MSC (MicroSave Consulting), with support from the Swiss Capacity Building Facility (SCBF), conducted a workshop, “Assessment of the impact of COVID-19 on MSMEs in Asia and Africa” through a webinar on 28th January, 2021.

In this webinar, panelists discussed the impact of the pandemic on financial health, especially of the MSME sector and low- and moderate-income populations across Asia and Africa. Other topics of discussion included key opportunities that continue to emerge from this pandemic and how donors and governments can help these sectors recover. The key themes for discussion were as follows:

- The impact of COVID-19 and coping strategies

- The response of the government and donors to help low- and moderate-income populations and MSMEs mitigate the impact of the pandemic

- The impact of the pandemic on MSMEs, especially on women entrepreneurs

- Building resilience and the way forward

*00:0 – 3:38 Doreen Njau, Communications Manager—Anglophone Africa, MSC presents the welcome note

*3:39: – 25: 46 Anup Singh, Regional Head—Anglophone Africa, MSC gives a presentation on the impact of COVID-19 on low- and moderate-income (LMI) populations and micro, small, and medium enterprises (MSMEs) in Asia and Africa

*26:44 – 27:31 Graham Wright, Group Managing Director, MSC welcomes the panelists and introduces the topic for the first round of discussions, “The impact of COVID-19 and coping strategies”

*27: 32 – 29:40 Evelyn Stark, Financial Health Strategy Lead, MetLife Foundation talks about the effect of the pandemic on people’s financial health and their attitudes toward formal financial services

*30:35 – 35:22 Mike McCaffrey, Regional Manager—East and Southern Africa, United Nations Capital Development Fund (UNCDF) responds to Question 2: “What have been the key highlights of the response of the government and donors to COVID-19 in Africa? How adequate have these measures been in addressing the financial crisis of the low- and moderate-income populations?”

*36:17 – 45:44 Mark Napier, CEO, FSD Africa responds to Question 3: “As a key market facilitator in Africa, how do you see COVID-19 impacting the inclusive finance sector?”

*46:42 – 52:53 Payal Dalal, Senior Vice President, Social Impact, International Markets, Mastercard Center for Inclusive Growth responds to Question 4: “What is the impact of the pandemic on MSMEs, especially on women entrepreneurs? What key challenges do you see in the growth of the MSME sector post-COVID-19?”

*53:52 – 1:10:23 The panelists respond to round one of the questions from the audience

Question 1) Would the loan demand be different across the poverty levels of households and MSMEs?

Question 2) Digital payments are in place but in the absence of an ecosystem, cash is the final destination. Any thoughts on this?

Question 3) Please see if this makes more sense—Lower income people have been borrowing extensively during the pandemic through mobile loans. We have heard that banks and microfinance institutions have been re-scheduling the loans as most people are unable to repay them due to the ongoing pandemic. How will this affect the economy?

Question 4) Does the MSC Foundation offer programs in SSA that tackle for instance, pre-investment TAs in the form of training sessions and grants?

*1:10:29 – 1:11:41 Graham Wright introduces the second topic on building resilience and the way forward. He gives a data point from the Kenya study on farmers. Graham notes that farmers’ margins have contracted by 38% and this could reflect across different sectors.

Second topic: Building resilience and a way forward

*1:11:44 – 1:17:29 Evelyn Stark responds to Question 1: “How has the current crisis been shaping the strategies of the MetLife Foundation to support the financial inclusion of the poor? How has it helped build a coordinated response to support recovery? Is there a need to re-focus financial inclusion, considering COVID-19 has undone years of inclusive finance initiatives?”

*1:18:40 – 1:26:31 Mark Napier responds to Question 2: How can financial markets effectively address the financial constraints of low- and moderate-income populations and MSMEs and help these segments survive and recover from the pandemic?

*1:27:18 – 1:32:21 Payal Dalal responds to Question 3: What key opportunities have been emerging from this pandemic that can further the financial inclusion agenda amid the current health crisis? How is Mastercard Center for Inclusive Growth working to realize these opportunities?

*1:34:10 – 1:42:39 Mike McCaffrey responds to Question 4: What are the innovations that financial services providers can use to assist recovery from the pandemic?

*1:42:57 – 1:50:32 The panelists respond to round two of questions from the audience

Question 1) Has the enterprise finance gap increased in recent years? Can there be a dynamic measure of this gap that can be regularly updated to measure the interventions focused on reducing the gap?

Question 3) Why can we not have situations, such as in most sensible nations, where long-term leases are signed but the rent is paid monthly or quarterly. Why do private landlords have to further cripple businesses through this unfair practice?

1:50:49 – 1:55:04 Sitara Merchant, CEO, Swiss Capacity building Facility, presents the concluding remarks

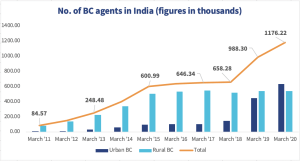

For the past seven years, Neelam Devi has provided banking services to her fellow villagers in the remote villages of Sonepat in Haryana. She began her journey as a banking agent or business correspondent (BC) when there were only a handful of BCs across the country. Now, Neelam is one of the top-performing BCs in the state. Her simple manta for success? “Hard work and dedication”.

For the past seven years, Neelam Devi has provided banking services to her fellow villagers in the remote villages of Sonepat in Haryana. She began her journey as a banking agent or business correspondent (BC) when there were only a handful of BCs across the country. Now, Neelam is one of the top-performing BCs in the state. Her simple manta for success? “Hard work and dedication”. For more than a decade, BCs like Neelam have played a pivotal role in achieving financial inclusion in India. With vast geography to cover and a huge population to cater to, BCs remain the

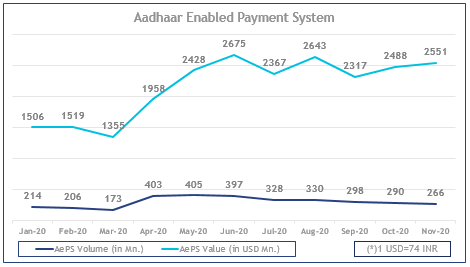

For more than a decade, BCs like Neelam have played a pivotal role in achieving financial inclusion in India. With vast geography to cover and a huge population to cater to, BCs remain the  April 2020 saw a month-on-month

April 2020 saw a month-on-month