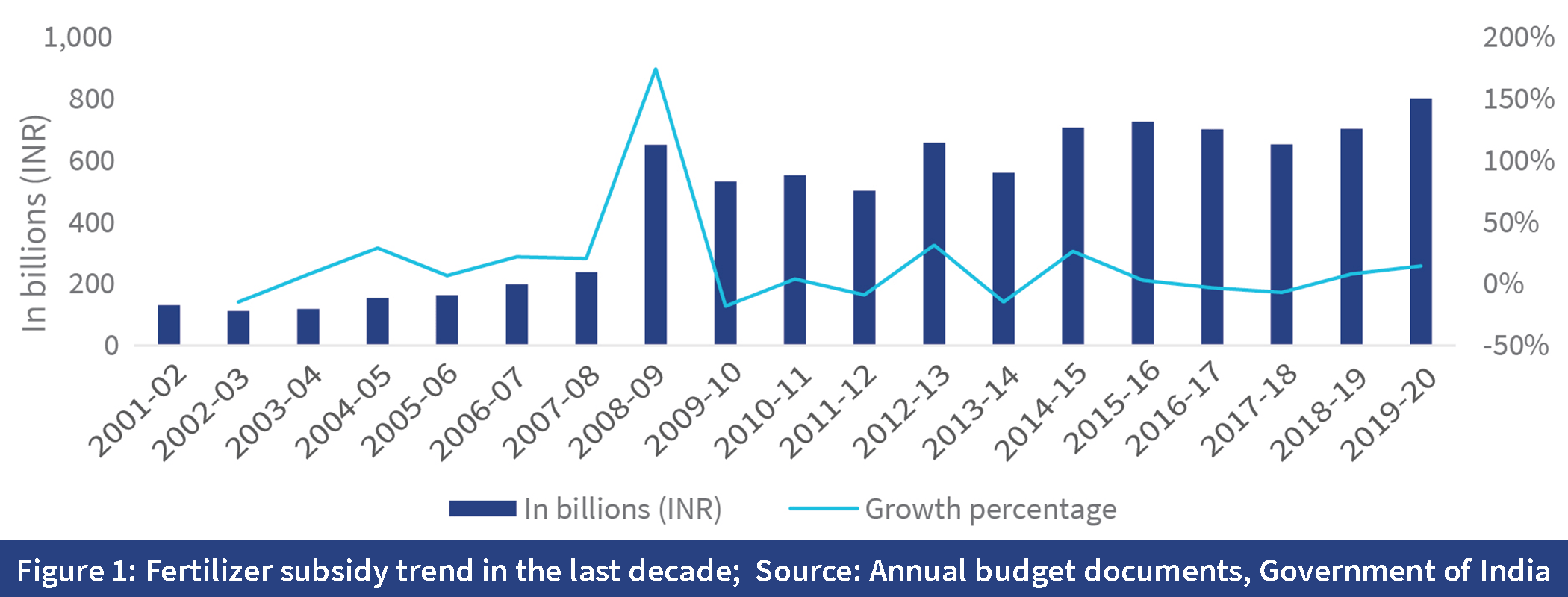

In the past two decades, the Government of India has increased the subsidy provided on fertilizers from USD 1.3 billion to USD 11 billion, as illustrated in the graph below. The subsidy has remained consistent at around 1-1.5% of the Gross Domestic Product (GDP). However, over the years, the distribution of fertilizers has become prone to “leakages.” The Economic Survey of 2015-16 estimated that 65% of the fertilizer produced does not reach the intended beneficiaries—small and marginal farmers.

In response, the Government of India (GoI) modified the fertilizer policy in 2018-19. It introduced a new direct benefit transfer (DBT)system in March 2018. Under this system, fertilizer manufacturers receive subsidy payments only after retailers sell the fertilizer to farmers through successful Aadhaar-based biometric authentication. DBT has facilitated the real-time tracking of fertilizer movement, demand estimation, and availability of stock. DBT in fertilizer helped the GoI save USD 1.54 billion during the first year. However, several challenges persist in the distribution of fertilizer in India.

The government has been considering a policy shift to direct cash transfer of the subsidy amount to the bank accounts of farmers rather than fertilizer companies. This move is expected to improve the efficiency of nutrient usage and ensure the delivery of the subsidy directly to end-users. The draft report of a panel under Ramesh Chand, a member of the NITI Aayog, shined a light on the feasibility of the implementation of DBT to farmers. The report also highlighted the criteria to determine the amount of subsidy, periodicity of subsidy transfers, and the mechanism of fund transfer, using data on beneficiaries and their landholdings from the PM-Kisan program. To ensure that the policy shift is implemented smoothly, it is essential to educate beneficiaries on the new system.

