The past ten months have been a rollercoaster for Ali, owner of a corner shop from Wonosobo Regency in the Central Java province of Indonesia. As the pandemic swept through his community, Ali did not know if his business would survive. He was unsure if he could open his corner shop, where he would be able to secure supplies from, and even whether he dare accept payments in banknotes—alleged to spread the deadly virus.

In time, the cost of supplies rose and the wholesaler refused to deliver them to his shop. Ali persevered, driven by the need to protect his business and ensure that his community could get the basics for survival. He used social media to tell people what he had in stock and thought about accepting digital payment, but chose not to as there was little demand for it among his regular customers.

As the pandemic recedes and the promises of vaccines offer light at the end of what has been a torturously long and dark tunnel, Ali is rebuilding and diversifying his business. “At times I thought I did not have enough liquidity to survive but I have emerged stronger. I have even learnt how to market using WhatsApp and Facebook”, he reveals with a hint of pride.

Restricted mobility, a constant fear of exposure to the virus, loss of loved ones, and loss of income have characterized the year 2020 (and it continues in 2021 with reduced scale). The scale of the COVID-19 pandemic has been unprecedented, at least in the past 100 years. Till mid-January 2021, the novel coronavirus has claimed close to 2 million lives across the globe and crippled the economy of numerous countries, mostly owing to measures like lockdowns that the governments were forced to take to control the health emergency.

As the pandemic started to unfold, MSC identified how we could help inform the response to this unprecedented global emergency and reduce its damaging effects. After rounds of internal discussions and brainstorming, we started a two-pronged approach.

To fight an enemy as dangerous as the COVID-19 pandemic, we needed allies. And we found a natural ally with L-IFT. Like MSC, L-IFT sought opportunities to help the global community respond. They started by extending their Corner Shop Diaries project in Africa. The project tracked corner shops, small retail businesses, in neighborhoods where these shops were the sole source of essentials during the lockdown, using the Financial Diaries methodology. Recognizing the potential of this approach, MSC partnered with L-IFT to bring the project to Asia.

