Besides access to finance there are range of capacity building services that MSMEs need for their growth and development. Non-financial services are such capacity-building inputs which are mainly targeted at enhancing the performance of a business enterprise. In this video, MSC’s Products and Delivery Channels Expert, Raunak Kapoor, shares his experience on the role and importance of non-financial services in complementing financing efforts for enterprises. He further talks about the role of different stakeholders including financial institutions, business development service providers and other support partners, such as donors in expanding the provision and effectiveness of non-financial services design and delivery.

Blog

The status of agents in Kenya: Proliferation, dominance, evolution & impact

The Helix Institute of Digital Finance released its third Agent Network Accelerator (ANA) country report on 19th June 2014, in a launch event conducted in partnership with FSDK and InterMedia. The research presented was based on a nationally representative sample of 2,113 interviews with agents that were conducted across Kenya in September/October 2013, as well as 748 additional interviews with banking agents. The presentation noted that agents in Kenya were very busy, conducting a median of 46 transactions per day for each provider, which is 48% more than the 31 transactions per day found in Tanzania. The presentation went further to focus on four key themes that emerged from the Agent Network Accelerator Survey: Kenya Country Report 2013, namely, the proliferation of agents in the country, the effect of Safaricom’s dominance, how the network of agents is evolving, and the indicators for the impact it is having on financial inclusion.

Proliferation

Over seven years ago Safaricom launched M-PESA in Kenya. The assumption among many is that agents in Kenya have been in operation for a number of years as well. However, the ANA research finds that 59% of agents have been in operation for a year or less. While it is clear that a large portion of this is explained by aggressive growth from the provider, the survey also found that only 58% of agents thought they would continue to be an agent in a year’s time. This indicates that there might also be a lot of turnover of agents in the network. Further, the vast number of agents is putting pressure on each of them individually, with agents ranking competition between themselves as the greatest barrier for them doing more business.

Dominance

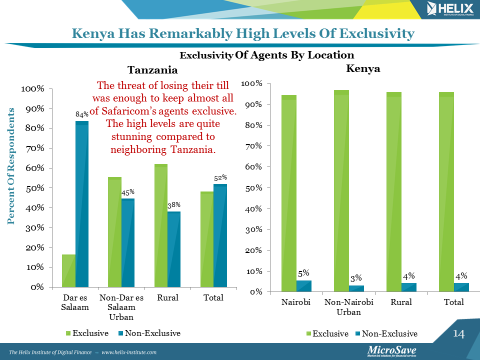

Agents were selected randomly for the survey, and 90% of the ones engaged were serving M-PESA. Across East Africa, each country has a leading provider, with MTN controlling 63% of agents in neighbouring Uganda, and Vodacom having 55% in Tanzania, but the high level of the dominance found in Kenya is unprecedented. This dominance has some interesting implications like the degree to which the country’s agent network is shared. Exclusive agents only serve one provider, and providers like to keep it that way so their competitors cannot leverage on their networks, but they need a lot of market power to enforce this aspiration. The dominance of Safaricom has allowed it to keep the most exclusive agent network in the region, with 96% of agents serving only one provider vs. 48% in Tanzania. This seems to greatly impact profits for the agent since they can only earn revenue from one provider rather than multiple, and explains much of why agents in Tanzania make a median of $US 95 per month vs. only $US 70 in Kenya. Therefore Kenyan agents do more transactions per provider but make less money overall by serving fewer providers per agent.

