Bangladesh’s digital financial services have been much in discussion for rapid growth. Six years since inception – where the market is heading to? What providers ought be doing. This and much more in this video where MSC expert, Akhand Tiwari, talks candidly on the critical role regulation and behavioural sciences will play in shaping the future of mobile banking in Bangladesh.

Blog

Do Financial Service Providers Really Understand Savings Group Members?

The 2016 State of Linkage Report found that 40% of financial service providers (FSPs) currently providing savings and credit products to savings groups (SGs) worldwide are in Kenya, Tanzania and Uganda. With an estimated combined SG population of 3.5 million, FSPs in these three countries may recognise the potential of this market – but how much do they understand about the needs and perspectives of the people they are aiming to reach?

FSPs can gain useful insights from some new perspectives from SGs (both linked and unlinked to banks). These were gathered through rapid small-scale demand-side studies in Ghana, Tanzania and Zambia carried out by Savings at the Frontier (SatF); and from feedback given by women belonging to Village Savings and Loans Associations (VSLAs) in Kenya during the East Africa Savings Group Linkage Summit organised by CARE East and Central Africa in December 2016.

Why do people join saving groups?

The strongest incentive for linking with formal FSPs for all the SG members interviewed for the SatF studies is the increased security of their cash. In Ghana, we heard about an SG treasurer who found a note under her door saying that she was going to be robbed. She rushed out and buried the cash box in a nearby field, terrified but thankfully not robbed. Similarly, one of the Kenyan VSLA members referred to storing “up to US$ 4,000 under the bed.” The fear and terrifying experience of potential loss of hard earned cash is an important driver towards formal banking among SG members.

Another incentive for SG members interviewed by the SatF team was earning interest on surplus savings. However, we encountered a lack of knowledge – and thus confusion – resulting from the way groups calculate interest on a monthly basis, compared to banks who do it annually.

The SatF country studies found that simply being members of a group enhanced savings discipline. Similarly, the Kenyan VSLA members reported that linkage helped to improve savings discipline, which in turn supported members to better plan for their futures.

Why don’t savings group members currently use banks?

In the three SatF country studies, SG members reported that they did not use banks because they did not think they had enough money to save. Bank bureaucracy was also seen as a major hurdle when directly compared to SGs’ simpler procedures. Similarly, the Kenyan VSLA members referred to “too much paperwork” putting them off using banks.

In Ghana, we found that physical access to banks was more difficult than in Tanzania and Zambia. Access remains a major challenge in reaching SG members who tend to be far removed from banking networks. A further hurdle is a lack of knowledge about formal products and services.

The women we spoke to in Kenya identified the following other linkage-related challenges:

- Worries about fees and deductions when savings were held in a bank;

- Confidence in mobile banking was undermined by poor network coverage and connectivity;

- Groups that didn’t access bank accounts through mobile agents had to travel quite a distance to reach a branch;

- Limitations on youth (i.e. under 18s) being included in linkage banking as they lacked ID cards; banks need these to meet Know-Your- Customer (KYC) requirements;

- Technology, including mobile money, can be a challenge for older group members and illiterate members; and

- Some group members were still wary of dealing in anything other than cash.

Technology as an Enabler

Technology will continue to be an important enabler of linkage. Access to mobile phones is prevalent in all three SatF study countries. However, registration for mobile money varies widely: it is low in Zambia (4.5% according to FinScope 2015) compared to the SG members we interviewed in Ghana and Tanzania with 32% and 85% respectively. The Kenyan women’s experience with technology, including mobile money, was that it provided ease of access, low costs, improved record-keeping, transparency and (in one case) reliable calculation of share-outs resulting from electronic records.

Limited Product Range

In terms of products for SG members, the women in Kenya reported that most banks serving SGs provided savings accounts. Only one bank had offered a small wholesale loan to one group. The women reported that banks made some efforts to lower entry barriers, for example by not charging account ledger fees or imposing a minimum balance.

Lessons for Banks

Drawing on all this, we believe there are a number of lessons for banks that will contribute to the success of future linkages with SGs, in particular:

- Understand your potential customers, get to know them and build trust: research both demand- and supply-side options. For example, six out of ten SG borrowers in Tanzania used loans for both productive investments and consumption purposes: this has clear implications for the development of tailored products;

- Segment the SG market: for example, women and youth in particular offer promising uptake of digital financial services, especially in Tanzania;

- Keep KYC requirements to an absolute minimum: lobby for changes in regulation and local government requirements, if necessary;

- Be prepared to experiment: remember, these linkages are likely to be context specific;

- There is rich potential for digitising informal collective savings: this offers the chance to record every single individual level transaction and thereby open up potential for cross-selling opportunities;

- Linking SGs can be profitable: some SGs we met in Zambia reported relatively regular banking transactions and high bank account balances;

- Acquisition costs for banks of acquiring new SGs and individual member accounts may well be high: especially in rural areas; and

- FSPs will need to work with SGs and their members to understand what is needed to ensure continuing active engagement and use of accounts.