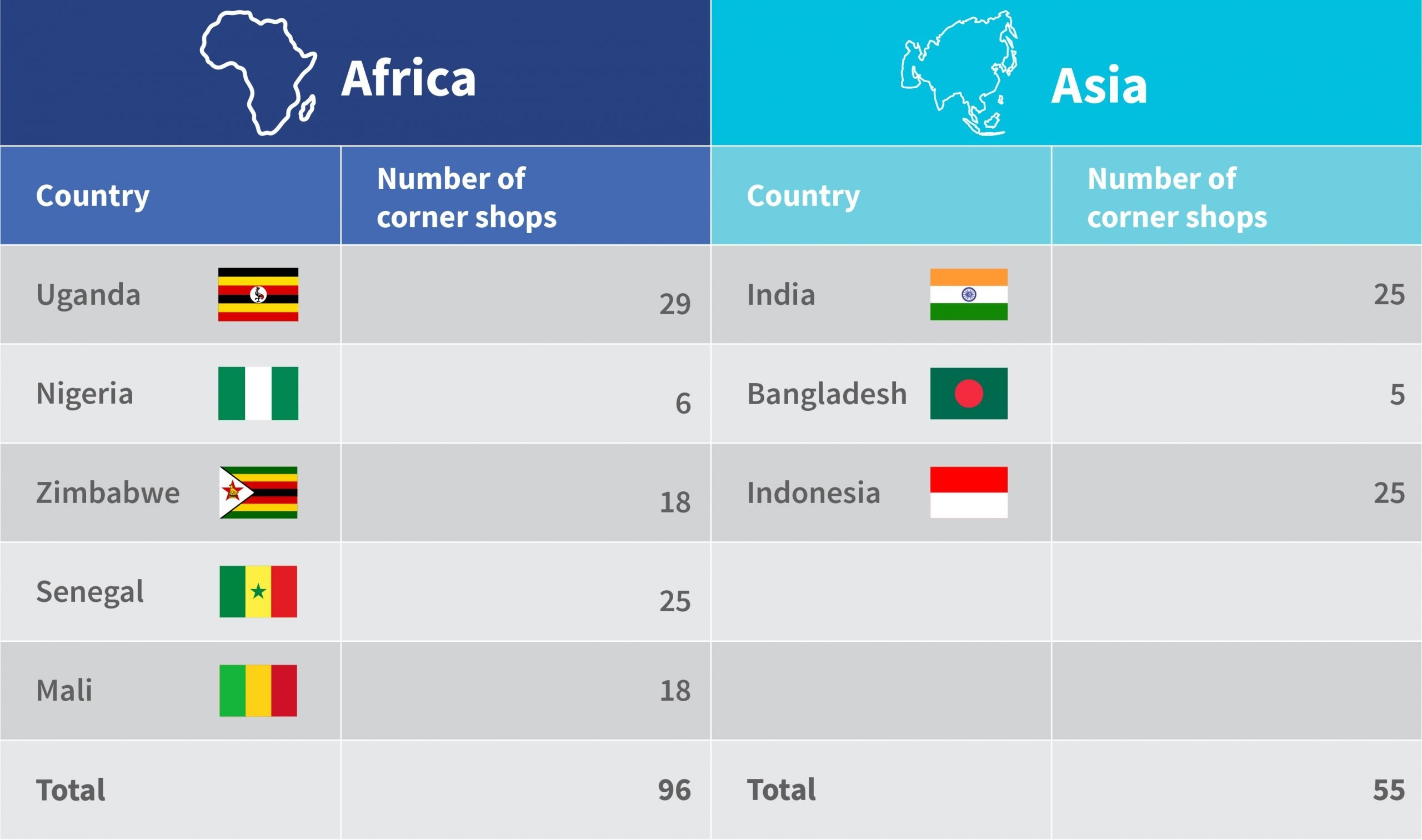

Since April, 2020, 78 corner shops in Senegal, Zimbabwe, Nigeria, and Uganda have reported to L-IFT on their financial transactions, how they are doing, and whether they can provide the basics to their customers. In July, 2020, five corner shops from Stuart Rutherford’s pioneering Hrishipara Financial Diaries joined the project. And from October, 2020, MSC started to track the progress of 25 corner shops each from India and Indonesia. L-IFT started tracking 18 corner shops in Mali from third week of January, 2021.

What was the rationale behind starting this research project? We are worried that all the poorest countries would be hurt disproportionately—not only by the disease but also by the lockdowns. Jean Drèze’s work on famines shows that most famines are the result of failing markets, faltering supply chains, and price shocks. We were concerned that these might happen as a result of the pandemic. We, therefore, wanted to track corner shops in different countries to monitor if food and other basics were still available, whether people could still afford them, and whether shops were surviving and could play their role of serving their communities and neighborhoods.

Initially, the research was seen as a way to identify, provide data, and raise the alarm for any specific locations where the situation was critical. Once the lockdowns were eased, the pandemic started to dissipate, and the economies started to revive, this research became a way to chronicle the journeys of the corner shops towards recovery, and to identify factors critical to their success.

The Corner Shop Diaries research sheds light on a variety of aspects (see Box 1) related to the effects of the pandemic and subsequent lockdowns on micro businesses and the people they serve. Even more importantly, if we can continue this data collection, we can learn about:

Furthermore, we can examine in detail:

We have documented our lessons from this research project in different countries through a series of blogs that we will publish on the project website as well as on the MSC website. Stay tuned for a more nuanced understanding of the struggle of small businesses during the pandemic and policy recommendations that can (and could have) help them to cope and recover.

For more details about the Corner Shop Diaries project, please write to Rahul Chatterjee <rahul.chatterjee@microsave.net>.

Agriculture is the largest employer in the world and could not escape the destructive effects of the COVID-19 pandemic. The disease and the resultant restrictions have had a severe impact on agricultural activities and ultimately on farmers. People in the agricultural communities have continued to struggle with low revenues and profits that stem from the fall in demand and fluctuations in the price of the products. The increase in the cost of inputs and high operational costs for transport has proven to be a challenge.

Many farmers lack enough cash to pay wages to farm laborers and have consequently laid off several staff members, which has increased the vulnerability of the daily wage laborers. The sector needs appropriate responses at all levels to support the farmers in the aftermath of the crisis. This spurred MSC’s research to assess the economic impact of the COVID-19 pandemic on farmers in Kenya to understand the extent of impact and identify areas that require support in the short, medium, and long term. The report presents the comparison between the status of farmers in September and in December, 2020.

Since the economy has reopened, most agents have started to see rising footfall, number of transactions, and even commissions earned. However, their business is yet to return to pre-COVID levels. Although CICO agents are the key enablers of social benefits transfers, they have not received any relief or support measures similar to those offered to other enterprises during the pandemic. Our report takes a deeper look at the situation and provides recommendations to the government and financial institutions on initiatives that will boost the transactions and income level of the agents.

The percentage of children who are stunted, wasted, underweight, anemic, and obese is on the rise across India. Despite impressive progress in areas, such as water and sanitation—immunization and maternal health indicators of child health alongside nutrition remain a matter of grave concern. UNICEF predicts a further increase in malnutrition by at least 10% in the country, as a result of the COVID-19 crisis.

