Migrant workers, are a unique client segment that interests financial service providers- specifically the digital financial service (DFS) providers. Though most of the DFS providers’ launch their DFS products and services with a remittance product, there is little understanding about what drives the remittance behaviour of migrant workers’ population. Furthermore, it has been difficult for DFS providers to nudge migrant workers to use a broader product suite they offer. This Note examines decision making context and behavioural aspects of the migrant workers. The Note concludes that DFS providers may use such insights while designing and promoting their money transfer products to ensure use of the entire product bouquet and compete with existing informal and semi-formal money transfer products and services.

Blog

Examining Micro Credit through the Behavioural Lens

Despite criticism over high interest rates, over-indebtedness and little to no impact on poverty alleviation, microcredit has reached impressive and continued growth worldwide. For long, behavioural economists opined that microcredit mechanisms work as behavioural levers on the same features that distinguish it from formal lending methodologies. This Note explores these behavioural explanations that govern design intricacies of microcredit and also the anomalies in the business model. Further, the Note explains how the intrinsic behavioural levers in the model synergises with the mental money management mechanisms of low income segment. Finally, it highlights necessity to use these fundamentals to re-define products, processes and methodologies to cater to the needs of low income people adequately.

Bending the Rules for Better Customer Service is probably a Good Thing

https://www.microsave.net/helix-institute/Recently, a team of qualitative researchers interviewed sixty mobile money agents and users in Kenya and Uganda to understand the drivers of important behaviours like non-compliance. The findings were intriguing since it was clear that the driver of agents breaking some rules and regulations was their ambition to provide excellent customer service and thus increase the likelihood of repeat business, and therefore the reputation of the provider’s brand they represent. From this perspective it is quite ironic that they might receive heavy penalties from the providers or regulators themselves for this.

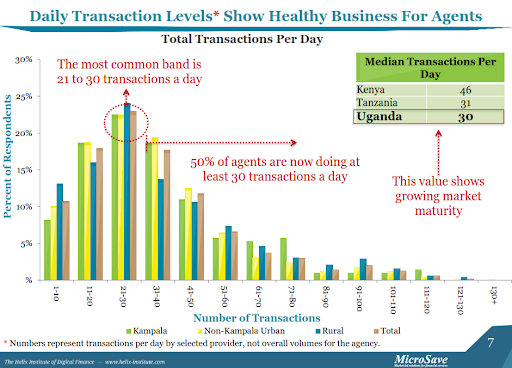

The ANA Uganda country report shows significant variations in transaction levels between agents, across urban and rural settings. There are various factors that affect number of transactions at the agent point, the quality of customer service being amongst the most paramount. Good agents consistently strive to offer a trustworthy and convenient service and with competing agents usually located all around them, they have to be clever about using all the tools and relationships they have available. This enables them to grow a loyal customer base and guarantees demand for their services, however, as can been seen from the three examples below sometime they prefer to work outside the system to do so.

The ANA Uganda country report shows significant variations in transaction levels between agents, across urban and rural settings. There are various factors that affect number of transactions at the agent point, the quality of customer service being amongst the most paramount. Good agents consistently strive to offer a trustworthy and convenient service and with competing agents usually located all around them, they have to be clever about using all the tools and relationships they have available. This enables them to grow a loyal customer base and guarantees demand for their services, however, as can been seen from the three examples below sometime they prefer to work outside the system to do so.

Customers transacting without identification: Most of the agents interviewed do not enforce the regulation that requires customers to show their identity cards before a transaction can occur. Whilst one could argue that display of identity card is actually to the benefit of the agent as chances of being conned or defrauded are decreased, some of the agents said that many of the customers come to transact without identity cards and insisting on it will likely lead to loss of customers since there are plenty of agents willing to serve them without their identity cards. Helix Institute research in Uganda in 2013 further revealed that agents reported recognizing a median of 50% of customers they served as repeat customers. At some point it is just embarrassing to ask people you know to prove who they are, and agents seem to favour serving customers more informally to encourage their return business.

