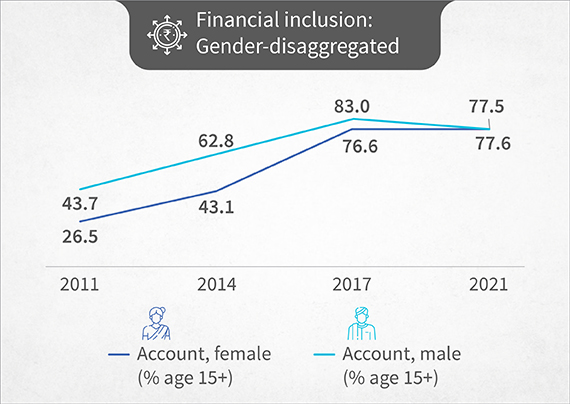

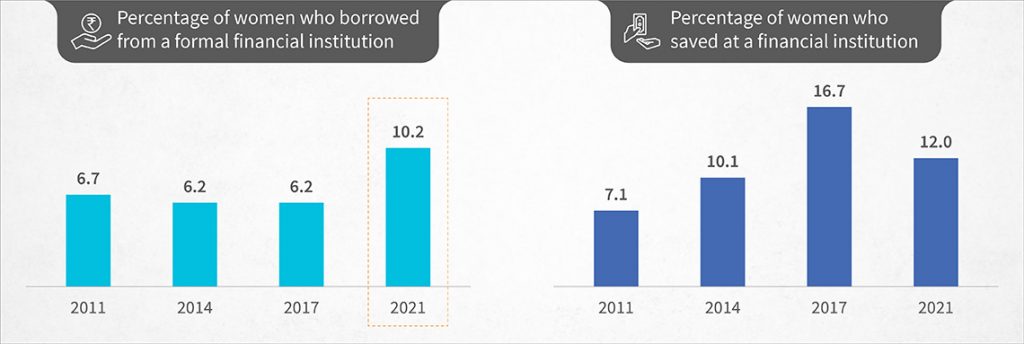

The road to achieving digital financial inclusion for women is long. Yet we must acknowledge that we are (slowly) moving in the right direction. The status of women in the financial inclusion ecosystem looks bright. The Global Findex data 2021 highlights that the gender gap among bank account holders has narrowed due to increased account ownership among women. Financial activity among women has risen as more women borrow from financial institutions and save in them.

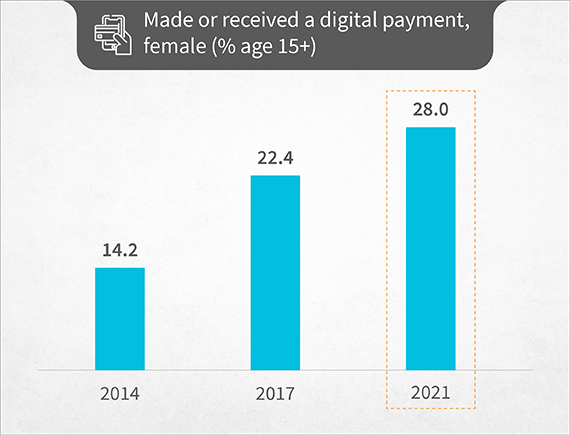

Moreover, DFS-related activity has also seen growth. The ownership of debit and credit cards among women has also increased notably. Women who make or receive digital payments have almost doubled since 2014.

Figure 1: Account ownership among women increased to 77.6% in 2021, reducing the gender disparity in financial inclusion to 0.1%

Figure 2: Percentage of women who borrowed from or saved at a financial institution

Figure 3: Percentage of women who made or received a digital payment

Despite the increasing ownership of financial accounts, the adoption and use of digital financial services are yet to take off fully among women. Increased risks around customer protection and data privacy in the digital finance ecosystem have emerged as a significant deterrent to the uptake of DFS among women. Women often do not trust digital channels when they try to access financial services. For instance, MSC’s research with female recipients of G2P programs in Bangladesh highlights that fear of fraud is a key reason why women hesitate to use digital modes of payments beyond cash-outs.

Despite the increasing ownership of financial accounts, the adoption and use of digital financial services are yet to take off fully among women. Increased risks around customer protection and data privacy in the digital finance ecosystem have emerged as a significant deterrent to the uptake of DFS among women. Women often do not trust digital channels when they try to access financial services. For instance, MSC’s research with female recipients of G2P programs in Bangladesh highlights that fear of fraud is a key reason why women hesitate to use digital modes of payments beyond cash-outs.