Evolution

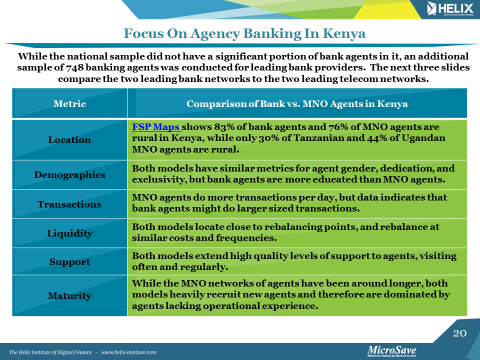

The agent network in Kenya, not only continues to proliferate rapidly but is also evolving the types of agents it has. About three years ago, banking agents were introduced to the market, and more recently mobile money merchants began operations (see the blog on merchants in Kenya here). Banking agents are now becoming an important part of the digital financial ecosystem in Kenya and display some interesting traits. A lot of the banking teams building these networks used to work in mobile money, and seem to have designed certain facets of them similarly. For example, both mobile money and agency banking networks display similar levels of dedication, exclusivity, rural/urban locational splits, liquidity management techniques, and support systems. However, the differences may be even more intriguing, as we see bank agents being more educated, and willing to do much larger transactions for clients than mobile money clients. Bank agents are also displaying some growing pains, taking a long time to register new customers, and still having 50% of their agents doing 30 transactions per day or less. Banks will have to focus on these issues as they continue to expand their networks across Kenya. However, the outlook is positive given some of the mature metrics of agent support and management they are already displaying.

Impact

Impact

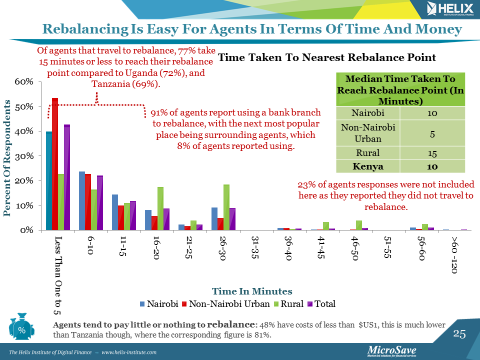

The presentation examined impact from multiple angles including, the geographical expansion of the access to financial services. The access frontier is being expanded with at least 55,000 agents across the country, which is much higher than the approximately one thousand bank branches in Kenya. However, it seems like they might be constrained geographically. Of the 77% of agents that report travelling to rebalance their float levels, 77% of them say it takes them 15 minutes or less to reach their rebalance point. With 91% of them reporting using a bank to rebalance, this seems like the majority of Kenyan agents are concentrated around the financial infrastructure that we are trying to extend outwards. Further work is planned to look at the correlations to population densities, and try to determine the degree to which this is problematic.

Conclusion

Conclusion

Agents feel like the market is saturated, with some reporting opening side business to supplement revenue, and only 58% of them saying they think they will still be an agent in a year. It seems likely that the number of agents on the market will contract. Safaricom’s M-PESA continues to dominate the market, and while the regulatory wind seems to be pushing towards non-exclusive agents, the high-quality support they are providing to their agents’ means it will continue to be hard to wrestle market share from them. The addition of banking agents to the market is welcome, and they may be finding a different market need than mobile money such as showing the ability to conduct bigger transactions for customers. Finally, the agents are extending financial inclusion, but evidence indicates they many may be tethered to the existing financial infrastructure for rebalancing, and therefore further expansion into rural and remote areas may require superior liquidity management techniques. Overall, it is a very positive picture, from the frontier market in digital finance.

To read our ‘Agent Network Accelerator Survey – Kenya Country Report 2013‘ in full click here

To read our ‘Agent Network Accelerator Survey – Tanzania Country Report 2013‘ in full click here

To read our ‘Agent Network Accelerator Survey – Uganda Country Report 2013′ in full click here

Challenges to agency business – Evidence from Tanzania and Uganda (Part- I)

As part of The Helix’s Agent Network Accelerator (ANA) survey programme, we interviewed 2,052 agents in Tanzania and 2,028 agents in Uganda. We looked at a wide variety of issues including:

- Agent and agency demographics

- Liquidity management

- Provider support for agents

- Agents’ business model viability

- Core operational issues

Under the latter section, we asked about the biggest operational challenges that agents were facing. The responses were instructive.