The Ministry of Health and Family Welfare, Government of India has recently released a report on findings from the first round of the Fifth National Family Health Survey (NFHS 5). The survey covers 17 states and five union territories, which comprise 54% of India’s population, and informs policy on household-level health and nutrition indicators. Since the NFHS is an outcome-level survey, conclusions or attributions on inputs and policies that might have contributed to these outcomes are difficult to draw.

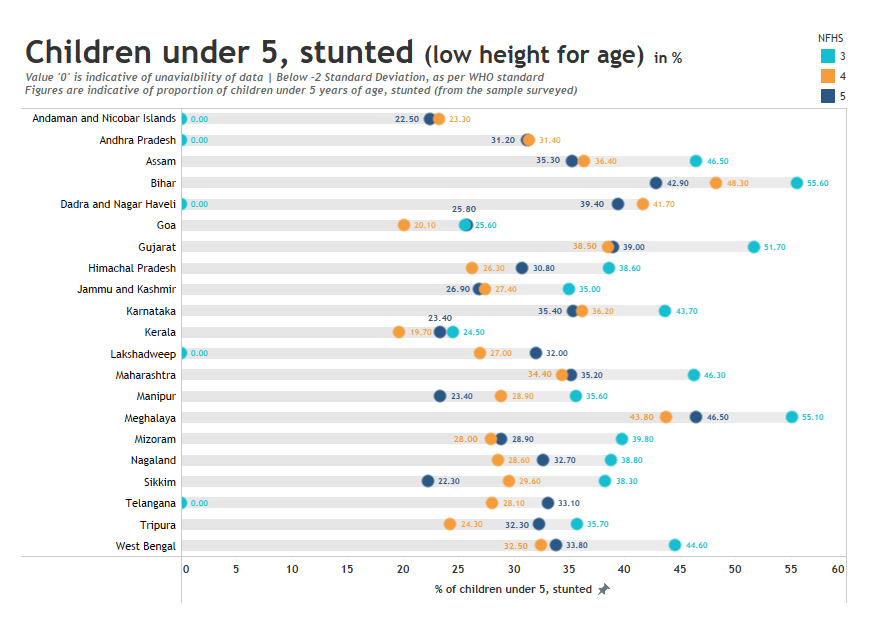

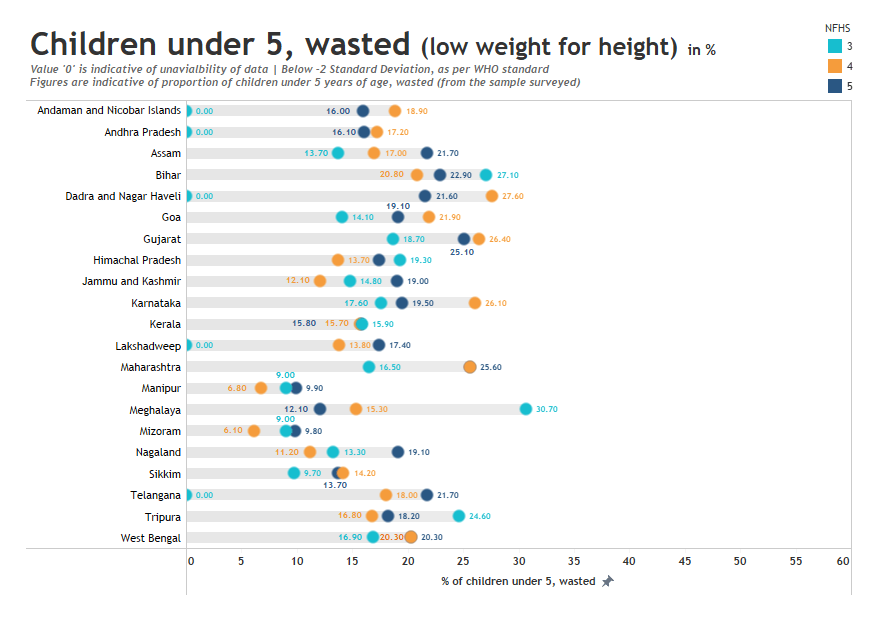

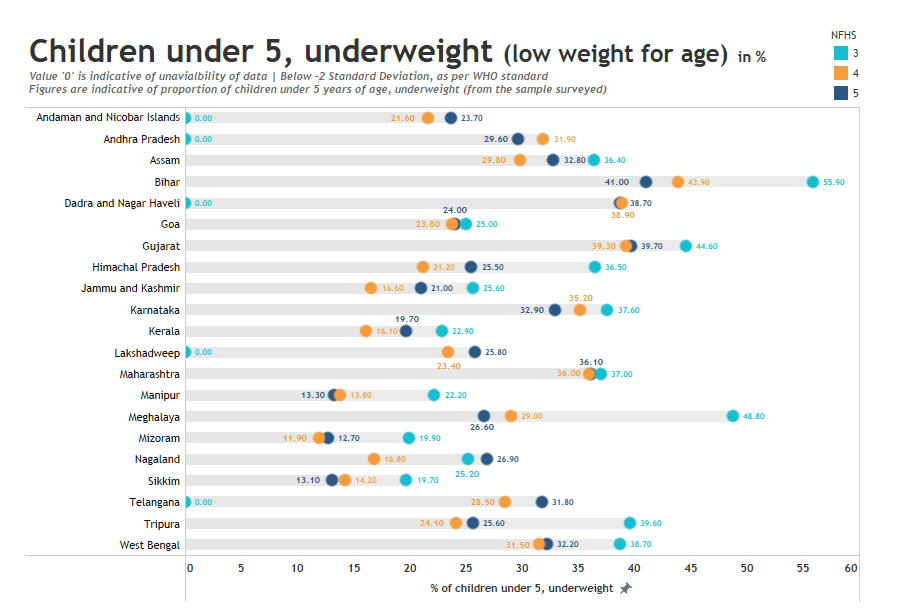

The NFHS has 42 indicators related to child health and nutrition. The trends in neonatal and infant mortality rates from 2015 to 2019 suggest that India has managed to reduce child mortality. Yet the major public health indicators for child health have only improved marginally or not at all, while nutrition-related indicators have worsened in most states. These include stunting (13 out of 22 states and union territories saw an increase), wasting (12 states and union territories saw an increase), underweight (16 states and union territories saw an increase), anemia (16 states and union territories saw an increase), and obesity (all states and union territories except Goa saw an increase).

NFHS-5 child nutrition story

Stunting: The level of stunting, or lower-than-expected height for age, has either deteriorated or improved only marginally in most states and union territories, as compared to NFHS-4 (2015-16). Out of the states surveyed, the levels of stunting worsened in 11 states while others recorded a marginal improvement. The rates of stunting went up significantly in the states of Goa, Kerala, Telangana, and Himachal Pradesh. Tripura emerged as the worst-performing state on the indicator, with a rise from 24.3% to 32.3% in the last four years. Bihar, which had the highest levels of stunting in NFHS-4, saw a marginal decline from 48.3% to 42.9%.