Direct Deposits: In this case, the agent receives instructions from the customer on what amount to send and to where, and the agent goes ahead and sends it directly from his phone to the recipient. Mary, a customer in Uganda, requests her agent to send money to an intended recipient on her behalf, and she later pays him when she gets cash. The convenience of being able to send money on credit, and with some customers, even being able to call their agent to have it sent and then go in and pay later is incredibly convenient.

Such cases are not just common in Uganda. An M-PESA customer in Kenya mentioned that her agent allows her to conduct transactions even when she is not physically present at the outlet. Most telecoms try to discourage this behaviour as it means they have to pay the agent a commission on the deposit, yet do not earn revenue on the P2P transfer, as it is circumvented by having the agent make the transfer themselves. Telecoms might think about how to price these activities into the system as opposed to banning the increased levels of customer service their agents are offering.

Customers not signing the record book: When customers make a transaction, the agent is supposed to record it manually in a logbook and the customer is supposed to sign to acknowledge the details of the transaction, however, not all agents follow this practice. Agents say some of the customers are reluctant to do this as they are always in a hurry to leave and do not want to be bothered while others cannot write (almost 30% of Ugandan adults are illiterate). Again, the agents argue that insisting that the clients sign in the record book, makes them less competitive relative to the multitude of competitors in the market who are not strictly enforcing this regulation.

Why are these insights important?

Since better customer service, and thus increased usage, is in the interest of providers, agents and customers, it is time to be creative and examine ways that the customer needs that are driving these behaviours can be met within the bounds of mobile money system. Providers and regulators need to also understand that as the market matures, it becomes more congested with agents and different providers selling their services, and these types of behaviours will become both more common and also harder to control.

It seems time for a rethink in the name of customer service in advanced markets like Kenya and Uganda. IDs are not required at the ATM, can just a PIN be good enough at an agent as well? Or can agent interfaces be updated so that when they input a customer’s number their ID pops-up in the screen for verification (tablets or smartphones would be needed)? Can the profile then be saved, so the customer can then be “fast-tracked” at that outlet in the future? Can a system be developed in general that allows agents to treat their preferred customers as such? The Helix Institute research in 2013 in Kenya and Uganda showed that 35% and 52% of agents respectively in each country had been operating for a year or less. This means there is only more competition to come, and providers who focus on these issues, and give their good agents an edge with customer service, will certainly see results in their bottom-lines.

The Better Service Agents Provide, The More Business They Do

One of the major objectives of the Agent Network Accelerator (ANA) project is to determine which aspects of strategic operations really build the business case in the agency business. The Helix Institute has partnered with the Harvard Business School to dig deep into the data that is being collected and some of the initial findings are quite interesting. Specifically, agents who are more transparent with their pricing and more knowledgeable about mobile money policies experience significantly higher transaction demand than their less transparent and less expert peers. More knowledgeable agents also experience an even greater increase in demand when there are competing agents nearby.

By conducting econometric analysis[1] of The Helix Institute’s rich, nationally-representative survey of agents in Kenya and Uganda, combined with geographic data, the effect of agent service quality can be determined. One aspect of quality, pricing transparency, is measured by the presence (or absence) of a tariff sheet in the agent’s shop. Another measure of quality, expertise, was measured with a difficult question about mobile money policies – highly knowledgeable agents were able to answer this question correctly.

We measured competitive intensity by the number of directly competing agents within a 1km radius of each surveyed agent. After controlling for many factors that were likely to influence demand, such as population and poverty concentration within 1km, the number of tills the agent used, the agent’s gender, and the brand the agent worked under, we find economically and statistically significant effects of service quality on demand.

We find that the presence of a tariff sheet increases demand by over 12% and the ability to answer a difficult question about mobile money policy increases demand by over 10%. We also find that highly knowledgeable agents reaped even greater rewards for their expertise in the face of competition.

Furthermore, we find that the positive effect of being highly knowledgeable is magnified in the face of competition from other agents – suggesting that expertise is a dimension upon which mobile money agents compete.