Ian Robinson is an independent consultant and George Muruka is a senior consultant at MicroSave in Nairobi. They make up the demand-side team on the Savings at the Frontier programme.

Savings at the Frontier is a $17.6 million partnership between Oxford Policy Managementand The MasterCard Foundation. Its aim is to expand the range of financial products and services available to people living in poverty in Ghana, Tanzania and Zambia by testing and implementing business models that sustainably deliver those products and services to savings groups and other informal savings mechanisms. For more information, please visit the link.

Bench marking customer to agent ratios

DFS providers struggle with a variant on the chicken and egg problem: whether to recruit more agents or more customers? How to provide adequate access for customers while ensuring agents face sufficient demand? All are interested in striking the right balance. New research from The Helix Institute finds that to date we have overestimated the number of customers per agent required to ensure network viability in maturing markets.

DFS providers struggle with a variant on the chicken and egg problem: whether to recruit more agents or more customers? How to provide adequate access for customers while ensuring agents face sufficient demand? All are interested in striking the right balance. New research from The Helix Institute finds that to date we have overestimated the number of customers per agent required to ensure network viability in maturing markets.

Existing Industry Benchmarks

Until now, network management gurus (GSMA, McKinsey, The Helix Institute) referenced what has become a CGAP’s classic: the graph depicting the evolution of M-PESA customer to agent ratio in the early month after its launch in Kenya (Figure 1).

Figure 1. M-PESA Customer to Agent Ratio (2007-2009)

In 2013, GSMA further qualified the M-PESA benchmark. Using data from the Global Adoption Survey, it recommended a target ratio of 150 to 800 active customers per active agent. A new Helix study draws on 15 datasets to offer updated and more precise benchmarks for five leading DFS countries: Bangladesh, Kenya, Pakistan, Tanzania and Uganda. In this blog, we use a similar methodology[1] to examine provider-specific customer to agent ratios in these markets.

Registered Customers vs. Active Agents

In East Africa, customers generally need a registered account to use mobile money and providers set targets for new registrations. These must be balanced with agent acquisition. Using the latest data available for Kenya, Tanzania, and Uganda[2] we determine provider-specific registered customer to active agent[3] ratios for seven leading MNO DFS providers range from just under 100 to under 300 (Figure 2).

Figure 2. Distribution of Leading East African DFS Providers, by Registered Customer to Agent Ratio

Figure 2 shows that the bulk of East African leading providers have registered between 100 and 300 customers for each agent who has transacted at least once over the past quarter. This ratio is much lower than the initial M-PESA benchmark. In fact, looking at more recent M-PESA ratios, calculated using subscriber and agent figures reported in Safaricom annual reports, we find that for the past four years it has flattened out between 200 and 300 (Figure 3).

Figure 3. M-PESA Subscriber to Agent Ratio (2010-2016)

Registered customer to agent ratio will and should fluctuate during periods of expansion, as providers shift focus between on-boarding new customers and new agents. Nevertheless, benchmarks can help gauge whether growth is becoming too imbalanced. Importantly, provider and agent viability will vary even at similar registered customer to agent ratios, depending on product offering, customer activity rates, and commission structures. Thus, customer to agent ratios should not be targeted in a vacuum.

Active Customers vs. Active Agents

Because a large proportion of customer accounts are inactive, we also examine the ratio of active customers[4] to active agents for 16 providers in the five leading markets (Figure 4). Naturally, these ratios are much lower than the ones in Figure 2.

Figure 4. Distribution of Main DFS Providers in Five Leading Markets

Plotting active customer to active agent ratios in the most dynamic digital finance markets helps update and narrow the target range from 150-800 down to 100-300. Some factors that affect these ratios include DFS take-up and usage rates. Higher levels of dedication would translate into the ability and need to accommodate greater numbers of customers because dedicated outlets focus exclusively on serving mobile money clients. High agent churn could lower the ratio as less experienced agents tend to serve fewer customers, or increase it if outlets going out of business are not immediately replaced. While proposing benchmarks amidst this complexity is a tricky affair, we find the 100-300 range more useful than the guidance available up to now.

Ratios vs. Agent Performance

To further hone in on the viable range of active customer to active agent ratios, we have plotted them against agents’ daily business volumes (Figure 5).

Figure 5. Agent Business Volume vs. Active Customer to Active Agent Ratios

NOTE: One provider’s data is included in the analysis but not shown as its unique values would have revealed its identity.