The National Family Health Survey (NFHS) survey is a large-scale nationwide survey of households. The ministry has designated the International Institute of Population Sciences as the nodal agency. Fifth in the series, the factsheet released for states and union territories provides aggregated data on 131 parameters. NFHS-3 was conducted in 2005-06 and NFHS-4 in 2015-16.

Wasting: The levels of wasting, or lower-than-expected weight for height, saw a similar trend of reversal or stagnation in most states. Of the 21 states and union territories, 10 have reversed on the parameter and the figures are closer to the levels in NFHS-3 (2005-06). Nagaland and the union territories of Jammu and Kashmir increased by six percentage basis points. With a drop from 26.1% to 19.5%, Karnataka emerged as the best-performing state. The states of Meghalaya and Goa also improved as compared to the previous survey.

Underweight: Another indicator used to gauge the status of child nutrition is the percentage of underweight children aged five or less. This indicator also showed alarming trends similar to other nutrition parameters. The population of underweight children increased in 11 states and all five union territories. Bihar, Gujarat, and a few northeastern (NE) states saw a marginal to low decline in the levels. However, more affluent states like Kerala and Telangana saw a rise in the proportion of underweight children by almost three percentage basis points. The levels went up from 16.1% to 19.7% in Kerala and from 28.5% to 31.8% in Telangana.

