet Chopra and Rajnish Kumar

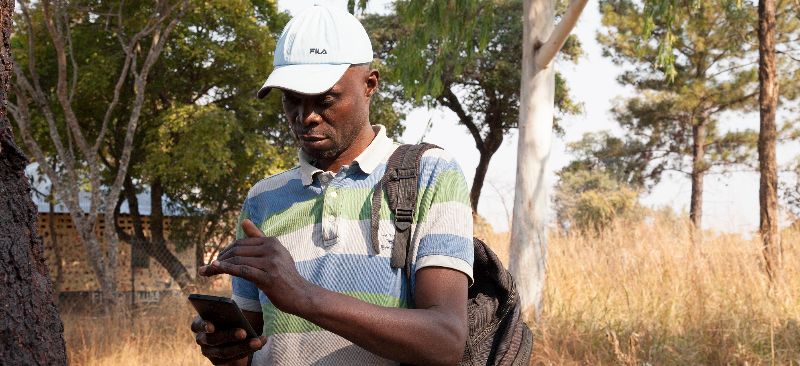

Developing micro-insurance ecosystem in Mozambique

Blog

Blog

Puneet Chopra, Lokesh Singh and Graham Wright

So many steps forward … And now one big step back

Publication

Publication

Akhand Tiwari and Puneet Chopra