Low awareness among farmers may pose a challenge: Evidence from the ground

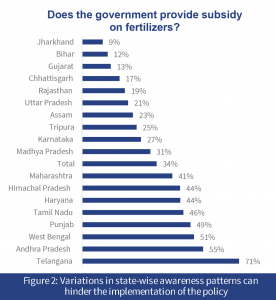

In our study,[1] we assessed the awareness of the subsidy regime among farmers. The data collected from more than 11,000 farmers from 18 states indicated that most beneficiaries are not aware of the current policies and practices. Only one-third of the farmers knew that they purchase fertilizers at a subsidized rate. Another one-third believed that they receive no subsidies on fertilizers, while the rest remained unaware of the subsidy.

In eight out of the 18 states surveyed, less than 25% of farmers knew that the government provided subsidies on fertilizers, (see figure 2).

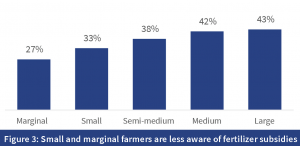

All categories of farmers—marginal, small, semi-medium, medium, and large—had limited awareness of the subsidy. However, the level of awareness varied significantly among the five categories (test statistic 143.96, p-value 0.000).

Of the farmers who were aware of the fertilizer subsidy, around 70% knew that they purchased subsidized bags from retailers, with INR 720 (USD 10) mean subsidy per bag. This amount was close to the subsidy amount provided by the government per bag of urea.

The challenges ahead

Some of the states that consume high amounts of fertilizer, such as Bihar (12%) and Uttar Pradesh (21%) have low levels of awareness regarding subsidies on fertilizer. A policy shift to deliver the subsidy directly into the bank accounts of farmers may evoke shock and displeasure since this would require farmers to first purchase fertilizers at the market price.

When asked about their preference for the subsidy regime, less than half (43%) of the farmers who were aware of subsidy on fertilizers preferred direct transfer into their account to the current option of buying subsidized bags of fertilizers. A possible reason for this reluctance is the high upfront cost involved in the purchase of fertilizers at non-subsidized rates. Farmers may find these costs difficult to bear given the high indebtedness among farming households. Based on our study, we found that farmers may need an additional up-front investment of INR 20,850 (USD 297.86[2]) to purchase fertilizers. According to the All-India Debt and Investment Survey, 2016 of the National Sample Survey Office, the incidence of indebtedness stood at 31.4 % among rural households, with an average debt of INR 110,438 (USD 1,488) and a debt-asset ratio of 7%. More large farmers (69%) and medium farmers (67%) with higher incidences and amounts of debt preferred the current subsidy policy as compared to small (55%) and marginal farmers (52%) (Pearson’s chi-square statistic of 149.52 and p-value = 0.000). Based on their experience with other programs, farmers fear that the subsidy may get delayed or they may not receive the amount altogether due to technical failures. As the purchase of fertilizer at the market rate involves high upfront investment, farmers may be reluctant to change.

Need for a focused communication strategy

The obstacles around a policy shift in subsidy are two-fold. Firstly, with low awareness of the current subsidy regime, farmers may find it difficult to accept the idea of receiving the subsidy amount directly into their bank accounts after purchasing fertilizers at market rates. Secondly, the preference for the current subsidy policy among farmers may prolong the process of implementation if the policy shift is not communicated properly.

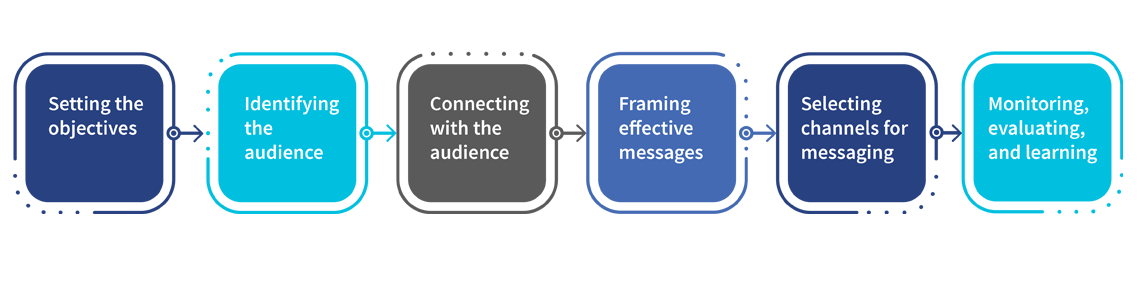

Communicating the shift in policy will be key to transitioning from the status quo to the proposed approach. MSC’s experience shows that effective communication before, during, and after reforms in subsidy is essential to ensure its smooth roll-out. An effective communication strategy will need a range of considerations and components for different stakeholders. The government will have to evolve a communication strategy that involves the following elements:

- Use outreach and two-way dialogue with citizens to highlight the need for reforms and their benefits;

- Consult with stakeholders and institutions to understand their concerns and perceptions about the planned reforms;

- Enable a feedback mechanism and an effective grievance resolution mechanism;

- Communicate consistently through evidence-based messages to build understanding and support for reforms, as well as minimize negative perceptions and potential social impacts.