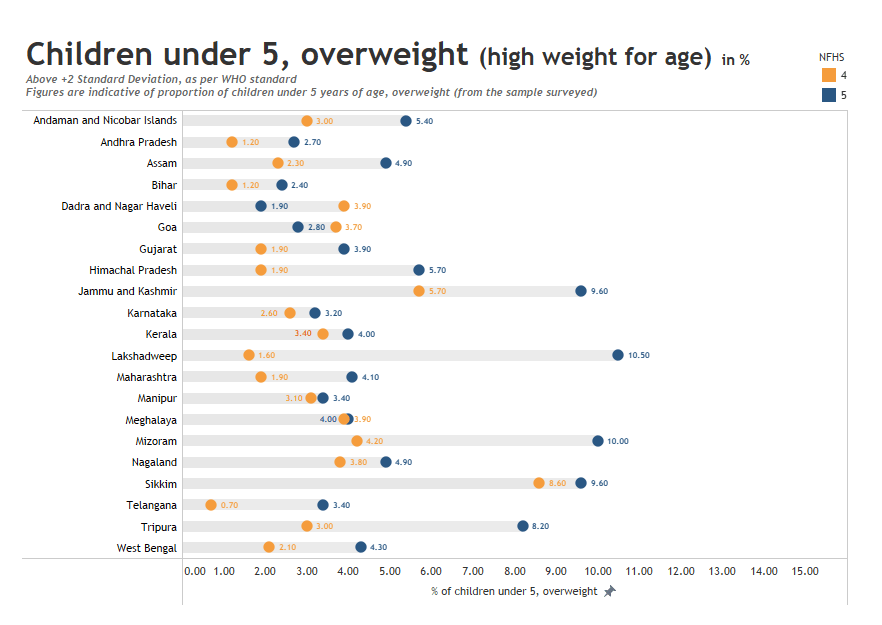

Overweight: Children aged under five are considered overweight if their weight-for-height is two standard deviations above the median of WHO’s Child Growth Standards. Although the proportion in India is within the world average as per WHO, the indicator is under distress. As compared to the previous survey, 16 out of 17 states recorded an increase in the percentage of overweight children in NFHS-5.

With a decrease from 3.7% to 2.8%, Goa was the best-performing state. All other states recorded an increase in the indicator, ranging from 0.1% to 5.8%. The percentage of overweight children more than doubled in Mizoram.

The findings point to a triple burden of malnutrition in India, in terms of stunting, wasting, and child obesity.

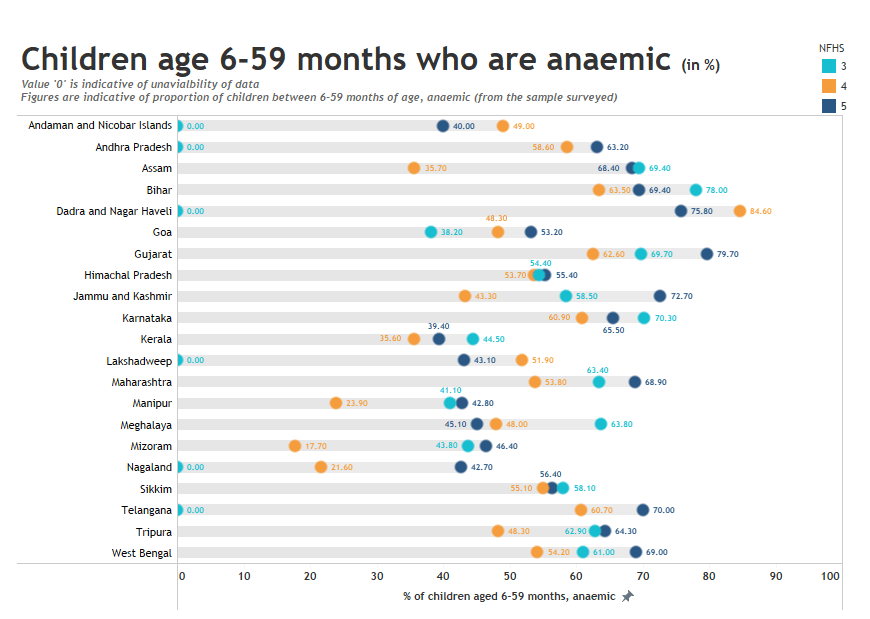

Anemia: The increasing prevalence of anemia among children aged 6-59 months was also worrying. In some states, the prevalence is even higher than that of NFHS-3 (2005-06). For instance, the levels rose from 35.7% to 68.4% in Assam, while Gujarat recorded a 15% increase. Other states also show a major reversal from NFHS 4 levels. The analysis highlights that as compared to NFHS-4, the parameter has worsened in 17 out of the 21 states and union territories, as shown in the graph below.

Though phase 2 data from other states will provide more clarity, these results are certainly a cause for concern and require urgent action. The second phase of NFHS-5 may present even more alarming findings since the survey was carried out after the lockdown-related restrictions were relaxed.