Some sixteen data points only indicate a trend, but Figure 5 presents a fairly clean and strong one. Interestingly, providers with a ratio of 84 or higher perform a median of ten transactions or higher. Therefore, we can make a tentative conclusion that to keep median daily transactions above ten, the ratio of active customers to active agents should fall roughly within the 100-250 range, depending on commission rates, agent density and other variables like transactions per active customer.

Conclusion

In nascent markets, customers transact less often than those in more mature markets, where customers have developed trust in the DFS systems and enjoy a wide range of opportunities to transact. The above analysis suggests that in “lift-off stage” of deployment providers may aggressively recruit customers to drive demand for their service. This, in turn, allows them to further expand the agent network. As DFS take-up and usage rates intensify and the deployment reaches its “orbit stage”, the ratio of customers to agents will eventually flatten out, at a much lower range of 100-300 than the 400-600 benchmarks the industry has been using until now.

[1] We combine data from IMF and World Development Indicators with nationally representative Agent Network Accelerator (ANA) and Financial Inclusion Insights (FII) surveys to calculate provider-specific number of active agents as well as registered and active customers. See Appendices III, V, VII and IX in Agents Count. for a more detailed explanation.

[2] Analysis is based on the latest data available, which is 2014 for Kenya and 2015 for Tanzania and Uganda.

[3] Active refers to agents who have conducted at least one transaction in that past 90 days. Bank of Tanzania statistics on activity rates are used as best available proxy for Kenya and Uganda.

[4] Active customers are defined as having performed a financial transaction using mobile money in the past 30 days.

Where credit is due – Customer experience of digital credit in Kenya

Digital credit offers enormous promise to enhance provide a valued service to the mass market thus increasing financial inclusion, while also driving uptake and use of digitial financial services (DFS). However, with 2.7 million people already blacklisted on the credit reference bureau in Kenya, concerns are growing about current standards of regulation, customer protection and product design. In response, MicroSave conducted a brief study in Nairobi and Meru to examine the root causes of the alarming default rates on digital credit and propose recommendations for regulators/competition authorities, providers and other stakeholders. The research examined the process of applying for loans from different providers as well as conducting individual interviews with borrowers to understand their needs, aspirations, perceptions and behaviours.

Demonetisation and digitisation – A diagnostic study

This demand-side diagnostic study aims to gauge the end-user experience in adopting cashless modes (including cheques) along with the barriers (behavioral and functional) they faced in uptake and usage of cashless solutions.

Getting it right: Why counting mobile money agents accurately matters

Financial access is the foundation of financial inclusion. A person cannot decide to use a financial service until it has been extended within their reach. Central to measuring access to finance is the number of physical locations in a country where a person can use financial services. Historically, these access points have included bank branches and ATMs. However, with the GSMA’s State of the Industry Report 2016 reporting that 92 countries now offer mobile money services, it is important to measure the number of agent outlets offering these services.

Counting agent outlets in a country is complicated. In fact, many in the industry may be surprised to learn that there is no consensus on these numbers — not even in countries leading the world in digital finance. This is a consequence of having two different methodologies for arriving at outlet statistics, yielding widely disparate results. The first is a series of censuses conducted as part of the Bill and Melinda Gates Foundation-funded FSP Maps project, which sought to geo-locate all agent outlets in six countries. The second approach aggregates agent numbers providers submit to their respective regulators (as well as to GSMA, in some cases).

While both methodologies have weaknesses, the bigger issue is that they are designed to measure different statistics. Therefore, we have not been able to compare the results. For example, when the FinAccess geospatial mapping 2015 located 65,970 mobile money agent outlets in Kenya, after the regulator had published a figure of 123,703 agents in December 2014, it was hard to interpret either number.

The discrepancy is easily explained: A census counts up the number of visible and operational agent outlets, whereas providers report on the number of agent tills[1] they have registered on their books. The distinction between active agent outlets and total agent tills is crucial for measuring access, for two important reasons. First, in two-thirds of countries where mobile money is offered, multiple providers are serving the market. Often multiple providers distribute their services through the same agent outlet. Consequently, when regulators aggregate provider reports, many agent outlets are counted multiple times. Second, from the perspective of access, the only tills that matter are those being used (active tills), and while GSMA calculates inactivity rates, very few regulators publish figures disaggregated by activity.

It would seem that FSP Maps statistics are more appropriate for measuring access to finance, but they present challenges as well. The first is that they are only available for a couple of years, in a handful of countries. The second is that to date we have not been able to reliably gauge their accuracy. In a new paper titled, “Agents Count”, authored by The Helix Institute of Digital Finance, we make the first attempt to reconcile these numbers and garner consensus around the total number of active agent outlets in five key countries: Bangladesh, Kenya, Pakistan, Tanzania and Uganda.