Drawing from our experiences on G2P payments and direct benefit transfers, MSC has devised a communication approach to develop and deliver impactful messages to stakeholders on any policy change. Based on Well Made Strategy’s approach, this six-step process recommends –

Before the government implements a shift in policy, it must consult stakeholders, communicate with them effectively during implementation, and address their concerns.

Before the government implements a shift in policy, it must consult stakeholders, communicate with them effectively during implementation, and address their concerns.

________________________________________________________________________________________

[1] MSC (MicroSave Consulting) undertook a pan-India study in 2018 on the process evaluation of DBT in fertilizer. The research used a nationally representative sample of 11,281 farmers and 1,182 retailers from 54 districts of 18 states. The quantitative research provided national and state-level point estimates on the status of implementation of the pan India roll-out of the Aadhaar-enabled fertilizer distribution system.

[2]The calculation is based on the findings of the process evaluation of the DBT-fertilizer study done in 2018.

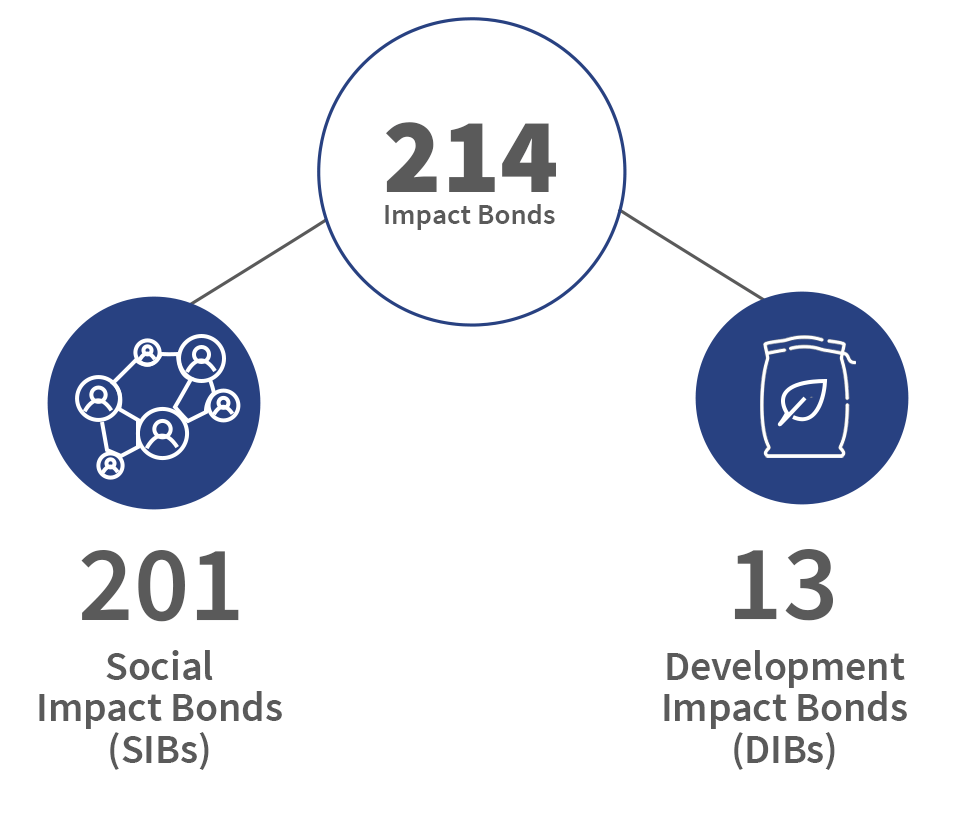

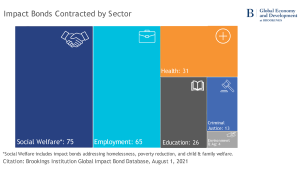

Since the first SIB launched in

Since the first SIB launched in  The potential role for SIBs in India and the developing world

The potential role for SIBs in India and the developing world