Underutilization of allocated resources

The government must also consider the results of the first phase of NFHS-5 in the context of India’s Mid-Day Meal (MDM) initiative. The Accountability Initiative of the Centre for Policy Research reported that only 14 states utilized 100% of the total funds allocated under MDM in 2018-19, which indicates sub-optimal performance on the ground. Another analysis by the Accountability Initiative shows that only 44% of the government-approved amount for Integrated Child Development Services (ICDS) was utilized in 2018-19. Furthermore, the number of children aged six months to six years who receive benefits under the Supplementary Nutrition Programme (SNP) was less than half the estimated number of beneficiaries in 21 states and union territories between 2017 and 2019.

The economic slowdown and stagnation in wages of the poor have translated to lower consumption, as evident from the expenditure survey of NSSO (2017-18). In this context, the results of NFHS-5 will likely reflect the reduced ability of the poor to access quality nutrition and the inadequate contribution to programs, such as ICDS and MDM, which advance better nutrition.

Need for enhanced focus on nutrition due to COVID-19

The COVID-19 pandemic has the makings of a perfect storm for the existing nutrition crisis. According to the India Child Well-being Report 2020 of World Vision India, more than 115 million children in the country no longer have three meals a day and many continue to miss mid-day meals as schools remain closed. This will have long-term adverse effects on the economic prospects of the country due to reduced schooling and cognitive impairments, and the consequent loss in productivity.

New estimates by Derek Headey and colleagues in The Lancet suggest that without timely action, the global prevalence of child wasting could rise by a shocking 14.3%. In the face of a drastic decline in income, the poor would stop consuming the more expensive nutrient-rich foods to preserve their caloric intake. This would exacerbate the undernutrition crisis. For the poorest and the most vulnerable of India, the effects could be particularly detrimental.

Dalberg’s survey of 47,000 poor households highlights the devastating economic impacts during the lockdown imposed to curb the spread of COVID-19. Primary income earners in two-thirds of surveyed households in the LMI segment lost their jobs or wages during the lockdown, and the average family lost more than 60% of their pre-crisis income. The economic distress, coupled with the halt in the mid-day meal initiative, is expected to lead to a dangerous deterioration in dietary quality.

While the ministry is yet to release granular data for all states and union territories, the consistent reversal on several parameters that gauge child nutrition is apparent from the phase 1 data. The overall trends suggest an improvement in many input indicators, such as access to sanitation, use of cleaner fuels, immunization, maternal health check-ups, exclusive breastfeeding, and adequacy of the diet. Other social determinants of health, including indicators of women’s empowerment, have also improved. However, more focused policy analysis, revised policies, and institutional overhaul are needed to identify and address the multidimensional aspects of child malnutrition.

The drop in performance across child nutrition indicators is a wake-up call for India. The country must take proactive measures and scale-up innovations to address malnutrition. Going forward, the government needs to work on certain quick fixes to address the issue of malnutrition. These could include:

References;

[1] The National Family Health Survey (NFHS) survey is a large-scale nationwide survey of households. The ministry has designated the International Institute of Population Sciences as the nodal agency. Fifth in the series, the factsheet released for states and union territories provides aggregated data on 131 parameters. NFHS-3 was conducted in 2005-06 and NFHS-4 in 2015-16.

1. Background

Toward the end of December, 2020, The Times of India reported incidents of sexual harassment on Indian telemedicine platforms that offer consultations with doctors. The report noted that these platforms “have become sites for sexual harassment of women doctors, with ‘patients’ flashing, masturbating or making lewd conversation in the guise of seeking consultation.” The report went on to state that instead of informing the police of such incidents, the platforms kept it under wraps and implemented additional measures to prevent such incidents, without much success. While the report mentions the misuse of some private platforms, it does not mention whether eSanjeevani, the telemedicine platform of the Government of India where more than 1 million consultations have been recorded until the end of December, faced similar issues.

eSanjeevani had its genesis on 25th March, 2020 when the Medical Council of India (MCI) and NITI Aayog jointly released the telemedicine practice guidelines. These guidelines enable Registered Medical Practitioners (RMPs) to provide healthcare remotely using digital platforms. Soon after, on 13th April, 2020, the Ministry of Health and Family Welfare (MoHFW) launched eSanjeevani, a platform that offers remote health services. Private sector players, such as Practo, 1mg, among others, also rapidly launched their telemedicine services.

Telemedicine is not new to India. As early as 2009, Health Point Services (HPS) launched a telemedicine offering, eHealthpoint (eHP), in Punjab. However, eHP did not gain much traction. A decade later, the delivery of health services online is now an attractive proposition. This was possible through India’s robust telecommunication infrastructure and ubiquitous availability of the 4G network. The low cost of data, a result of competition among telecom players, as well as high mobile penetration also played a major role in this transition. The COVID-19 pandemic further accelerated the need for remote healthcare and consultation.