The implications of this work to mobile money operators and agents are clear: service quality is critical to a healthy agency. This provides further evidence for the importance of training and shop appearance. These agent attributes are not only important to the operator, but this work shows the importance of transparency and expertise to agents themselves.

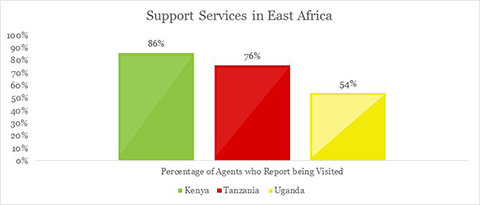

From a strategic operations perspective, the Helix Institute 2013 country reports for Kenya, Tanzania and Uganda give us a good idea of where some improvements can be made in this regard. Outcomes like transparent pricing are a result of consistent monitoring and support visits, which can ensure that an outlet is branded and compliant. In the leading East African markets, the below graph shows that providers in Kenya are doing a fairly good job of this, compared to almost a quarter of agents in Tanzania that reported not being visited, and almost half of Ugandan agents. Therefore, for those providers who are still not regularly visiting their agents, this does seem like a worthy investment.

Knowledgeable agents are a product of quality, targeted, and repetitive training. While the East African providers were doing a good job of getting the initial training done at the time of the survey (with Tanzania performing significantly lower), the below graph shows quite a different story for refresher trainings.

These follow-up trainings need to happen to remind agents of important information, and update them on any new changes that have happened of which they need to be aware. They will complement the monitoring and support visits, which when done correctly are also an important opportunity to disseminate information to the agents. With only 40-45% of agents across these East African countries reporting to have received refresher trainings, we can safely say that providers need to place a greater focus on this moving forward.

The Helix Institute and the Harvard Business School (Karthik Balasubramanian and David F. Drake) will continue to work together as the next round of ANA surveys are conducted in 2015 in East Africa, to use time series analysis to test the effect of different types of service reliability (transactions denied due to stocking out of cash/e-float vs. transactions denied due to system failure) on transaction demand. Other Harvard work includes an effort to mathematically determine how much cash and e-float an agent should stock in the morning by taking into account historical sales, commission structure, and the cost of capital.

Stay tuned!

[1] To conduct this analysis, we combined the survey responses from mobile money agents affiliated with mobile network operators from the Helix Institute’s surveys with two geographic data sources. First, we integrated data from FSPmaps: the precise locations of over 68,000 financial access and transportation points (including mobile money agents, banks, and bus stands). Next, we add granular (per square kilometer) spatial estimates from WorldPop of overall population and the population in poverty in each given square kilometer of Kenya and Uganda. By using buffer analysis, for each surveyed agent we generate within a 1 square kilometer the number of directly competing agents (same operator), indirectly competing agents (different operator), bus stands, bank branches, population, and the percent of population in poverty. Buffer analysis is a technique that generates circles of specified radii around points of interest (such as mobile money agents) and then calculates the number of other features of interest (such as the number of other agents and population counts) that fall within these circles. The process is described here in greater detail.

“Clients Should Be At The Centre Of Your Business” – So What’s New?

“This may seem simple, but you need to give customers what they want, not what you think they want. And, if you do this, people will keep coming back.” – John llhan, Crazy John’s mobile phone retail chain.

“Investing in quality talent, and ensuring they have the skills, training and tools that enable them to empathize and actively listen to customers are central to providing consistently excellent service experiences.” – Jim Bush, EVP American Express

I remember meeting my Father in 2000 and trying to explain to him what I was doing with my life. “I am running a project that helps financial institutions put the customer at the centre of their business and build products, processes, pricing and marketing on the basis of customer needs”. He looked at me as if I was from Mars, and said, “They don’t do that anyway?”

My Father was ahead of his time, but even in 2000, business 101 courses had figured out that a market-led (as opposed to product- or sales-led) approach was the key to success. Understanding clients’ perceptions, needs and aspirations is the foundation for successful business.