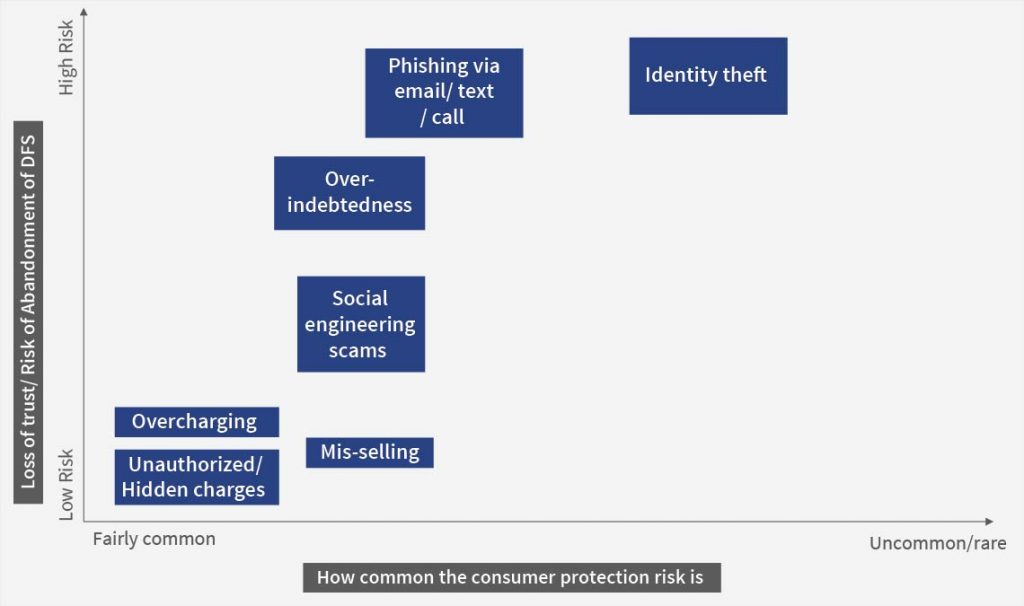

Unfortunately, as CGAP reports, women, specifically rural women, are more vulnerable to experiencing DFS-related risks. DFS-related risks are constantly evolving. They reduce confidence in using DFS, decrease active usage, and, if unaddressed, may even compel users to abandon DFS completely. Below, we have mapped[1] the most common DFS-related consumer risks to their impact on a woman’s trust in DFS or risk of abandonment of DFS by women.

Unfortunately, as CGAP reports, women, specifically rural women, are more vulnerable to experiencing DFS-related risks. DFS-related risks are constantly evolving. They reduce confidence in using DFS, decrease active usage, and, if unaddressed, may even compel users to abandon DFS completely. Below, we have mapped[1] the most common DFS-related consumer risks to their impact on a woman’s trust in DFS or risk of abandonment of DFS by women.

Why women?

Women’s higher susceptibility to DFS-related risks is certainly not shocking. While the drive from governments and DFS providers to financially include women is admirable, their frequently low digital capability limits their understanding of the potential risks and vulnerabilities associated with DFS. This makes them easier targets for fraudsters.

