It may just be a branding problem. “Financial Education (FE)” and “Financial Literacy” really do sound both condescending and boring. Its new and improved name, “Financial Capability (FC)” is slightly less insulting (perhaps), but still fails to clarify what’s on offer to very poor people whose only real incapability is very limited financial resources and no prospect of more money any time soon.

The World Bank is aware of the less than optimal impact the often biased marketing materials (guised as FC materials) from banks and microfinance institutions (MFIs) have on these audiences. For more background information, visit Financial Education: Time for a Rethink and MicroSave’s online library to see our research on this issue.

We’re ready now to suggest some alternative ways we might approach this issue and hear your thoughts. Of course, we too have a new name – in-house, we refer to it as Alternate FE. But since we understand “AFE ” is unlikely to solve the branding or any other problems under discussion, our principal focus is imagining what relevant, meaningful information financial service providers and international donors might usefully offer that isn’t just a sales pitch or theoretical financial management concepts. (For more specifics on how to design AFE programmes, please click here.)

|

Products come first not FE An interesting example of this type of smart product design includes Flexi and Flexi Plus, an LIC (Life Insurance Corporation of India) offering that allows variable deposits and maturity benefits more compatible with erratic cash flows and shifting priorities. Flexibility for monthly recurring deposits is especially important for this target market—and a more realistic way to encourage long-term savings. |

Here’s what we already know:

- Poor people are smarter about money than most Financial Educators may realize. (See Breaking Free from the Myths of Financial Education),

- Their failure to save or invest won’t be solved by ignoring the obvious. Their saving condition is quite different- unpredictable income and short pressing needs make regular saving sometimes difficult.

- Consumers need products and services that actually fulfill their needs, not whatever the marketers are selling this week (see an example in the box).

Recent field research has also taught us a fair amount about human nature and what makes people in all income brackets feel more secure and less secure, about money. An essential component of AFE is promoting more individual control and confidence about personal finance.

In many Financial Education/Literacy/Capability classes, the attendees are expected to learn the same material at more or less the same speed, from an external trainer with whom they have no personal connection. In real life, however, very few of us actually retain and implement information this way.

The making of mavens

Most of us look to what Malcom Gladwell calls a “maven” (see here), the most well-informed, trusted person in a group, to guide us—and to share the blame if something goes amiss. Given enough relevant, persuasive facts to work with, almost everyone enjoys being a maven. Expert knowledge confers status and authority (which lead to the control and confidence, noted above, necessary for competent money management).

Here is where AFE gets a bit tricky. The goal is to create as many confident experts as possible, not just one maven who metes out factoids and advice on an occasional basis. And, of course, factoids and figures alone are boring. They are necessary to substantiate the claims that “Flexi Plus”, or any other savings option under discussion, works better for most of its customers than the alternatives. To be compelling, however, these details have to be part of a story—ideally one that sounds real and local and personally credible.

The best mavens understand instinctively how to relate such stories and real-life examples. They realize that the details of an ignominious financial failure are always more compelling and useful for a group discussion than a tiresome little parable about rigorous frugality and its rewards. Everyone can feel superior, and thus more expert, than the failure. Varying paths to success and tales rife with seeming contradictions are also useful story-telling techniques to encourage participation and share knowledge. Taking a cue from the maven story, AFE incorporated a key strategy to identify mavens and with their support create as many mavens as possible to reach a tipping point for a social change.

Other alternate FE alternatives

An integral part of maven effectiveness is envy and insecurity. Aspiration is all very well and good, but the most powerful motivators to exploit are sometimes the negative ones. Anxiety about old age, illness, other family emergencies generally prove to be excellent AFE anchors and effective learning tools, as highlighted in the behavioral science theory of loss aversion.

A final point, worth keeping in mind for all financial education that changes in attitude (read commitments and perceptions) are equally relevant. We may not see an increase in savings amount immediately for savings are indeed difficult. Even a very wealthy country like the United States has a deplorable savings rate (almost half the salaried population puts 10% or less aside each year; those with more variable incomes usually save nothing). Their personal debt ratio is even more alarming and, in most states, increasing steadily. Emerging economies may fare better in the short term—their needs are more urgent and thus incentives may prove stronger—but all those lessons in human nature should remind us that change happens slowly, if at all, and usually for reasons, we didn’t expect.

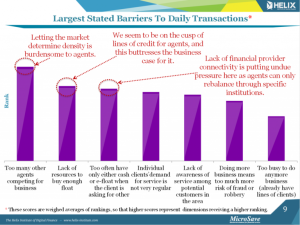

We know, for example, that in 2013 Kenya Safaricom tried to persuade M-PESA agents to hold more liquidity by increasing commission rates on higher value transactions. When this had little/ no impact on agents’ liquidity holdings, Safaricom returned to their original approach of saturating the market with agents. This allows customers seeking to conduct larger transactions to either go to the larger agents that hold bigger liquidity pools (for example those of

We know, for example, that in 2013 Kenya Safaricom tried to persuade M-PESA agents to hold more liquidity by increasing commission rates on higher value transactions. When this had little/ no impact on agents’ liquidity holdings, Safaricom returned to their original approach of saturating the market with agents. This allows customers seeking to conduct larger transactions to either go to the larger agents that hold bigger liquidity pools (for example those of