Initially inspired by Stuart Rutherford, for 15 years MicroSave has used a wide variety of qualitative research techniques to understand these perceptions, needs and aspirations. On the basis of the resulting insights we have not just innovated to build new products, but also achieved a series of much lower cost “quick wins”, through tweaking existing products, delivery systems and communications, in response.

From 2001-2007 MicroSave’s ten partner financial institutions in Africa developed or refined 9 savings products and 11 loan products. These products were used by <150,000 customers in 2001; by the end of 2007, they were being used by nearly 2.5 million people – a growth of more than 1,500%. The savings balances in these 2.5 million accounts soared to more than $530 million (an average balance of $212). At the end of 2007, 373,705 customers had outstanding balances on these loans were $300 million.

So we had made important stride forwards, but two important and valuable new approaches have now been added to the mix.

|

Human (or User) Centred Design has, in many circles become short hand for “ask your customers and/or conduct mystery shopping” –and of course there are many ways of doing this. However, HCD approaches have highlighted a very important technique and an extremely important issue:

1. The Technique: Rapid prototyping: HCD has moved this from a series of mini focus group discuss the product ideas on the basis of cards/a brief presentation to approaches that try to create the actual buying experience of the customer and iterate /build on these ideas as they observe customer and receive feedback. This is an important step forward and one which we have incorporated into the new Market Insights for Innovation & Design (MI4ID) approach now used by MicroSave.

2. The Issue: Understanding the context and supply side: Initial HCD work in our sector paid inadequate attention to the supply side, or even in some cases the regulatory environment – clearly there are times when “optimal ignorance” needs to be calibrated. Although overlooking supply side or regulatory issues are more debilitating, perhaps my favourite example of this was when one excited HCD team delightedly announced that they had “discovered” Susus in Ghana and that these had profound implications for product design. A little less ignorance would have revealed that Susus are one the oldest financial systems in Africa, and were well documented from as early as 1957!

|

Behavioural Sciences have even more to offer, as the theory of the “rational economic man” has always been a stretch given the way we all really behave with money. MicroSave has started to look in detail at how the realities of human behaviour impact the design and delivery of savings, credit, insurance and remittance products. We have already applied some of these insights and ideas already including: how tweaking an account opening form triggers usage or how modifications in financial capability approach spurs average deposits in banks and microfinance institutions.

The target customers for mass market digital financial services (DFS) and financial inclusion are not used to (making a decision or taking an action to) access formal service channels, and seldom use technology. Insights generated through the behavioural research approach can radically alter the way DFS products and services are designed, delivered and marketed … and thus their uptake and use.

MicroSave has also used the MI4ID approach to: conduct research on household money management and decision-making; design of insurance products; find solutions for MFIs in India to tap savings, create financial education programmes for microfinance institutions, and assess agent behaviour in East African mobile money markets. The latter highlights how understanding customer/agent behaviour can help with management of the supply side. Indeed, almost all the supply side work we do at MicroSave, (process-mapping, product pricing, pilot-testing, strategic/product marketing, staff incentives etc.), necessarily involves research to understand customer/agent perceptions, aspriations, needs and behaviour. This is the core of any market-responsive approach.

These are exciting, and rapidly changing, times – my Father would have been delighted to see the renewed emphasis on putting the client at the centre of our business and moving towards what MicroSave has been calling a “market-led approach”.

“The more you engage with customers the clearer things become and the easier it is to determine what you should be doing”. – John Russell, President, Harley Davidson.

Behavioural Economics and User Centred Design – Opening up New Vistas in Research Processes

To understand the customers better, it becomes imperative to not only understand their needs, decisions, or actions; but also understand the context in which they take decisions, various tendencies that are basis of their aspirations, choices and actions. Behavioural economics is a useful science to be applied in such explorations as it provides insights into customers’ cognitions along with a neuroscientific, evolutionary anthropology and genetics lenses. This Note is an high level peek into behavioural research method that MicroSave’s MI4ID approach uses to understand customers financial behaviour