2. The government’s telemedicine platform: e-Sanjeevani

eSanjeevani seeks to improve access to health services that had been severely curtailed during the pandemic. This was due to movement restrictions imposed during the lockdown and due to the lack of available health infrastructure as a result of COVID-19. The Centre for Development of Advanced Computing (CDAC) developed and launched eSanjeevani in record time. The platform is available in the following two variations:

As per the Press Information Bureau on 14th December, 2020, the 1 million consultations recorded until December included more than 200,000 doctor-to-doctor consultations and more than 750,000 doctor-to-patient consultations.

3. Addressing the three “As” in eSanjeevaniOPD: Abuse, availability, and access

While it is commendable that the government reacted with alacrity and agility to ensure health services were available in remote areas, the eSanjeevani platform faces three main issues, which are discussed below.

Abuse: The verification process involved in the registration is similar to that of private platforms, which makes eSanjeevaniOPD susceptible to abuse. A patient must register on the platform before they can use it. The two-step process requires a patient to first verify their mobile number through a one-time password (OTP). Subsequently, they must complete a registration form that includes personally identifiable information (PII), such as name, age, biological sex, and address. To simplify the registration process, no proof of identity is requested at the time of registration. This makes it easy for potential abusers to misrepresent their details and enter the platform without being traced back. The OTP verification only serves to confirm whether the patient can access the mobile number provided during registration. It does not provide additional verification features that can enable law enforcement agencies to trace back the number in case of misuse.

One way to address the issue of abuse mentioned in the article of The Times of India is to use Aadhaar verification during the registration process where an OTP would be sent to the mobile number registered against the person’s Aadhaar. However, this would complicate the registration process and as many do not have their Aadhar linked with their mobile numbers, they would not be able to use the platform. Another way to address abuse in the platform would be to match doctors and patients algorithmically, based on biological sex. This will discourage those who sign up to misuse the platform. Users of the eSanjeevani platform confirmed that male patients were matched with female doctors. This could potentially lead to misuse, similar to incidents reported on private platforms. Moreover, as mentioned explicitly in the telemedicine guidelines, consultations should not be anonymous and both the patient and the doctor need to know each other’s identity. This enables the platform to identify any misrepresentations and take necessary action.

Availability: Doctors, particularly women, who have faced such abuse on these platforms may decline to provide online consultations going forward. This would further reduce the availability of healthcare professionals necessary for the platform to function effectively. eSanjeevani already struggles with a shortage of doctors, which is evident by the time it takes for a patient to receive relevant advice after they request a consultation. Patients recounted incidents where doctors were not readily available, which resulted in long waiting times. They mentioned that it sometimes took more than an hour to consult a doctor, with no indication of the time it would take for a doctor to become available.

Although the portal provides patients with an option to select specialist consultation services through a drop-down menu during registration, patients often receive a message stating that the selected service is closed. Patients then try to avail of a general service where the doctor may not be qualified to diagnose the problem, which can lead to an unsuccessful consultation. This suboptimal experience could discourage them from trying to use the platform again. Besides onboarding more doctors, the platform can provide an option for patients to record their symptoms or ailments when they first seek a consultation. The patient can either type it in their chosen language or record an audio message. Using natural language processing (NLP), the platform can then initiate an algorithmic match between a doctor and a patient to reduce unsuccessful consultations.

Access: While telemedicine practice guidelines allow for video, audio, text-based, and asynchronous modes of communication for teleconsultation, the eSanjeevani platform is solely video-based. This requires the patient to have a smartphone or a laptop with an internet connection. The eSanjeevaniOPD application makes remote health consultation accessible to those with such technology. However, it does not solve the problem for digitally excluded individuals and communities, which include those with feature phones that have no internet connectivity or those who do not own a mobile phone. As of October, 2019, approximately half of India’s population was digitally excluded. Even among those who own a mobile phone, 40% remain digitally excluded. Moreover, the patient must also complete the registration forms before they can initiate a teleconsultation and navigate through the appointment process. This requires a knowledge of the English language since the forms and instructions are only available in English. To ensure that such services are accessible to all, governments should set up functional teleconsultation helplines, auto-diallers, text messages, and other asynchronous channels as these modes are permissible under the telemedicine guidelines.

The government can also use community-based digital centers equipped with mobiles or tablets to increase access, such as panchayat (village level government) offices and Self-Help Groups (SHGs). Governments that do not make adequate investments in these channels risk excluding their “digitally limited” segments of the population, thereby depriving them of access to healthcare. This could lead to a situation where the most vulnerable populations with limited access to healthcare cannot access remote healthcare services as well.