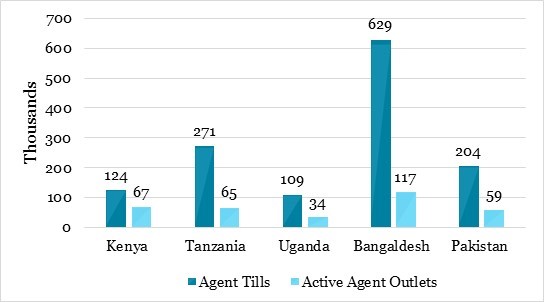

Our approach adjusts the total number of agent tills that respective regulators report to account for inactivity and non-exclusivity. We use the best available estimates of country-level activity rates and measurements of non-exclusivity collected by The Agent Network Accelerator (ANA) project. In doing so, we find FSP Maps census numbers to be accurate, and the total number of active agent outlets in the five leading digital finance countries to be only 25.6 per cent of the regulator reported figures. This is important, as our literature review shows that it has been popular in the industry to use regulator figures to report the number of agent outlets in a country.

Figure 1. Agent Tills vs. Active Agent Outlets

The importance of measuring access to digital finance

In the paper, Fighting Poverty, Profitably (2013), The Gates Foundation makes four main recommendations to the industry, the first of which is to create baseline statistics in the industry to better measure impact. Insights from “Agents Count” suggest that the industry has overestimated the number of operational agent access points in leading countries by a factor of four. In a 2014 report by The World Bank, The Gates Foundation, and The Better than Cash Alliance for the G20, titled, The Opportunities of Digitalizing Payments, authors noted: “Providing physical access to financial services or cash-in/out points and ensuring sufficient liquidity at access points, including in rural areas, remain the core challenges in moving toward digital payments.”

To address this challenge we still have many strategic operations work to execute on the ground. Now that we have a better understanding of financial access in key countries, we must track our efforts by accurately measuring progress. Many of the leading organisations in the industry already understand this, but still, lack the data needed to move forward. This missing data underpins the efforts of key financial inclusion initiatives, including:

1. Global Partnership for Financial Inclusion (GPFI) – In 2016, the G20 updated its list of Financial Inclusion Indicators to include digital financial services. The Access Indicators section now contains the indicator 11D: agent outlets per 100,000 adults. However, the data source listed for 11D is the IMF FAS Survey which compiles regulator statistics, and therefore represents agent tills, not agent outlets.

2. The World Bank is spearheading a program called, Universal Financial Access by 2020 (UFA2020). One of the major goals of the program is to increase access points by 25 per cent by 2020. To measure its progress, it has added a new module called “Accounts and Access” to the World Bank Global Payments Systems Survey (GPSS). This module includes supply side measurements of access points and has specific metrics for agents. However, the GPSS also obtains its data from regulators, so it will not be able to provide accurate data on agent access points to UFA2020.

3. The Alliance for Financial Inclusion (AFI) has a working group of regulators called, The Data Working Group (FIDWG), which published a list of financial inclusion core indicators (2013) for regulators. Indicator 1.1 in the Access section recommends that regulators measure the “number of access points per 10,000 adults…” While this indicator does not provide instructions for how to do this, it does define an access point as a “physical entity where an individual can perform cash-in and cash-out transactions.” Many regulators will not be able to measure these physical entities using current data collection methods.

4. The UNCDF’s Mobile Money for the Poor (MM4P) program works to increase digital financial inclusion in eight countries across Africa and Asia. In the MM4P theory of change, one of the key indicators of advancement from the expansion to the consolidation stage of development is the number of active agents per 100,000 adults. Given this data is not currently available, the MM4P will have to invest in data collection in its target countries.

The Future of Measuring Access to Digital Finance

Past analyses based on regulator figures, compiled in this manner, have severely overestimated the level of financial access in respective countries. While the newly released paper provides clarity on the number of agent outlets in five key countries, it does not cover many other countries of interest, and the methodology relies on research not currently set to continue. This is problematic because all efforts to extend financial inclusion around the world need an accurate baseline measurement of the number of agent outlets and will require tracking this metric in the future to measure progress against their goals. To ensure this happens, plans need to be made now. In another blog, we outline our recommended steps for doing so.

Please find a link to the full text of the new report: “Agents Count: The True Size of Agent Networks in Leading Digital Finance Countries”.

Note: This blog originally appeared on GGAP’s Microfinance Gateway. The Microfinance Gateway is a global resource on financial inclusion.

[1] Till is a provider-issued registered “line”, either a special SIM card or a POS machine, used to perform enrollment, cash-in and cash-out transactions for clients.