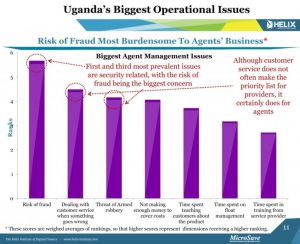

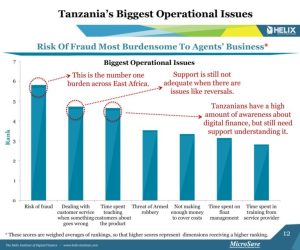

Fraud and armed robbery

Top of the list in both Uganda and Tanzania was fraud – closely followed by armed robbery. We have discussed these problems in the blog “Why Rob Agents? Because That’s Where the Money Is” about a year ago, and clearly they persist.

One of the key ways to address the challenge of fraud is through on-going support and training for agents, so that they are aware of and can respond to the latest scams being perpetrated in the market. And yet, the ANA surveys repeatedly show that agents receive very limited training.

In Tanzania, 55% of agents have never undergone refresher training, and in Uganda, 57% of agents have never undergone refresher training. In Uganda, only 33% of agents were visited by the provider, whereas 46% of agents report not being visited at all. Of those who were visited 35% report, they were with no fixed frequency. In contrast, 76% of Tanzanian agents report being visited. Of those visited about three quarters were visited directly by the provider with a frequency of at least once a month. Clearly, the agents are not getting the support they need. And given the prevalence of agents reporting “Time spent in training from a service provider”, much (if not all) of this training and support needs to be on-site as part of providers’ agent monitoring systems.

Customer service

Providers can essentially choose between three policies on repudiation:

- No Repudiation: The provider opts not to interfere with the transactions, callers are advised to either resolve the matter with the recipient directly or seek legal redress.

- Call Centre Repudiates Instantly: The provider’s call center may repudiate transactions on the strength of the sender’s request only without consulting the recipient.

- Funds are Suspended Prior to Repudiation: Under this scenario, the customer calls the provider’s call center and requests for repudiation. The call center immediately suspends the funds to ensure that they cannot be withdrawn. The recipient is then called. If the recipient insists that the funds are genuinely theirs, the call center employees release the funds to the recipient. However, if the recipient accepts that the funds belong to the sender, the funds are reversed back to the sender.

Each of these policies has advantages and disadvantages – but all require a careful agent and customer education to manage expectations and behavior.

Effective fraud management, security and customer service require investment from the agents and/or mobile money providers. This, in turn, affects profitability and the ability of agents to educate/market to customers and offer a range of products. These aspects will be discussed in the next blog in the series.

G2P Payment: A Job Half Done

Direct Benefit Transfer program was thought to be effective method of achieving goal of financial inclusion. Its effectiveness was thought to be an outcome of necessity of making payments to individual bank accounts and also because of regularity of payments. However, due to operational issues its progress does not inspire much hope. At best DBT as tool of financial inclusion is a job half done.

Agent Network Accelerator Survey – Kenya Country Report 2013

The Kenya Country Report is based on a nationally representative sample of over 2,000 mobile money agent surveys carried out at the end of 2013, all over the country. The report finds that after seven years of market development, Kenya continues to be dominated by one strong provider with an army of exclusive agents. These agents are well supported, and generate very high transaction levels but only offer a limited suite of products and have fairly low profits. Download to read the report in full for more exlusive insights and data

Mobile Money Merchant Payments – What does the Future Hold?

In October 2012, GSMA MMU asked the burning question; ‘Can mobile money work for merchant payments?’ Across the developed world cards are being swiped, dipped or waved to pay for everyday purchases, but the question remains if mobile money can, or will, have the same levels of usage in the developing world.

Currently mobile money providers have thousands of agents who facilitate the exchange of cash and electronic money. They are usually small retailors, and are paid a commission for offering the service. In contrast, mobile money merchants generally do not facilitate these exchanges, but simply accept electronic payments in exchange for the goods or services they provide. The merchant, the customer, or neither is charged a fee by the provider for using the mobile money service. These merchants are still very new, but the 2013 State of the Industry Report, shows adoption of merchant payments is slowly gaining traction, with 65% of the mobile money deployments now offering the service. Although activation rates are still very low, this is to be expected with mass market strategies that target micro, small and medium enterprises, and in places like Kenya, we see the numbers already improving.

In this blog we’ll discuss why merchant payments are important, what they mean for the evolution of the agent network, and where they might be headed.