4. The way forward: Benchmarking eSanjeevani to global platforms

Besides strengthening eSanjeevani along the lines of the three As discussed above, it can also benefit from offering a wider variety of services similar to other online health platforms based in India and overseas. To reimagine more diversified service offerings on the eSanjeevaniOPD platform, we benchmarked services offered in the teleconsultation space by eSanjeevani, Practo and 1mg in India, Ping An Good Doctor (PAGD) in China, and Amwell and Teladoc in the USA. Some of the services available on these platforms include online consultations, e-health profiles, express drug delivery, health management plans, appointment services, health check-ups, hospital referrals, second opinions, inpatient arrangements, and domestic or overseas medical services (see Appendix-2 for description of the services). The table below highlights the services these platforms provide.

As evident from the benchmarking analysis provided above, there is an untapped opportunity to build eSanjeevani into a world-class teleconsultation platform. This is possible by integrating it within the larger healthcare ecosystem that connects hospitals, clinics, pharmacies, laboratories, diagnostic centers, and doctors who offer in-person consultations. This could be pursued through the National Digital health Mission (NDHM) of the Government of India. However, the government must first address the three “As” of abuse, availability, and access.

Appendix 1: Various health platforms used for comparative study

Practo is a platform based in India that seeks to simplify healthcare by connecting the entire healthcare ecosystem, which includes patients, doctors, pharmacies, diagnostics, clinics, hospitals, and testing labs, among others. Patients can consult doctors virtually and book appointments with them for in-person consultations, order medicines, as well as book tests and check-ups. Practo offers a management software to clinics and hospitals to facilitate activities, such as appointment booking. It enables doctors to create their profiles to increase their online presence and offer online consultations and also allows patients to make appointments for offline consultations. 1mg is another Indian online healthcare service that serves primarily as an online pharmacy. It also offers online consultations and allows patients to book lab tests.

1mg is an online health platform operating in India. 1mg aims to make access to healthcare a hassle-free experience by addressing all health needs of an individual remotely. One can avail of allopathic, ayurvedic, homeopathic medicines, vitamins & nutrition supplements and other health-related products delivered at home. The company also collects samples for lab tests at the patient’s home and provides a platform to consult doctors.

Ping An Good Doctor (PAGD) is a healthcare software company that operates in China, headquartered in Shanghai. PAGD utilizes the internet and artificial intelligence (AI) to address gaps in the Chinese healthcare system. Its objective is to become a one-stop healthcare platform by integrating healthcare information, medical services, drugs, health supplements and equipment, as well as health plans. This includes doctors, hospitals, pharmacies, physiotherapy centers, health check-ups, fitness, beauty care, insurance, and e-commerce. PAGD offers online consultations, e-health profiles, express drug delivery, health management plans, health headlines, centralized appointment services for offline consultation, health check-ups, hospital referrals, second opinion, inpatient arrangements, and domestic or overseas medical services (medical tourism).

Amwell is a telemedicine company based in Boston, Massachusetts that connects patients with doctors over video calls. For healthcare providers, Amwell sells its platform as a subscription service to place their medical professionals online. Its software development kits, APIs, and system integrations enable clients to embed their system into existing workflows.

Teladoc Health, Inc. is a telemedicine and virtual healthcare company based in the US. It provides telehealth services, medical opinions, AI and analytics, and licensable platform services. Teladoc Health uses telephone, video conferencing, and mobile apps to provide on-demand remote medical care.

Appendix 2: Description of the services that have been used for benchmarking telemedicine platforms

Online consultation: Patients can talk to physicians online and consult them through video or voice calls for diagnosis, prescriptions, and other services

E-health profile: Digital version of a patient’s health chart that includes real-time health records, which capture their medical history, diagnoses, medications, treatment plans, immunization records, test results, etc.

Express drug delivery: Medicines can be delivered to patients soon after a consultation, through a delivery platform

Health plans: Customized health plans based on e-health profiles of patients

Appointment services: Booking of appointments through a centralized system

Health check-up: Thorough physical examination, including a variety of tests based on the age and health of a person

Hospital referral: After consultation with a physician, if more advanced care is required, the doctor can refer the patient to a hospital

Second opinion: After an unsatisfactory diagnosis, a patient can request to consult a different doctor for a second opinion

Inpatient arrangement: Arrangement for admitting patients to a hospital for surgery or other procedures

Domestic/ overseas services: Travel arrangement for patients who wish to travel to a different location for medical treatment or care