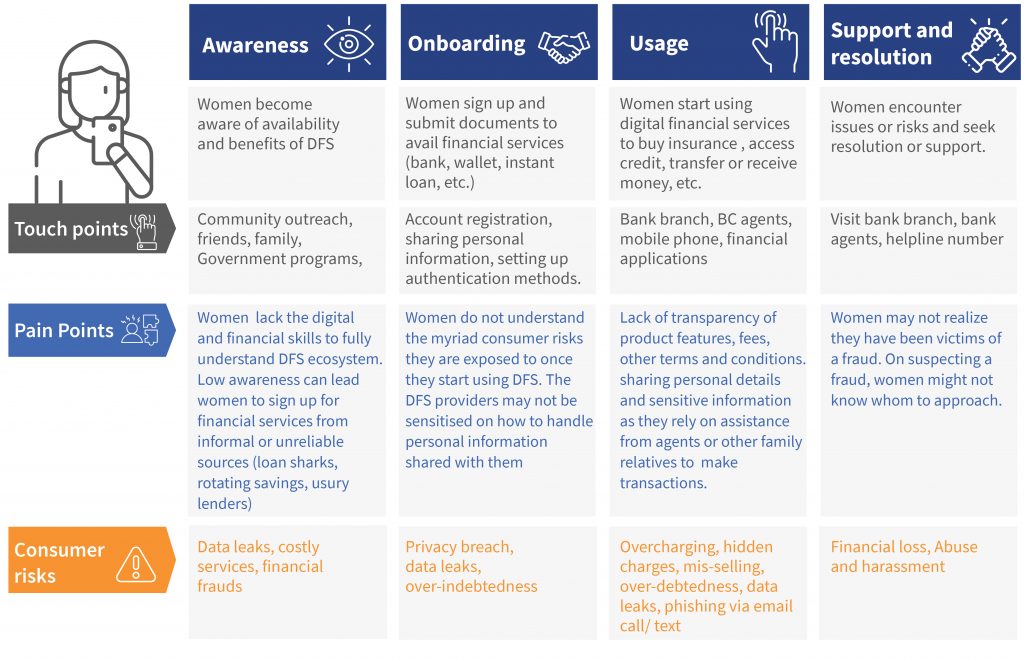

Many women are essentially DFS proxy users or agent-dependent users. They rely on family members or assistance from agents to access financial services and conduct transactions. Women may face unique social challenges as others manipulate their relationships or exploit power dynamics to gain unauthorized access to their financial accounts or sensitive information.

Figure 5: Tracing a woman’s journey as she accesses financial services to map DFS consumer risks she is exposed to disproportionately

So, what can DFS providers do?

Controlling evolving consumer risks is crucial to ensure sustained DFS usage among women. This can be done through the creation of an action-oriented, gender-intentional approach to monitor and safeguard DFS users against consumer risks. Devising solutions that reduce DFS consumer risks for women will require DFS providers to:

1. Collect and analyze gender-disaggregated data: DFS providers should collect gender-disaggregated data for digital financial services and products. The gender-disaggregated data should be collected for account ownership, usage, and user grievances. This will help identify early on the most common issues concerning women. An analysis of gender-disaggregated data for a grievance resolution mechanism (GRM) can help DFS providers improve their products and offer women customized solutions. Moreover, this data can be used to design financial education collaterals that target specific needs highlighted by women.

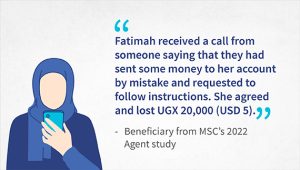

2. Design robust and responsible grievance resolution mechanisms: DFS providers should build GRM systems that have a simple user interface and easy-to-navigate user experience designs. MSC’s research in Uganda highlights that most customers do not use GRM systems because they lack trust in the systems or struggle to navigate complex interfaces. Fraudsters impersonate customer care executives and deceive them in the name of resolving issues, which leads them to lose money. Since women are more susceptible to such fraud, DFS providers should ensure they build responsible GRM systems that are well-communicated and have a quick response time.

3. Design responsive channels and content to spread awareness about DFS consumer risks: The likelihood of DFS users being defrauded would be lower if they knew more about fraud and the fraudsters’ behavior. An interactive chatbot can be preinstalled on mobile phones with in-built features that include information on types of financial fraud, new trends, and patterns fraudsters use, and the best practices users should follow while making digital financial transactions. For feature phones, IVRS can be used to sensitize female DFS users to make them more vigilant while using digital channels.

4. Creation of market monitoring mechanisms: Monitoring and analysis of GRM data for women can help DFS providers design better products for women and improve their access to finance. Furthermore, providers can seek regular feedback from women through surveys, analyze social media complaints, and review and track risk management practices to detect potential risks or vulnerabilities women who use DFS face.

In conclusion, DFS providers must recognize and address women’s heightened vulnerability to DFS-related risks. Providers can build a safer DFS ecosystem tailored to women’s needs by adopting these practices. Education initiatives that seek to raise awareness of customer protection hold immense potential to safeguard women’s financial well-being when coupled with robust mechanisms to mitigate fraud risks.

As women continue to drive revolutions through increased financial activity, DFS providers must create safeguards to protect them from potential risks in their financial engagement. If DFS providers place the security and empowerment of women front and center, they can carve a path for a transformative era in women’s financial inclusion—and in the process, a better future for all.

Raman and Sudipta found their entrepreneurial spirit in their early childhood days. Raman started earning in the eighth standard by renting out video games. Raman reminisces how those video games changed his future forever. On the other hand, Sudipta wrote software and did market research assignments to support his college fees. Raman and Sudipta are tech and data enthusiasts and realized early on that data could change the landscape of the lending industry.

Raman and Sudipta found their entrepreneurial spirit in their early childhood days. Raman started earning in the eighth standard by renting out video games. Raman reminisces how those video games changed his future forever. On the other hand, Sudipta wrote software and did market research assignments to support his college fees. Raman and Sudipta are tech and data enthusiasts and realized early on that data could change the landscape of the lending industry.