Why is it important?

Why is it important?

Currently, mobile money is only being popularly used for a small subset of payment purposes, mainly small airtime top-ups, infrequent bill payments or transfers to a friend/family member (P2P), which cumulatively account for 97% or transactions by volume or 89% by value globally (State of the Industry 2013). Even in the famous Kenyan market, the CEO of Safaricom, Bob Collymore notes that 98% of transactions are still done in cash. Further, people are using their mobile wallets for savings, but the amounts stored are very low, and the majority of funds are still withdrawn from the system quickly after they are received.

Merchant payments add another use case for mobile money by enabling customers to pay for goods and services from the value stored on their mobile wallets. This additional service for the customer encourages them to transact with electronic money more often as there are more options for doing so, and also incentivizes them to store money electronically as it becomes more useful tool for making payments.

This is attractive to the provider as both these changes in behaviour can increase their revenue, and potentially goes a long ways towards increasing usage of the systems as payments to merchants are made so frequently. According to industry insiders “the ratio of merchant payment transactions to P2P transfers is 16:1 in a developed market.” Although we cannot directly compare the developing world to the developed, it does seem that this indicates that there is a huge opportunity for digital merchant payments. Therefore this is a key element in making mobile money more relevant on a daily basis, and evolving the payments system away from cash and onto the digital platform.

What does this mean for the evolution of the agent network?

When mobile money hit the market, many providers engaged existing Fast Moving Consumer Goods (FMCG) retailors to try and reach scale quickly. They convinced the retailors in these networks to additionally provide cash-in and cash-out services, and therefore evolved their functionality. Many predict that these agents will be converted into merchants, accepting digital money for their goods and services rather than exchanging it for cash. However, for customers, paying in digital money in some cases incurs a fee and takes longer than paying in cash, and for agents receiving a commission, transitioning to merchant payments likely means forgoing it. This makes it a hard transition to sell and means providers around the world are struggling with a number of different models to try and make it work.

In Kenya, the Lipa na M-PESA merchant payments service that Kopo Kopo and several other aggregators help manage charges the merchant 1% of the value of the transaction, enabling the customer to conduct it for free. Kopo Kopo entices businesses to become merchants by providing them with business analytics from the transactions they make on the system, and focusing their pitch on specific value propositions like reducing pilfering associated with cash businesses. However, the design of this system means that it is generally more alluring to more sophisticated businesses that generally were not previously targeted as mobile money agents. The result in Kenya is that instead of building on top of the agent network, the merchant network seems to be evolving mostly alongside it, increasing the overall places in the country where mobile money can be used.

Where are we and how might we move forward?

Where are we and how might we move forward?

From Lipa na M-PESA in Kenya, to TigoPesa in Tanzania, ZAAD in Somaliland and EcoCash in Zimbabwe, there are a myriad of different attempts to build models in this field. After about two years of market development it is safe to say we are still not sure which ones will succeed, but in Kenya we now have two years of data from which we can make some astute observations to help the industry understand what we do know.

Kenya is obviously a unique market because of its maturity where 62% of the adult population actively uses M-PESA already. Merchant payments should be easier in an environment like this where people already trust the system, and are accustomed to holding some digital money on their phones that they can use to make purchases. Emulating this stage of market maturity is likely something providers will need to do first before launching merchant payments, as Ignacio Mas quips, you cannot make payments with an empty wallet.

However, Kenya is also a success story in part because of the innovative work Kopo Kopo is doing to select, acquire, train and support new merchants. Launched in 2012, it now manages over 12,000 merchants for the ‘Lipa na M-PESA’ (‘Buy Goods’) service. It has designed analytics to reduce inactivity in the network, and has even launched Grow, a merchant cash advance service to encourage merchant usage and retention, which caught the whole industry’s attention. Some of the techniques used are similar to those used for managing agents and can be important, and others are just being learned.

This marks the first blog in a series that will explore the emerging world of merchant networks in mobile money to shed light on what some of the best practices in the industry currently are and where the industry seems to be headed.

The blog was co-authored with Ben Lyon – Director of KopoKopo Inc