The limits of digitalization

The sheer magnitude of the financial inclusion gap–two-thirds of households in developing countries are unbanked—calls for pretty radical solutions. The notion that we cannot count on brick-and-mortar investments to massively expand access to finance in developing countries is now widely accepted. We need to go branchless, and to do so safely we have an opportunity to leverage mobile phones that are increasingly ubiquitous.

But it is clear that enhancing access alone will not solve the financial inclusion challenge. Availability does not automatically translate into usefulness, and usefulness of electronic payments does not automatically translate into the usefulness of other electronic financial services. We need to overcome not only an access barrier (last mile infrastructure), but also a relevance barrier (right-sized products and services), and even a usability barrier (friendly and intuitive customer experience).

Seeking more service relevance is taking many institutions down the path of fragmenting customer needs into ever-finer slices so that they can tailor products to each need. But such an approach risks moving away from service concepts that reflect the more holistic way in which people think about their money management and creates a marketing challenge: how can financial service providers, especially those working with mobile and branchless networks explain to the average customer such a specialized portfolio of services.

Integrated services that replicate how people think about money

What we need are service concepts that help people manage their financial lives the way in which they think about them. Customers need to give shape to their own user experiences. That means providers must think of products as tools which customers can use in different ways rather than as products that offer specific, inflexible services.

The key requirement is that the user interface be intuitive, engaging and consistent. This can only be achieved if the user interface, and the products it is linked to, derive from a deeper understanding of how customers are expected to relate to the entire service experience. The ultimate objective is being able to design a single, mobile-enabled, mass-customizable experience that puts customer goals first. Their priorities are the basis for their interactions with the financial service provider. The key driver for this experience is less the underlying financial products that fulfill the service and more the user interface and customer information management systems that guide the customer. It is the customer interaction in the context of their own mental models that will drive uptake and use.

Increasingly, online services, financial education, and entertainment have been brought together, often following the rules, mechanics and incentives of games. Designing services in this fashion might combine financial education with actual usage in a learn-as-you-go approach.

Understanding the why of use

Carol Coye Benson notes in connection with the use of cash: “What research there is tends to focus on patterns of use (diary studies, etc.), rather than on the why of use.” This probably stems from the modern analytical bias: the urge to collect data first –as much of it as possible—with the hope that we can infer from it what went on in people’s lives and minds. This seems like a laborious and round-about way to get at people’s motivations.

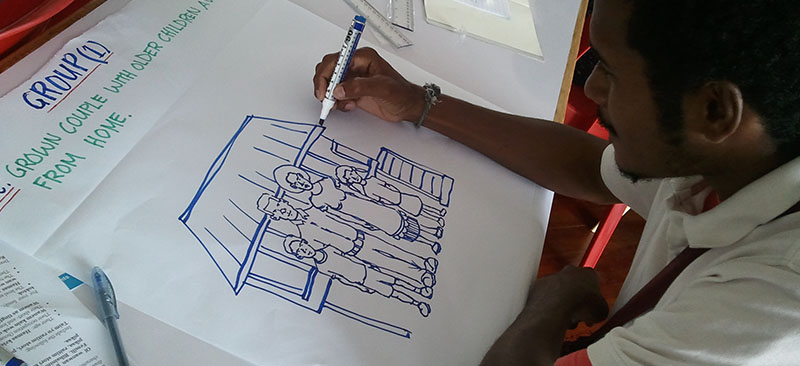

There needs to be a deliberate effort at capturing those thoughts and expressing them in cogent mental models. Earlier this year we embarked on a project we called Metamon (short for Money Management Metaphors) specifically with the intent of trying to uncover mental models through a different path: by engaging people at a more emotional level. We set out to experiment with a range of qualitative research tools which might help design financial services that are closer to how people interpret the role of money and finance in their own lives.

Towards simplified metaphors of household financial management

In a follow-up blog post, we will explain in more detail how we developed the metaphors and what we came up with. In the end, the metaphors we developed during our project fell short of capturing entire mental models, but we came out of the exercise thinking that this research approach allowed us to listen to customers more accurately, more free of our own biases. We think that such approaches are a useful complement to the more traditional use pattern-based methodologies.